Summary

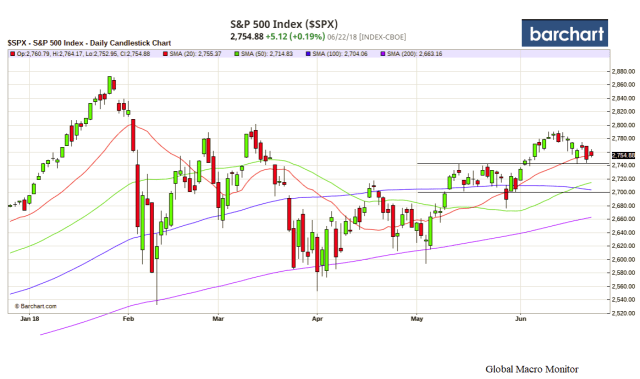

- The S&P500 is trying to establish a new trading range above past resistance at 2742, the .618 Fibonacci retracement level of the current correction. It held last week. Watch that critical level for support

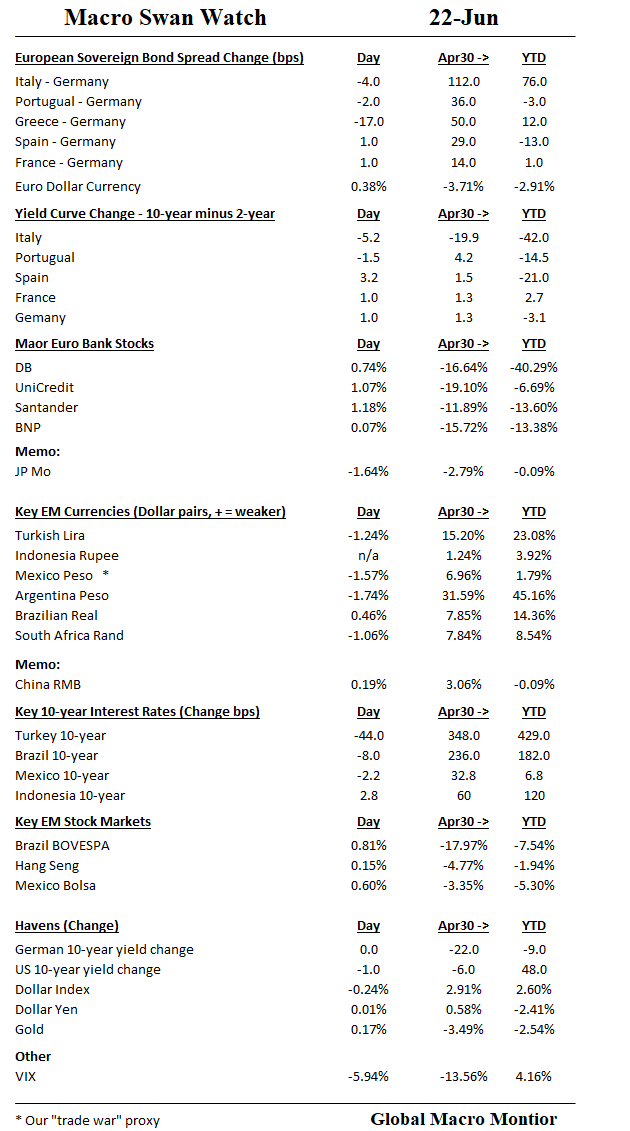

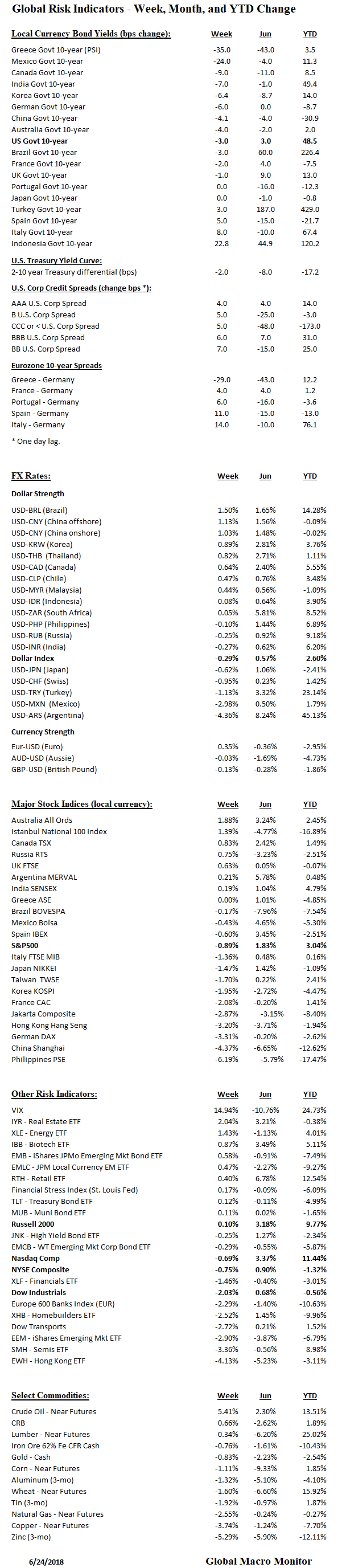

- Bond markets remained volatile but finished little changed on the week x/Greece, which was in big on its debt deal, and Mexico 10-year yield down 24 bps

- Corporate credit spreads a bit wider

- Spain and Italy sovereign spreads out 10-15 bps

- Argentina peso stronger on back of IMF program

- Euro/dollar a smidgen stronger

- Big sell-off in German, China, and Philippines stocks

- Crude up over 5 percent on less than anticipated OPEC supply increase

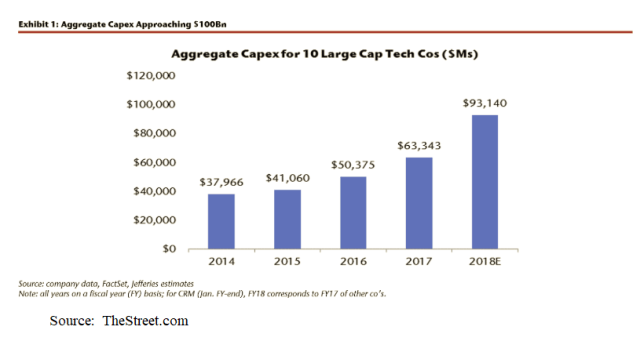

Commentary: Q2 GDP should be out soon, and many are expecting 4 percent plus growth. There has been a nice improvement in capital spending, which we suspect is dominated by big Tech CAPEX spending on the buildout of the Cloud. Investments in AI and labor reducing technology, mind you.

