Yes. And it’s significant and intuitive.

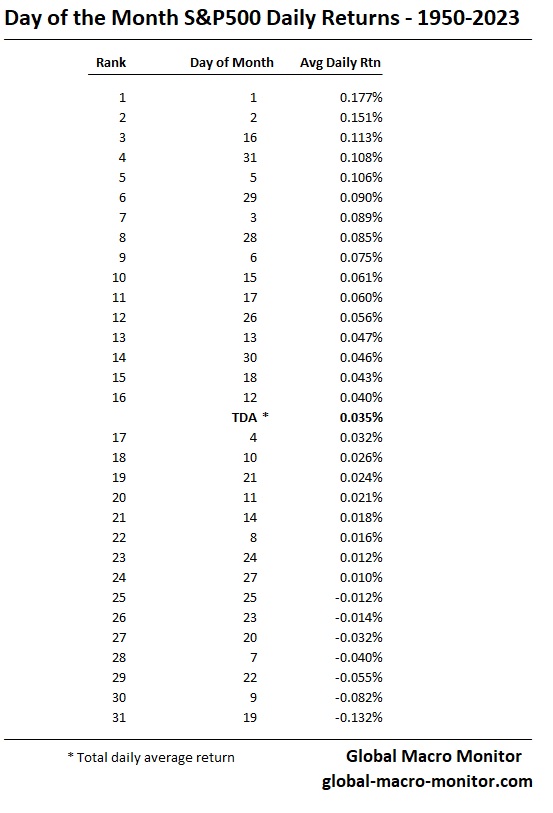

The table analyzes daily returns for the S&P500 since 1950 and illustrates the first of the month has returned on average 17.7 bps. That is 14 bps more than the daily average of 3.5 bps. Day one is followed closely by the second day of the month.

Explanation? Our priors are that it results from money flowing into stocks at the beginning of the month, and probably more so if we controlled for quarterly data. We also suspect the 19th day is last and distorted by the huge outlier of the 20 percent plus October 19, 1987 crash. Captain Obvious.

Shouldn’t efficient markets deem such large disparities in day of the month returns impossible, however?

Upshot? Don’t be short stocks on average at the beginning of the month.