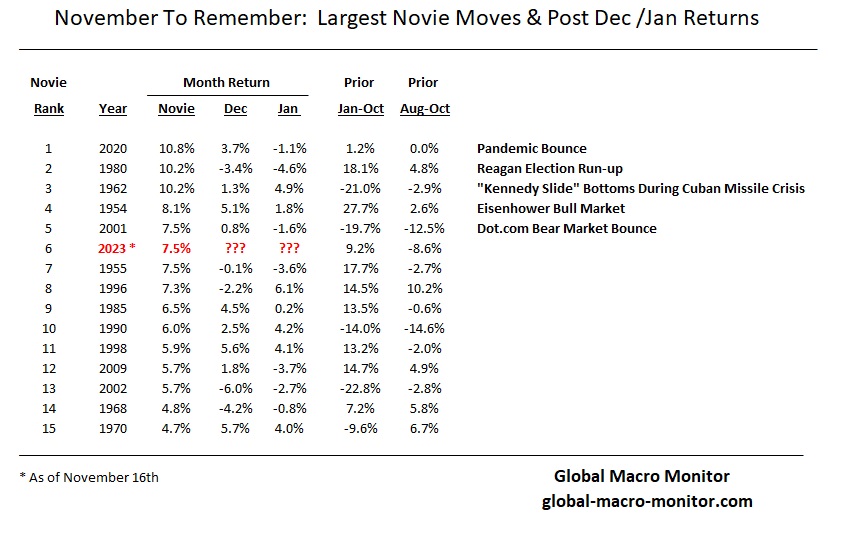

As of today’s close, the S&P move in just the first half of the month already ranks as the 6th most significant November monthly move in over seventy years.

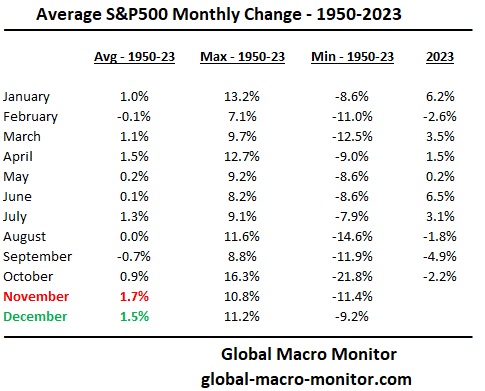

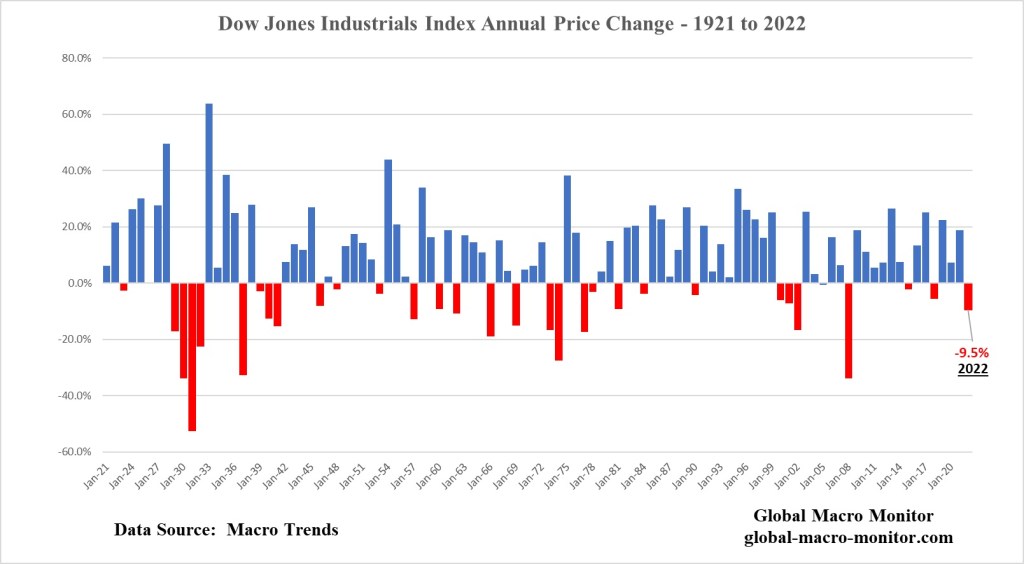

It’s challenging to find a similar set-up going into the end of the year as the index was up 20 percent at the end of July and then took an 8.6 percent swan dive during the next three months, setting up this humungous bounce in the first few weeks of November. Recall that, on average, November is the best month of the year for stocks by a wide margin, followed by December.

Of course, the set-up for December will change if we get a decent pullback in the next few weeks. It’s stunning to hear some talking heads predict another 7-10 percent for the rest of the year. It is possible, and we will take it, but the empirical probabilities suggest otherwise, as illustrated in the above table.

It’s a mug’s game trying to predict short-term stock moves, but we can’t help ourselves. Given the seasonals, the empirical probabilities point higher, likely after the stock market digests this big move, churning and burning in a narrow range before the Santa Claus ramp.

Today’s relative performance in the Russell 2000 was disappointing, but we do suspect that small caps will lead when the market begins its next holiday leg up. If not, we will take it as a signal a recession looms.

Who said this business was easy?

Pingback: Coming Soon: The Best Trading Days Of The Year | Global Macro Monitor