The world’s biggest tech companies have clearly gotten that memo. Aggregate spending for 2018 among the 10 largest tech companies is approaching $100 billion each for capital expenditures and R&D, according to new research from Jefferies. Capital expenditure commitments and R&D outlays are seen rising 47% and 24%, respectively, this year. The biggest spenders, which should come as no surprise, are Amazon (AMZN – Get Report) , Alphabet (GOOGL – Get Report) and Facebook (FB – Get Report) .

“We view their outsized investments as positive in extending their leadership for years to come,” says Jefferies analyst Brent Thill of the spending plans of the big three tech names. – TheStreet.com

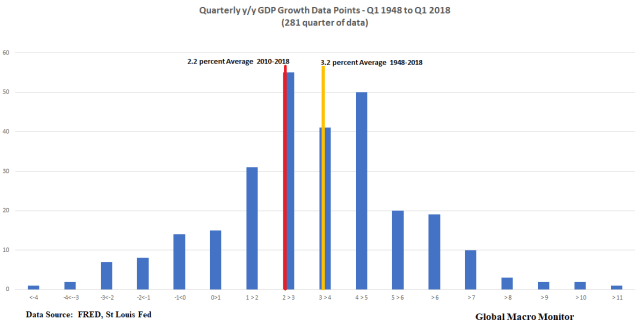

Increased investment spending should lead to a decent bump in Q2 GDP growth to the upper 3 percent. Better, but far from “greatest economy ever.” The chart below illustrates that y/y quarterly GDP growth since 1948 has averaged 3.2 percent and 2.2 percent since 2000. The data for 281 quarterly y/y growth observations show a relatively normal distribution with a slight negative skew.