After 363 trading days since election day, the JFK and Trump S&P500 are only 1.52 percent apart regarding price performance.

The Kennedy bull run peaked 274 trading days after the November 7, 1960, election rising 31.81 percent and topping on December 12, 1961. The Trump Bump rose 34.77 percent in 306 trading days, peaking on January 26, 2018.

The major factor why, other than the symmetric political cycle, that both markets have tracked so well is because of the similar large runs in such a short period. Speculative behavior repeats itself as human nature has not changed, even if it is machine programmed by algos that search reams of time series financial data to search for similar patterns that mimic that behavior.

As the analog illustrates it is now time for the S&P to break lower. Today (April 19), Trading Day 363, marked the swing high in 1962 and the start of the subsequent precipitous drop that took the S&P500 down 23.72 percent before bottoming on June 26, 1962.

If the analog is a true tracker — that is not daily correlated, but both move together on a relative basis in the same time and direction space — the market should break in the next few days or week.

The catalyst? Maybe higher interest rates and inflation fears.

JFK Presidential Papers of the 1962 Bear Market

We sifted through some of President Kennedy’s briefing memos concerning the 1962 bear market, which is available online (see here). We thought you would find the following three interesting and very relevant.

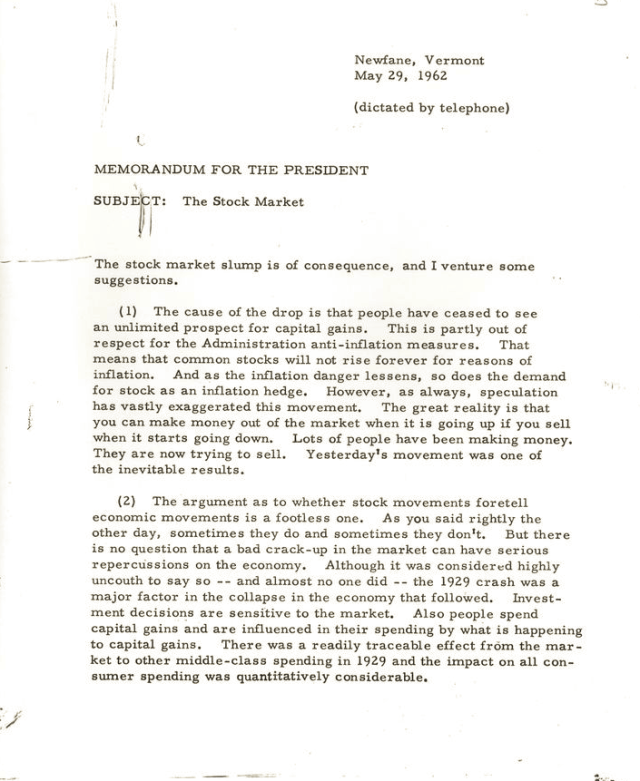

The first is from JFK’s economic adviser, John Kenneth Galbraith (JKG) who lists several reasons for the bear market, mainly market psychology and the government’s anti-inflationary policies. Recall Galbraith wrote a seminal book on the 1929 market crash.

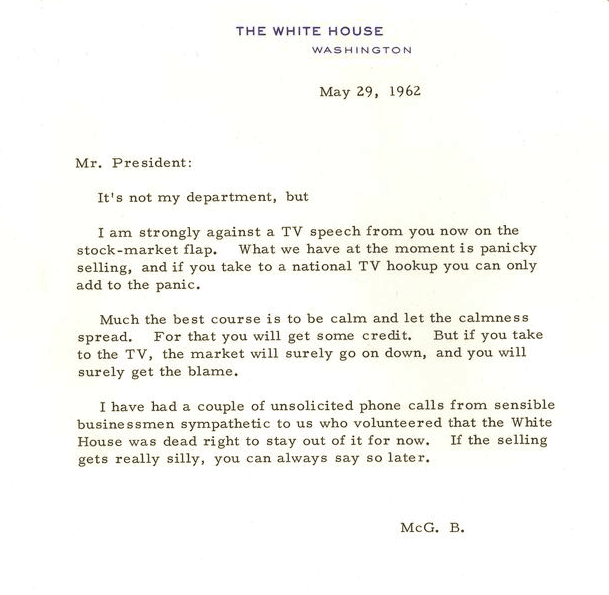

The second from McGeorge Bundy, Special Assistant to the President for National Security, urging the President not to panic after the 6.68 percent flash crash on May 28, 1962. The market decline did not warrant the White House’s attention until the May flash crash.

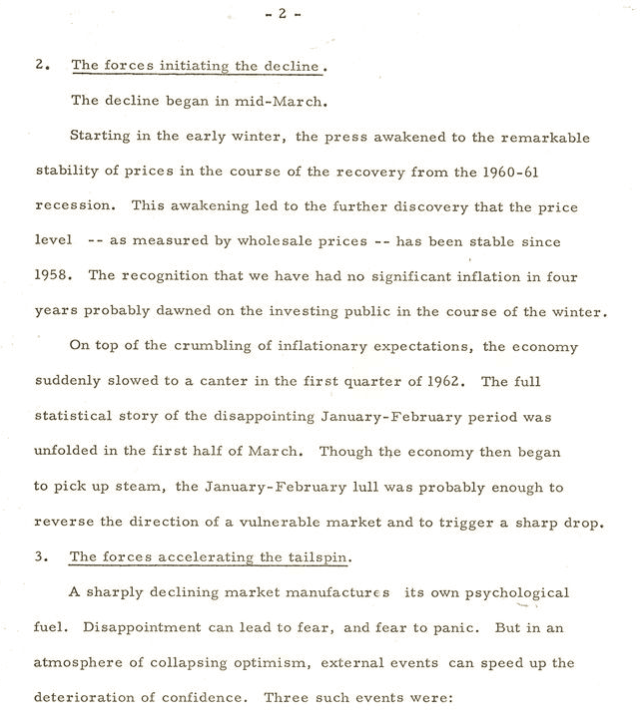

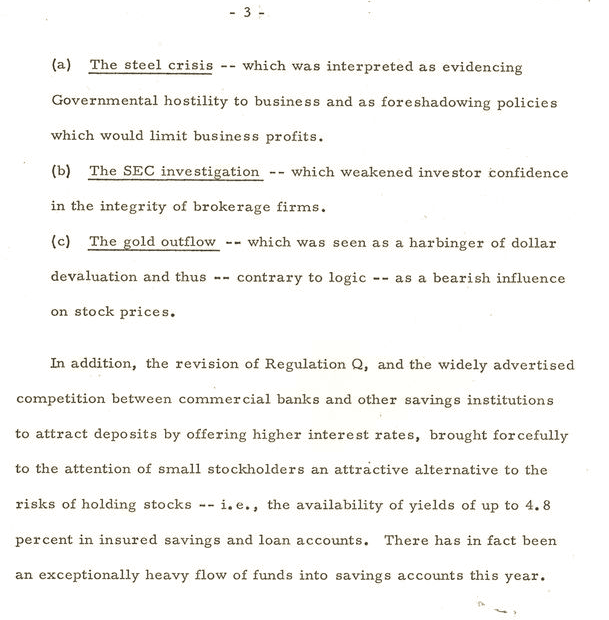

Finally, the third memo is the last three pages of a briefing to the President from Walter Heller‘s Council of Economic Advisers (CEA) listing several macro reasons for the market slump, including steel prices, balance of payments deficit ergo tighter money, and competition from rising short-term rates. All seem similar to the current macro issues affecting the market.

John Kenneth Galbraith

McGeorge Bundy

Walter Heller, CEA

Time to buckle up.