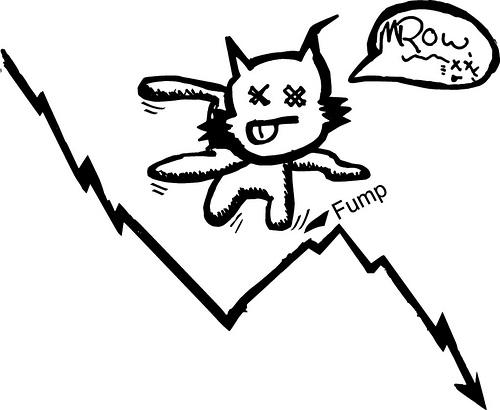

Our Chart of the Day is the Dead Cat Bounce in the Euro. The currency rallied on rumors of massive QE by the ECB to support the bonds of the PIIGS? Come on! QE of such size would drive the Euro lower.

Our Chart of the Day is the Dead Cat Bounce in the Euro. The currency rallied on rumors of massive QE by the ECB to support the bonds of the PIIGS? Come on! QE of such size would drive the Euro lower.

The economic data in the U.S. is improving and much of Europe is slowing. Unless a global facility is constructed to recapitalize European banks and provide support for European sovereign bonds, we remain bearish on the Euro. The markets seem also to be ignoring the politics. The highly respected economist, Barry Eichengreen, wrote today,

It pains me to say this. I’m probably the most pro-euro economist on my side of the Atlantic. Not because I think the euro area is the perfect monetary union, but because I have always thought that a Europe of scores of national currencies would be even less stable. I’m also a believer in the larger European project. But given this abject failure of European and German leadership, I am going to have to rethink my position.

The Irish “program” solves exactly nothing – it simply kicks the can down the road. A public debt that will now top out at around 130 per cent of GDP has not been reduced by a single cent. The interest payments that the Irish sovereign will have to make have not been reduced by a single cent, given the rate of 5.8 per cent on the international loan. After a couple of years, not just interest but also principal is supposed to begin to be repaid. Ireland will be transferring nearly 10 per cent of its national income as reparations to the bondholders, year after painful year.

This is not politically sustainable, as anyone who remembers Germany’s own experience with World War I reparations should know. A populist backlash is inevitable. The Commission, the ECB and the German Government have set the stage for a situation where Ireland’s new government, once formed early next year, rejects the budget negotiated by its predecessor. Do Mr. Trichet and Mrs. Merkel have a contingency plan for this?

There you have it. And don’t forget the Irish package is contingent on their budget vote next week. Stay Tuned!