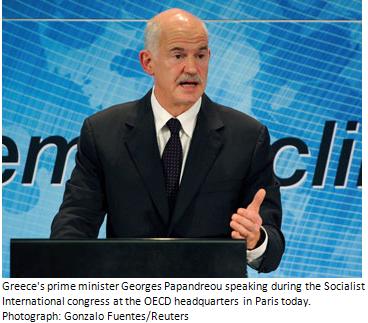

These were the words of Greek prime minister George Papandreou, speaking about Germany’s tough stance on burden sharing during his visit to Paris. The fracturing of the eurozone appears to be accelerating, or, at best, the fault lines are beginning to surface.

These were the words of Greek prime minister George Papandreou, speaking about Germany’s tough stance on burden sharing during his visit to Paris. The fracturing of the eurozone appears to be accelerating, or, at best, the fault lines are beginning to surface.

The debt burdens in some countries are just too large and the fiscal adjustments too onerous for the populations to bear, in our opinion. The Irish Times writes,

Germany’s tough stance on banks and bond markets sharing the pain of any euro zone sovereign debt default could force some economies toward bankruptcy, Greek prime minister George Papandreou said today.

“It created a spiral of higher interest rates for countries that seemed to be in a difficult position, such as Ireland or Portugal,” Mr Papandreou said during a visit to Paris.

“This could create a self-fulfilling prophecy … This could break backs. This could force economies towards bankruptcy.”

On other side, Germans are “incensed” at having to bail-out the highly indebted periphery and German Chancellor Angel Merkel fears their wrath in the 2013 general election. Der Spiegel reports today,

…Merkel defended her demands for tough new bailout rules on Monday by telling her party she was determined to create a new “culture of stability” in Europe. But other EU leaders are warning that her plan is scaring investors and could reignite the euro crisis.

German Chancellor Angela Merkel defended her tough stance on reforming EU budget rules on Monday as criticism of her policy mounted in Europe.

“Everything is at stake — if the euro fails, then Europe will fail,” Merkel told delegates at the party congress of her conservative Christian Democratic Union (CDU) in Karlsruhe, southwestern Germany. Market “excesses” caused the crisis and “markets have to bear the consequences of their actions,” she said. “It’s up to us. It’s our task to create a new anchor for a culture of stability in Europe.”…

With a permanent, legally binding mechanism in place, she won’t have to negotiate the inevitable extension of the safety net, a deeply unpopular measure in Germany where voters are incensed at having had to bail out high-debt nations this year. She faces a general election in 2013.

One thing is for certain, 2011 will not be dull. Stay tuned!