After a monster draw on inventories in the API data released last night, crude oil faces a key test on the EIA inventory release today. If EIA confirms API and the oil price can’t hold its gains, trouble in River City, folks. It likely $42 won’t hold and Goldman may be right that crude trades with a $30 handle.

However, there are some short-term bullish factors at play:

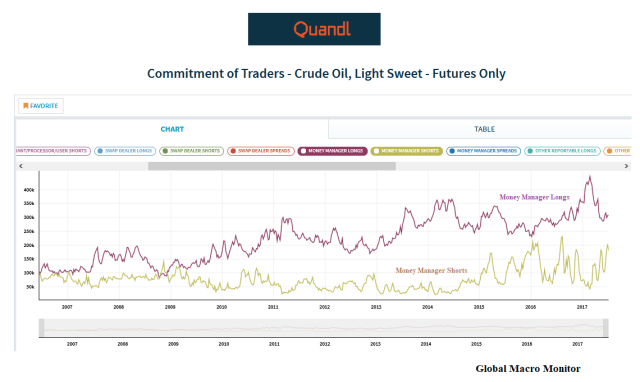

- Sentiment is negative, almost to an extreme (see Commitment of Traders chart below). We even posted a negative piece on the secular forces driving the oil price just a few days ago, but didn’t rule out a short-term pop, however.

- There is no geopolitical risk premium built into the oil price and the Middle East is a mess. The $42 level held in the recent downdraft, making a lower low, and the price might be finally starting to build in some of that political risk

- WTI futures traded over $46 in overnight trading and is approaching key levels:

- The 5-day high at $46.53

- The 50-day moving average at $46.90

- The key level is the 1-month high at $47.32. The recent lower high (see price chart).

The market is thus set-up for a nice squeeze.

A break above $46.53 takes us to the 50-day moving average and puts in play the key level of the recent lower high at $47.32. If that is taken out, its a new short-term ballgame and could firm up a short-term $45 to $52 trading range.

This analysis will be irrelvant at 10:31 AM after the EIA data is released and the market will do what it is going to do.

Just remember, folks, oil is the new widow maker. Its been a very difficult call and trade for both the longs and the shorts.

.