Nope!

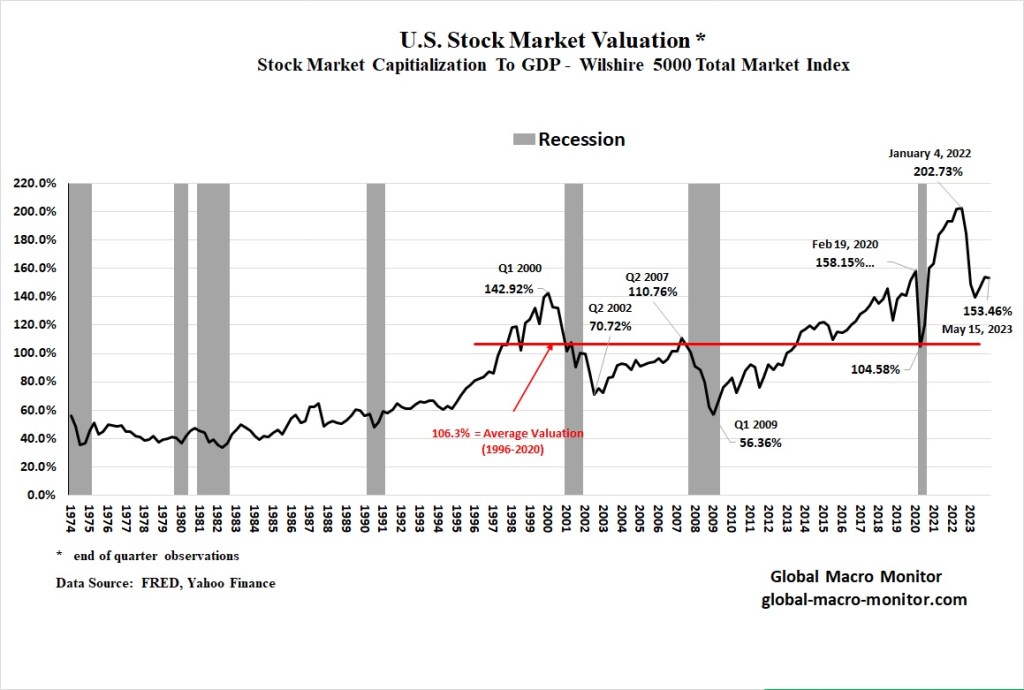

Based on Warren Buffet’s favorite stock market valuation metric, the market remains very expensive.

Note this is a mean-reverting chart — that is, the time series does not move from lower left to higher right as the total market capitalization as measured by the Wilshire 5000 is normalized by nominal GDP but will revert back to its mean valuation level.

Over the years, there have been various rationalizations as to why the market remained in the super-expensive zone for so long, such as globalization, low inflation, free money, China opening, offshoring, zero interest rates, and quantitative easing.

No mas, all gone. Now, the market must stand alone and grow earnings, and earnings grow with the economy.

Stay frosty, folks.

If that’s all there is to it, then I guess this would indicate the answer is no; not by a country mile. But the size of the global population and economy is how much larger today than say 1992?