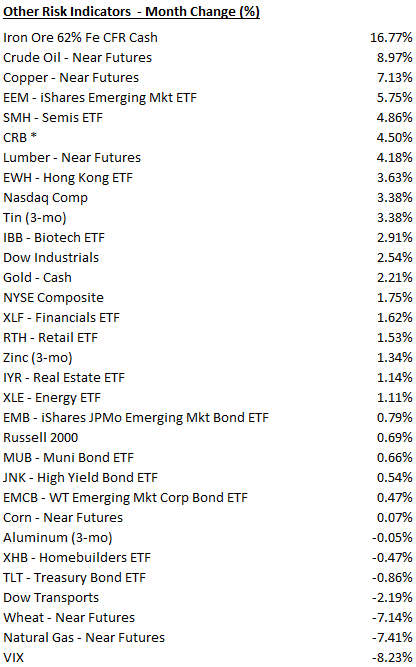

Stock Indices

- Emerging markets dominated stock returns in July with Turkey leading the way.

- India, which we stated was one our favorites at the beginning of the month continues to rip, up over 22 percent, YTD. This is going to be a spectacular bull market. Everything lined up – demographics, lots of inefficiencies to be improved, much room for policy improvement.

- The S&P500 continues to defy seasonality and move higher. We expect a correction in October as many stock negative forces will be converging by then.

- The German DAX hit by stronger euro currency.

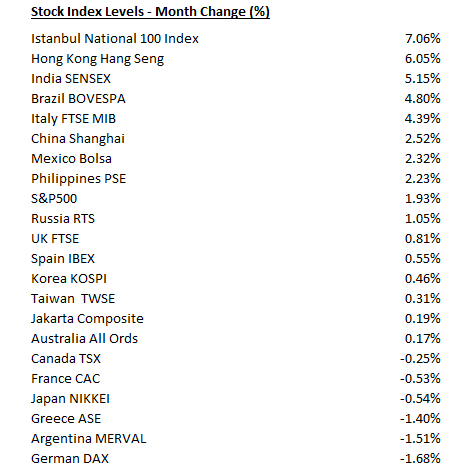

Local Currency Fixed-Income

- Brazil 10-year rates continue to move lower, now down about 140 bps on the year.

- U.S. 10-year flat.

- Indonesia and Canada rates moving higher with oil prices.

- Little change in U.S. yield curve.

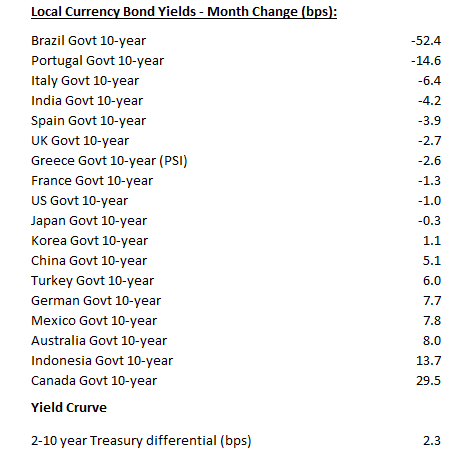

Currencies

- Dollar weak on the month, with index approaching key and critical support at 92. It is very over sold and non-commercial longest euro position since 2011, just months before the Eurozone almost melted down. We think it bounces here but keep it on a tight leash. Dollar slumping with Trump and with the Genaral taking charge of White House, confidence may be somewhat restored. Nevertheless, plan on gettting short on a close below 92.

- Aussie, commodity currencies, and Euro ripping higher.

- Global capital flows like 10 plus 10-year interest rate in Brazil, moving currency higher.

- Super Mario may be getting concerned about higher Euro. Look for some talk down.

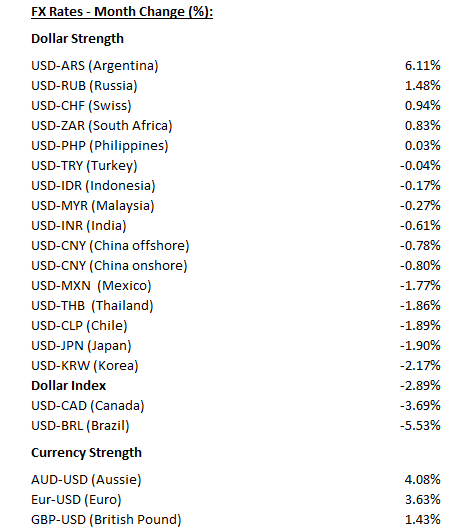

Other Risk Indicators

- Reflation trades picking up with weaker dollar

- Iron ore up big on the month. We posted it looked like it bottomed last month. A sign “old China” is reaccelerating.

- Ags, mainly wheat, giving some gains back.

- Energy stocks lagging the commodity higher

- We may be talking about higher cyclical inflation in the fall as markets and analysts continue to obsess over deflation. Blah, blah, blah!