(click here if charts are not observable)

(click here if charts are not observable)

-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,218 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

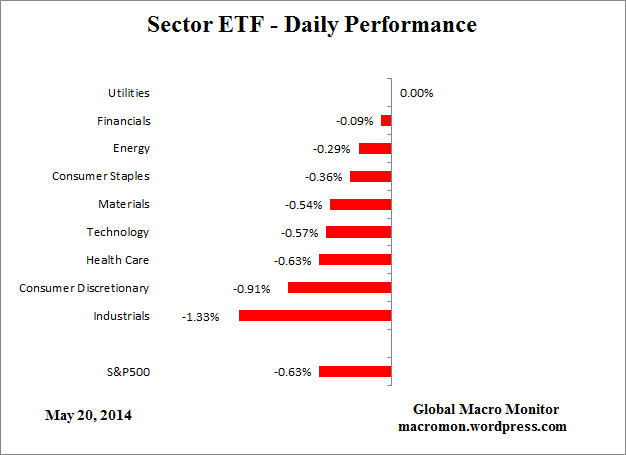

On Tuesday, May 20, 2014, there was a global stock market reversal as investors greed turned somewhat more to fear, specifically fear that the world central banks’ monetary policies, no longer sustain investment gains and global economic growth, and have made money good investments bad.

Global debt deflation commenced, as currency traders strongly sold the Australian Dollar, FXA, as is seen in the FX Sponsor chart report AUD/JPY Price Breaks Down Below Key Support, which turned Major World Currencies, DBV, parabolically lower with the result that Gulf States, MES, Australia, EWA, KROO, New Zealand, ENZL, Indonesia, IDX, IDXJ, Thailand, THD, Malaysia, EWM, South Africa, EZA, Norway, NORW, Brazil, EWZ, BRF, Turkey, TUR, Chile, ECH, Egypt, EGPT, Emerging Africa, GAF, Columbia, GXG, and the US Small Caps, IWM, IWC, led Nation Investment, EFA, and Small Cap Nation Investment, SCZ, lower.

With the Australian Dollar, FXA, now following the Euro, FXE, lower, investors are derisking out of debt trade investments, and delveraging out of currency carry trade investments in Global Industrial Producers, FXR, Industrial Miners, PICK, Small Cap Industrials, PSCI, Transports, XTN, Metal Manufacturers, XME, such as CMC, WOR, GHM, SCHN, GSM, STLD, RS, HAYN, CVR, MLI, CSTM, CRS, Steel Producers, SLX, Aerospace and Defense, PPA, Global Energy Producers, IPW, and Timber Producers and Paper Manufacturers, WOOD.

And investors resumed the sell of Solar Manufacturers, TAN, Biotechnology, IBB, US Infrastructure, PKB, Retail Stocks, XRT, such as PETM, URBN, TJX, CBK, BKE, EXPR, DEST, GES, DSW, CHS, GCO, ROST, DXLG, ANF, PLCE, TGT, BBY, DKS, Regional Banks, KRE, Small Cap Pure Value Stocks, RZV, and Small Cap Pure Growth Stocks, RZG.

The sell of Far East Financials, FEFN, Japanese Banks, SMFG, MTU, MFG, Australia’s Bank, WBK, Regional Banks, KRE, Investment Bankers, KCE, and Stockbrokers, IAI, led Global Financials, IXG, lower.

With the May 20, 2014, sell of Transportation Stocks, XTN, we have Dow Theory confirmation of a bear market, as the Airlines, Truckers, and Railroads, are joining the Industrials, XLI, in trading lower. The market direction trading pairs, XTN, XLI, and IYJ, IYT, are indicating a stock market reversal in World Stocks, VT, is in place.

Competitive currency devaluation coming from the hands of the currency traders, has commenced the destruction International Energy Investments, such as, RDS-B, SSL, E, TOT, STO, and Mining Investments, such as BHP, VALE, RIO, CENX, AA, HW, GSM, as well as the destruction of Yield Bearing Investments.

The May 20, 2014, trade lower in Gulf Dividends, GULF, Australia Dividends, AUSE, Water Resources, PHO, Global Real Estate, DRW, Global Telecom, IST, Smart Grid, GRID, Leveraged Buyouts, PSP, European Small Cap Dividends, DFE, and Dividends Excluding Financials, DTN, from their highs was an epic economic event: the investor, specifically the fixed income investor is going extinct.

The trade lower of Call Write Bonds, CWB, and the turn lower of Defensive Shares, DEF, such as Transports, XTN, International Energy, IPW, Global Agriculture, PAGG, Consumer Staples, KXI, Global Real Estate, DRW, and Global Telecom, VOX, from their rally highs, communicates the failure of credit and the termination of profitable equity investing. Of note, Zero Hedge reports Caterpillar Retail Sales Plunge By 13%, Most Since February 2010; Caterpillar, CAT, traded 3.5% lower on the day.

Outside of the Precious Metal Mining Stocks, Gold Mining Stocks, GDX, and Silver Mining Stocks, SIL, SILJ, the Banker Regime is no longer able to securitize any investment, nor market any any investment that will preserve wealth.

The see saw destruction of fiat investments, that is Equity Investments, such as World Stocks, VT, Nation Investment, EFA, Global Financials, IXG, Dividends Excluding Financials, DTN, as well as Credit Investments, AGG, has commenced, as the bond vigilantes have control of the Benchmark Interest Rate, ^TNX, which traded lower to 2.51%, but remains above support at 2.49%.

The trade lower in Aggregate Credit, AGG, from its May 15, 2014 high, is of historic importance. With both Equity Investments and Credit Investments trading lower, the world has passed through an economic inflection point. The world has pivoted from the age of currencies and the age of credit … and into the age of diktat and the age of debt servitude. On going disinvestment of currency carry trades and debt trades will introduce the much feared economic on a worldwide scale and introduce Kondratieff Winter, the final phase of the Business Cycle.