Summary

- Brazil 10-year blows out 21 bps and currency flops 5 percent on political concerns. The former president, Luiz Inácio Lula da Silva, is surging in the polls, even from his jail cell. While the other top presidential candidate, Jair Bolsonaro, a conservative populist defended the dark days of the military dictatorship that ruled Brazil from 1964-1985

- Argentina peso weakens to all-time low on economic and political uncertainty but South Africa a bit stronger, even after Trump misinformed tweet, in sympathy with temporary rebound in Turkish lira, due primarily to closed markets

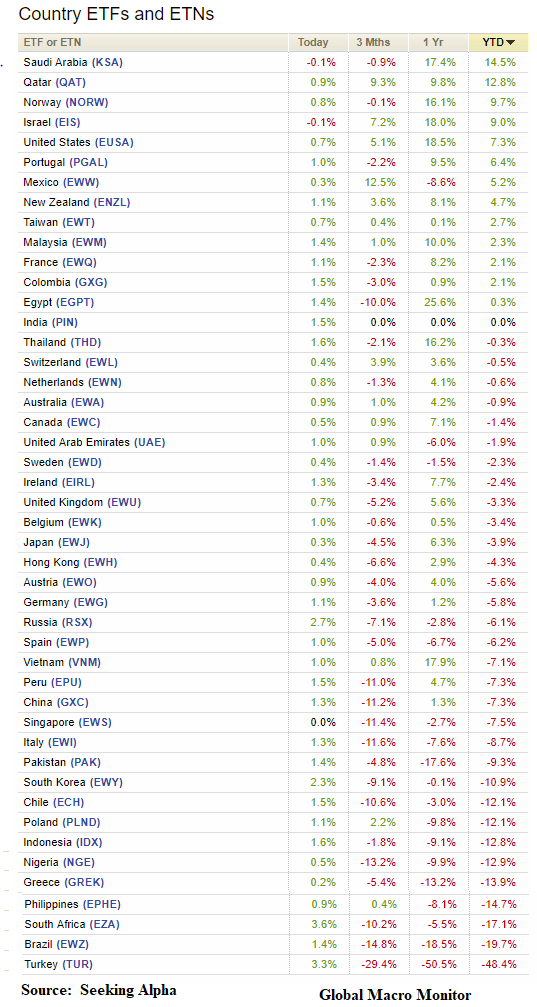

- Most global equity markets higher led by Asia

- Vix below 12, barely

- Nice bounce in metals

- Gold up 1.8 percent on the week

Commentary: Low volume and we expect the same next week as the entire world is still at the beach. Mr. Market perceived Fed Chairman Powell’s Jackson Hole speech as dovish. WTF? Was Mr. Market ever worried interest rates would rise at an accelerated pace? Mr. Market took a wrong turn on Highway 420 on Friday. Has weed been legalized in Wyoming yet?

Dollar chart looks weak after the blow off gravestone Doji candlestick on August 15, which took the index to 96.984. Nevertheless, we expect 95 to hold and the Dixie to trade in a 95-97 range unless U.S. politics gets real fugly. Not unrealistic, by the way.

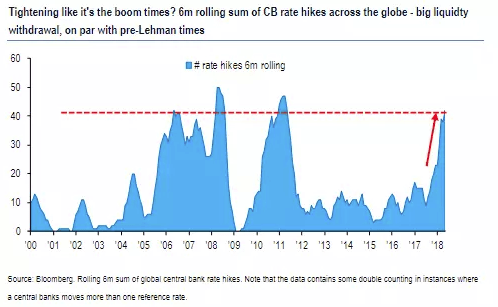

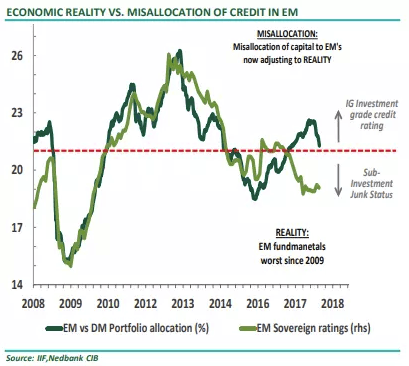

Everyone is looking to buy the emerging market sell-off (the chart). As we have posted, EM is oversold and ripe for a decent technical bounce. A fundamental buy is a long way off, however, and the probability of a major market disruption is higher than being discounted. The Fed is still tightening the vice and global liquidity is drying up. The Street needs an EM rally here, or they are looking at year-end bare-bones (as in bonuses).

No handshake with Mexico on NAFTA deal. Maybe next week, maybe not. Can they then cram it down on Canada? Not likely.

Laying low until after Labor Day.

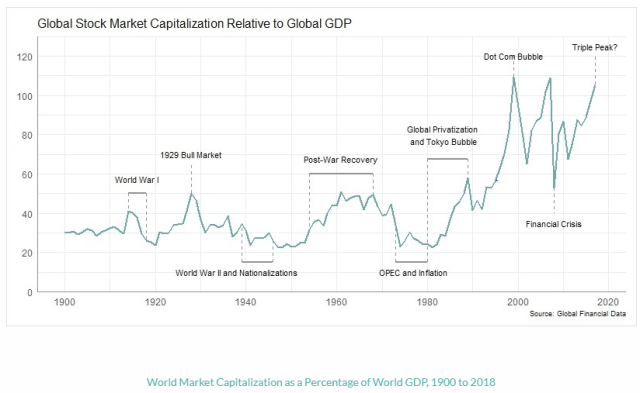

Would you load up on risk after examining the first two charts?

Just askin’.

Hat Tip: @MehulD108

https://twitter.com/OccupyWisdom/status/1033220222499598336

Global Liquidity Is Drying Up – FT Alphaville

Chart Source: FT Alphaville