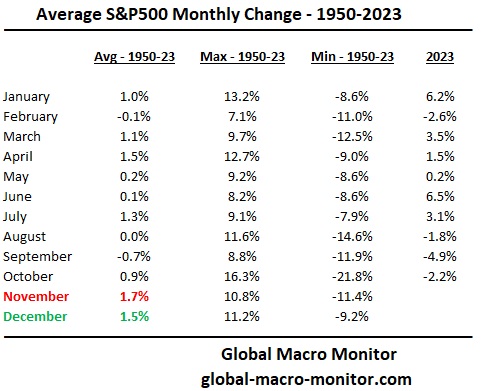

Stocks began “the most wonderful time of the year” by putting in a nice performance on the first day of the best-performing month of the year. The S&P500 was up 1.05 percent to start the month of November, which on average has generated a 1.7 percent price return since 1950, followed by December with an average performance of 1.5 percent.

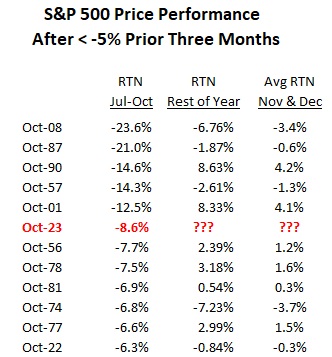

The index entered November after generating three consecutive months of negative returns, falling 8.61 percent since the end of July. Only five times in the last seventy-three years has the S&P500 entered November after such a poor performance in the prior three months. The following table shows that in three of those times, the performance for the rest of the year was negative, while in the other two instances, the S&P was up north of 8 percent.

It’s going to be an interesting rest of the year. Place your bets, folks.

So will there be carolling in the snow, or scary ghost stories of long ago? This is the question it seems. I’d say compared to 1981 and the 16% interest rate mortgage on my place in the Santa Cruz mountains, today’s 8% seems a bargain, yet few remembers those days, and there’s a lot of negative numbers on your charts there.

🙂 😦 ? -Mike G.

Pingback: Is It Russell’s Time? | Global Macro Monitor

Pingback: A November To Remember? | Global Macro Monitor