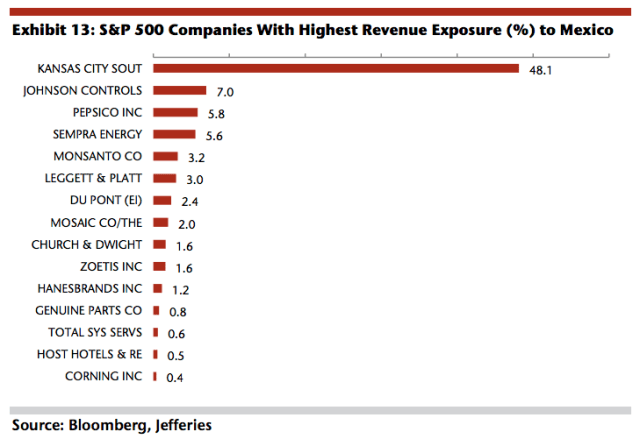

So King David at thinkinthemorning.com sends over an article showing U.S. stocks with revenue exposure to Mexico. Starts us thinking about who is smarter, equity traders or currency traders, who follows who, or who is fooled by randomness?

.

.

Definite comovement between Kansas City Southern (KSU) and the Peso. Looks like KSU may lead the Peso by a day or two, no? Sometimes. And there’s the rub.

.

Johnson Controls (JCI) slightly correlated, not so much. If you stare at the chart long enough you can convince yourself JCI leads. Currency traders a little more short-term than equity traders, in our opinion, are more reactive to and often trade more on noise.

.

Nevertheless, as the old saying goes “if you stare at the clouds long enough, you can see pink elephants.” By the way, check out the head and shoulders top in the lightening strike.

Nevertheless, as the old saying goes “if you stare at the clouds long enough, you can see pink elephants.” By the way, check out the head and shoulders top in the lightening strike.

On a more serious note, a shout out to our friends “down in Mexico“, who are “so far from God and so close to the United States” and now caught up in the nasty realpolitik of the moment that seems to be “shaking [the world] like a live wire.” We are with you.