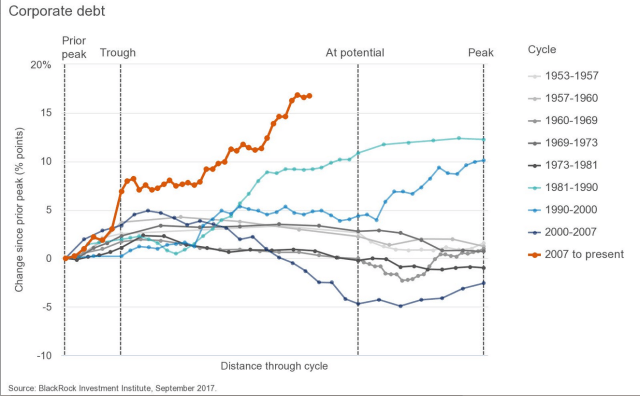

No lack of supply/issuance in the corporate debt market. No shortage of demand either.

Lots of nuances in interpreting data, however. First, much of debt going to financial engineering, i.e., stock buybacks. Some of the supply is borrowing against capital stuffed overseas driven by tax incentives, such as Apple.

Last, but not least, NIRP and ZIRP – record low real interest rates.

One big concern is, given the increase in financial regulation, who is going to make the markets and liquidity for this stuff when investors start coughing it up?

(COTD = Chart of the Day) Hat Tip: Jesse Felder