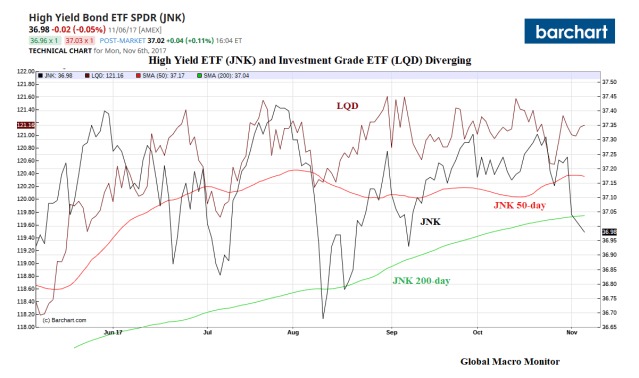

Take a look at the divergence between the high-yield ETF (JNK) and the investment grade ETF (LQD). This makes us a bit nervous – though no panic as JNK in only 1.28 percent off its high vs. the LQD, which is only 0.53 percent off its 52-week high. The LQD trades more closely with the risk-free bond.

Last week we saw a break in the momentum of spread tightening across the board even as the VIX closed at a record low. It seems very difficult to imagine that spreads can come in much further and we think we are very close to the floor.

Makes sense to take some risk off into this year-end rally.

Pingback: Weekend Reading: It's The Debt, Stupid | RIA

Pingback: Weekend Reading: It’s The Debt, Stupid - Investing Matters

Pingback: Weekend Reading: It's The Debt, Stupid - Political American

Pingback: Weekend Reading: It’s The Debt, Stupid | ProTradingResearch

Pingback: Weekend Reading: It's The Debt, Stupid -

Pingback: Weekend Reading: It’s The Debt, Stupid | Real Patriot News

Pingback: Weekend Reading: It’s The Debt, Stupid | Investing Daily News

Pingback: Weekend Reading: It’s The Debt, Stupid – Wall Street Karma

Pingback: Weekend Reading: It's The Debt, Stupid | WarMachines.com