We don’t know and neither does anyone else.

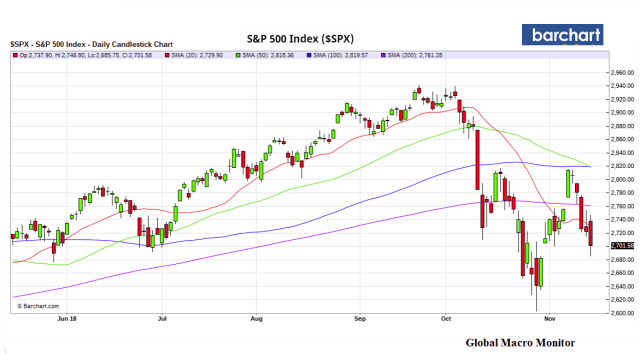

We do know, however, the market trades horribly; it can’t hold its water on rallies; has lost its leadership and trades rudderless, and the index is getting close to testing some key levels to the downside. It feels like a Cat 2 hurricane, dangerous but not yet catastrophic.

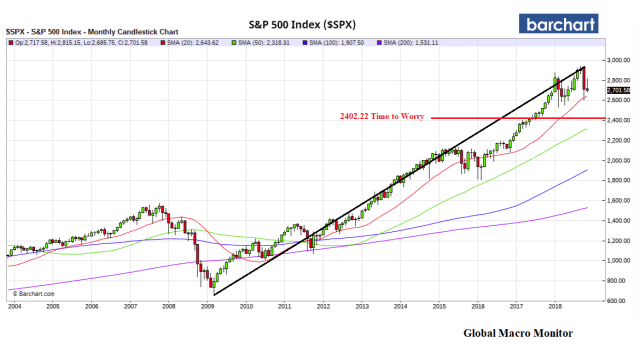

We begin to get nervous about the rally from 2009 if the 2018 lows break at 2532, and real nervous if the first Fibo of that rally is violated at 2404, which is 11 percent lower from today’s close. Still that level would not constitute a bear market.

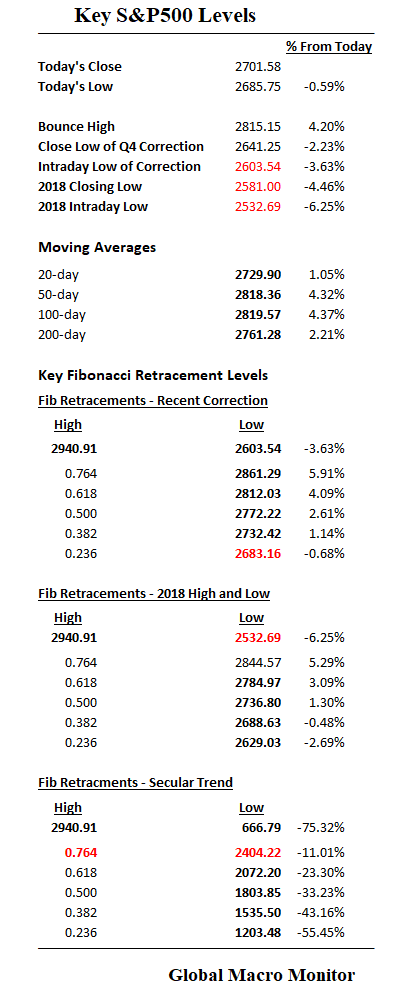

Key Levels

We have highlighted the key S&P levels to watch in red in the table below.

Watch today’s low at 2685.75, which was just above the .236 Fibo of the recent correction. Then 2641.25, the closing low of the Q4 correction, and finally the 2603.54 intraday low.

The probability of a retest of the 2018 intraday low of 2532.69, 6.25 percent lower, is a high probability event, in our opinion. If that fails, a bear market is likely.

Of course, this trajectory can change if, say, the U.S. and China soon kiss and make up on trade, which we put at 30 percent, or the Fed reverses shrinking its balance sheet, a 15 percent probability, in our opinion.

Stay tuned.

The midterms were a disaster for the Democratic Party. Not sure you recognize millenials are figuring this out – a mandate did NOT result as you perceive.

40 seat gain in House, 7 governorships, and 6 statehouses is a disaster?