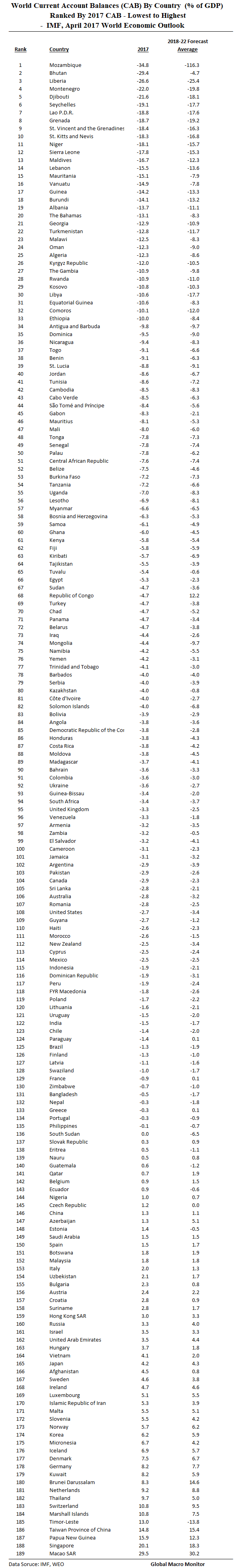

We have updated our ranking of the world’s 2017 Current Account Balances (CAB) by country from largest deficit to largest surplus in the ginormous table below. The data are from the April 2017 IMF’s World Economic Outlook database. Note, 2017 are IMF estimates and the 2018-22 annual averages are forecasts from the IMF country desks.

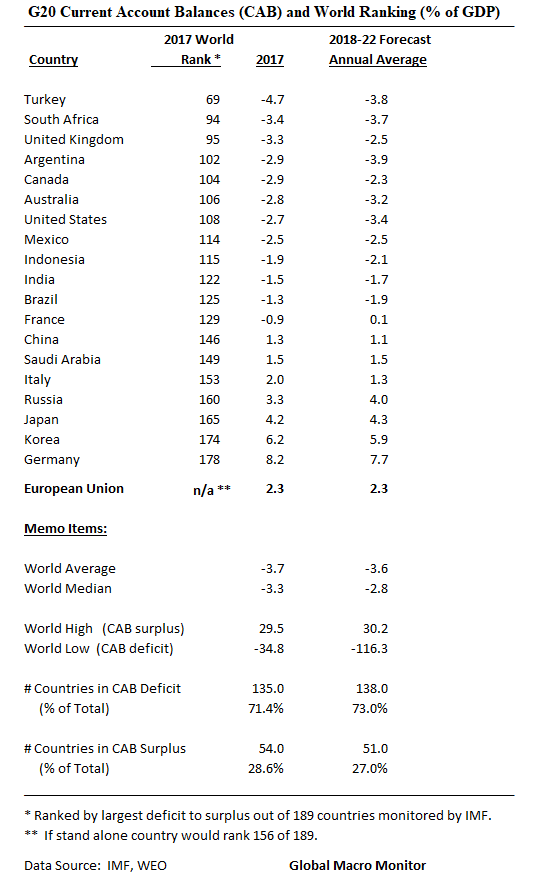

But, first, check out the current account balances of the G20. Germany under big political pressure for its 8 percent surplus.

In 2016, Germany ran a current-account surplus of roughly €270 billion ($297 billion), or 8.6% of GDP, making it an obvious target of Trump’s ire. And its bilateral trade surplus of $65 billion with the United States presumably makes it an even more irresistible target. Never mind that, as a member of the eurozone, Germany has no exchange rate to manipulate. Forget that Germany is relatively open to US exports, or that its policymakers are subject to the European Union’s anti-subsidy regulations. Ignore the fact that bilateral balances are irrelevant for welfare when countries run surpluses with some trade partners and deficits with others. All that matters for Trump is that he has his scapegoat.

Back in the real world, the explanation for Germany’s external surplus is not that it manipulates its currency or discriminates against imports, but that it saves more than it invests. The correspondence of savings minus investment with exports minus imports is not an economic theory; it’s an accounting identity. Germans collectively spend less than they produce, and the difference necessarily shows up as net exports. – Barry Eichengreen, May 11, 2017

.

.

Large current deficits are not always a bad thing. It largely depends on their cause and how they are financed. For example, Mozambique runs very large current account deficits and with robust economic growth, ranking 24th in 2017 world GDP growth out of 189 countries monitored by the International Monetary Fund. The country’s CAB mainly reflects large imports of capital goods for large energy projects and is financed primarily by fairly stable capital flows – Foreign Direct Investment (FDI).

Nevertheless, large current deficits usually result in negative economic consequences and Mozambique is not excluded. Its accumulated external deficits, coupled with a domestic political/debt scandal, has created much blowback with its external creditors and made the country more vulnerable to such events. Mozambique missed a coupon payment in January on its dollar-denominated Eurobond or so-called “Tuna Bond” and continues to miss debt payments on selected debt instruments.

Mozambique is facing serious economic and political blow back as its evolving hidden debt scandal continues to shake international confidence and domestic stability. Investigators uncovered $1.12 billion in fraudulent loans to Pro Indicus and Mozambique Asset Management (MAM) in 2015, implicating the previous administration of President Armando Guebuza. Pro Indicus and MAM secured loans, primarily from Credit Suisse and VTB of Russia in 2013-2014, loans which were then guaranteed by the Mozambique government.

This revelation – which also implicated tuna operator Ematum – led to to the suspension of IMF aid as well as assistance from 14 foreign governments in 2016, putting serious strain on Mozambique’s finances. Pro Indicus, together with MAM and Ematum – all owned by the Mozambique government and run by the country’s security services – racked up more than $2 billion in dubious loans, loans which Mozambique is now obligated to pay.

…Efforts to improve finances (the current account deficit is estimated at 30% of GDP for 2018), including reductions in oil and bread subsidies mean citizens are not benefiting from cheaper imports. To make matters worse, government efforts to raise the minimum wage have done nothing to ease cost of living pressures, instead angering both the public and international partners. Resident IMF representative Ari Aisen notes that Mozambique has “no clear overview or strategy” concerning minimum wage legislation, as the country boasts 16 different minimum wages across various sectors. – Global Risk Insights

Large current deficits financed by hot money or short-term flows = Bad News.

.