Summary

- Fireworks began at the end of the week with Trump announcing he was not happy with the Fed and currency moves

- Bonds sold on Friday

- EM FX mixed

- The dollar index closed weaker after Trump tweets. Note the dollar fell more that 10 percent during Trump’s first year, and now is moving higher. It is still down over 5 percent since his administration took office

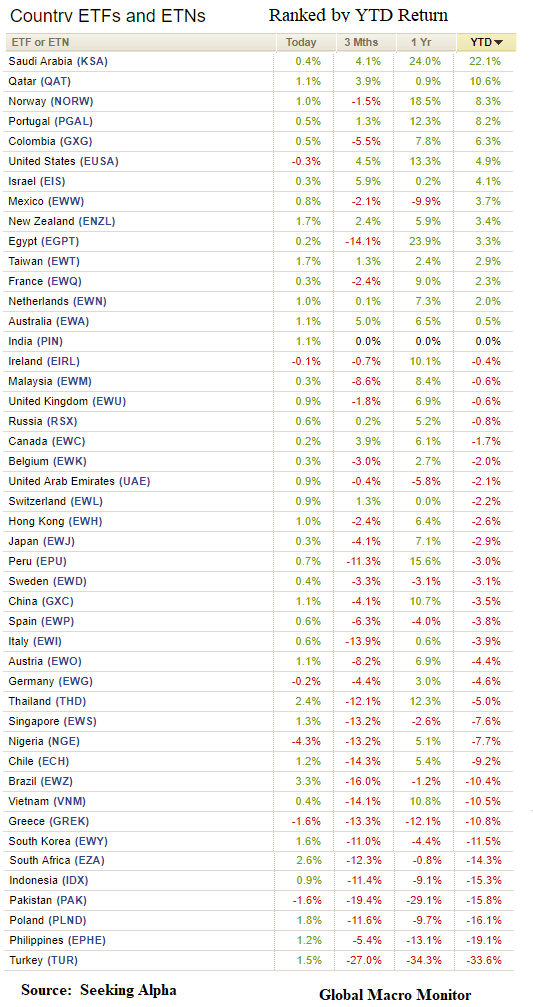

- Stocks relatively quiet, bookended by Turkey, up over 4 percent, and Russia down over 6 percent

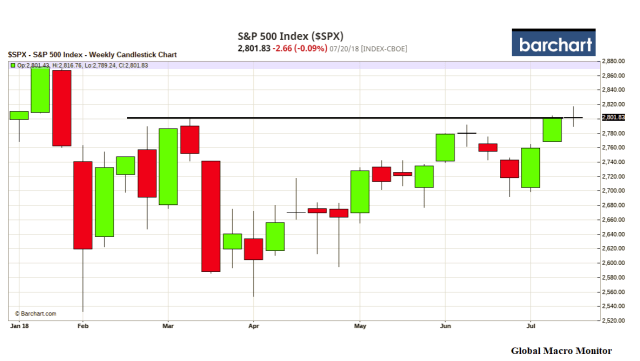

- S&P closed at the exact level of last Friday’s close. The only 5th time it has happened in the past 70 years. Weekly S&P500 having trouble closing above 2802

- Financials performed well as the S. yield curved steepened five bps

- Grains up around 4 percent as lumber now in a new bear market after making multi-year highs in May, down over 25 percent

- Only Oil exporter country ETFs with double digit gains this year

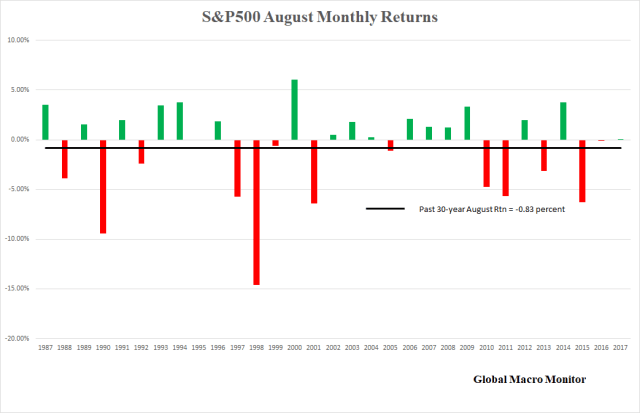

Commentary: We noted S&P might have used up its juice after rallying over 3 percent in the first two weeks of the month. Risks are rising as S&P moves into August, one of the most treacherous months. The month of big drawdowns and no liquidity with everyone on holiday. Cautious.