“But as any mathematician knows, averages can be deceptive. Andrew Robinson, CEO of famed advertising agency BBDO, once said, “When your head is in a refrigerator and your feet on a burner, the average temperature is okay. I am always cautious about averages.” — Eric Barker

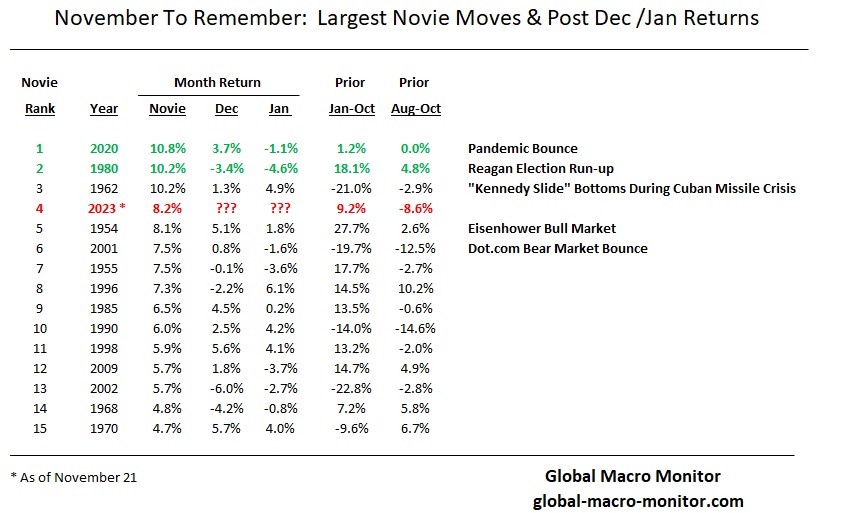

Since our post, A November To Remember?, the S&P500 continues to rise as one of the best-performing Novembers since 1950, advancing to the 4th best on an average monthly return basis, and it’s only the 21st! Who would have thunk it? And that is probably a good reason of this November to remember stellar performance, “nobody thunk it.”

In our years of market watching, we have deduced that short to medium-term stock moves are based on the rate of change, or first derivative, of the factors that drive prices, such as earnings and interest rates. What drove markets down in the recent bear market was the change in interest rates, and the recent rally has been driven by the change in interest rates, just with a different sign, for example.

Levels will eventually matter. Just as the still high level of liquidity central banks injected into the global economy during the pandemic matters, even as the rate of change is negative, is confounding economists, who have been forecasting a recession for the past year.

The level of interest rates, if the Fed is true to their word, “higher for longer,” will eventually bite both the markets and the economy.

There is no doubt markets are hooked on the monetary crack and the financial dopamine created by the anticipation of interest rate cuts and central bank liquidity injections, which drive the market multiples.

Hopes of interest rate cuts spring eternal.

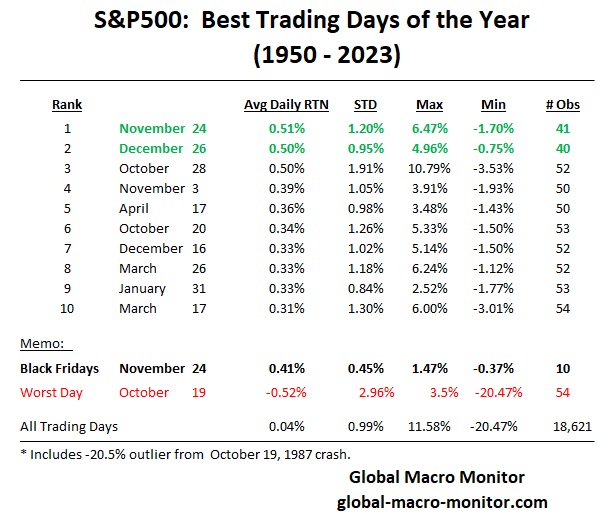

Best Trading Days of the Year

We have also analyzed the best trading days of the year, with November 24th ranked numero uno — that’s this Black Friday, folks — with December 26th a close second. Black Friday has fallen on November 24th, about 25 percent of the observations, so all can not be attributed to the urge to splurge on Christmas gifts. Let’s just say traders tend to get lathered up around the Thanksgiving holiday.

Twenty-two Standard Deviation Event

The table below also illustrates how one giant outlier, such as the 20 percent plus October 19, 1987, one-day crash, can skew the averages.

Before Monday, October 19, 1987 (now known as Black Monday), such a massive drop in the market wasn’t considered possible because statistics put such a decline at an impossibly rare twenty-two standard deviation event. How rare is a twenty-two standard deviation event? Writing about the drop in his 2000 book When Genius Failed, reporter Roger Lowenstein of the Wall Street Journal noted, “Economists later figured that, on the basis of the market’s historical volatility, had the market been open every day since the creation of the Universe, the odds would still have been against it falling that much in a single day. In fact, had the life of the Universe been repeated one billion times, such a crash would still have been theoretically ‘unlikely.’”

Yet it happened. – Forbes

Grateful

We can always find many things to be thankful and grateful for, even if the world seems to be rapidly moving sideways.

Happy Thanksgiving, folks.