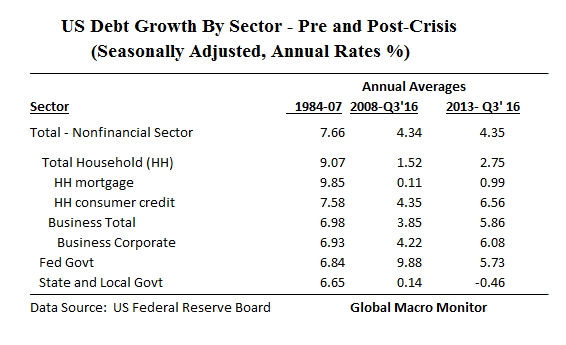

Note that the post-crisis total debt growth in the U.S. is just a little more than half the 23-year annual average before the crisis, a decline from an average annual growth rate of 7.7 percent to 4.3 percent. Household debt growth has experienced a more marked decline, falling from 9.1 percent to 1.5 percent, with an even sharper decline in mortgage debt growth.

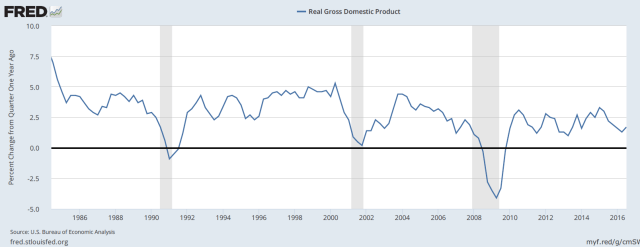

Is the decline in the debt growth rates the result of supply or demand constraints? Probably, both. But it certainly helps to explain the punk recovery in GDP growth since the crisis. After all, credit is the mother’s milk of economic growth.

…credit is the mother’s milk of growth; without credit the economy cannot flourish. And credit cannot flow freely without a well-functioning financial system. – Mark Zandi

We think credit to the private sector is about to go through a mini-boom as banks are fixed and ready and primed to starting lending again as their regulatory burdens are loosened under a Trump administration causing economic growth and inflation to surprise the upside.

One thing we have learned after 30 years in the markets is that expectations are adapitive, always looking in the rear-view mirror, and suffer from extreme inertia. And we were schooled in the theory of Rational Expectations!

An aside: While crunching the data we came across an interesting statistic. Though depository institutions have grown consumer credit by just over 25 percent, or $311 billion, since 2011 to a current total of $1.5 trillion, the Federal Government has grown consumer credit by 111 percent, or $550 billion, over the same period to $1.o4 trillion, most of which, is student loan debt.

.

.