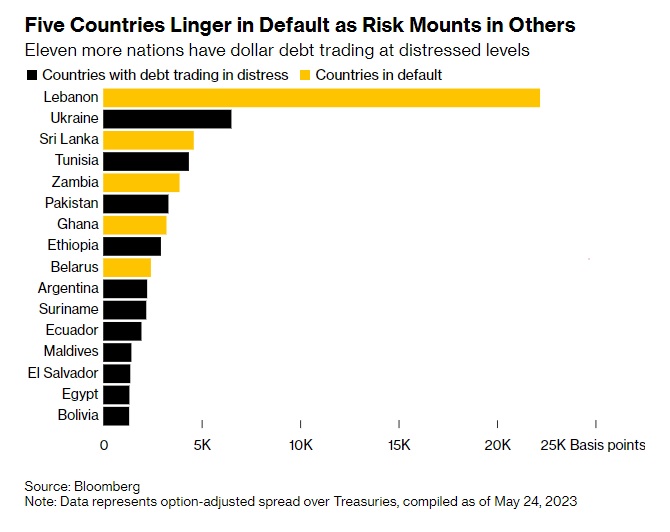

There are 11 emerging nations with dollar debt trading at a risk premium of at least 10 percentage points — a distressed level that signals the threat of default.

Lebanon, Sri Lanka, Zambia and others have already tumbled into default, locking the economies out of international capital markets until a deal can be struck with creditors. – Bloomberg

Money Points:

- A shakeup is brewing in the $1.6 trillion universe of emerging-market sovereign debt.

- Government defaults are rising to a record in the developing world.

- The debate is growing frantic over how to solve these debt crises.

- The International Monetary Fund (IMF) is pushing for a new global bankruptcy framework.

- The IMF’s proposal would allow countries to restructure their debts in an orderly way.

- The proposal has been met with resistance from some investors and governments.

- Some investors are concerned that the proposal would give too much power to debtor countries.

- Others worry that it would make it too easy for countries to default on their debts.

- The IMF argues that its proposal would help prevent future debt crises.

- The debate over how to solve sovereign debt crises is likely to continue for some time.

- Investors will need to be vigilant as they navigate this uncertain landscape.

- The stakes are high, as sovereign debt crises can have far-reaching economic consequences.

Not sure the world financial markets could cope if The Maldives went into default!