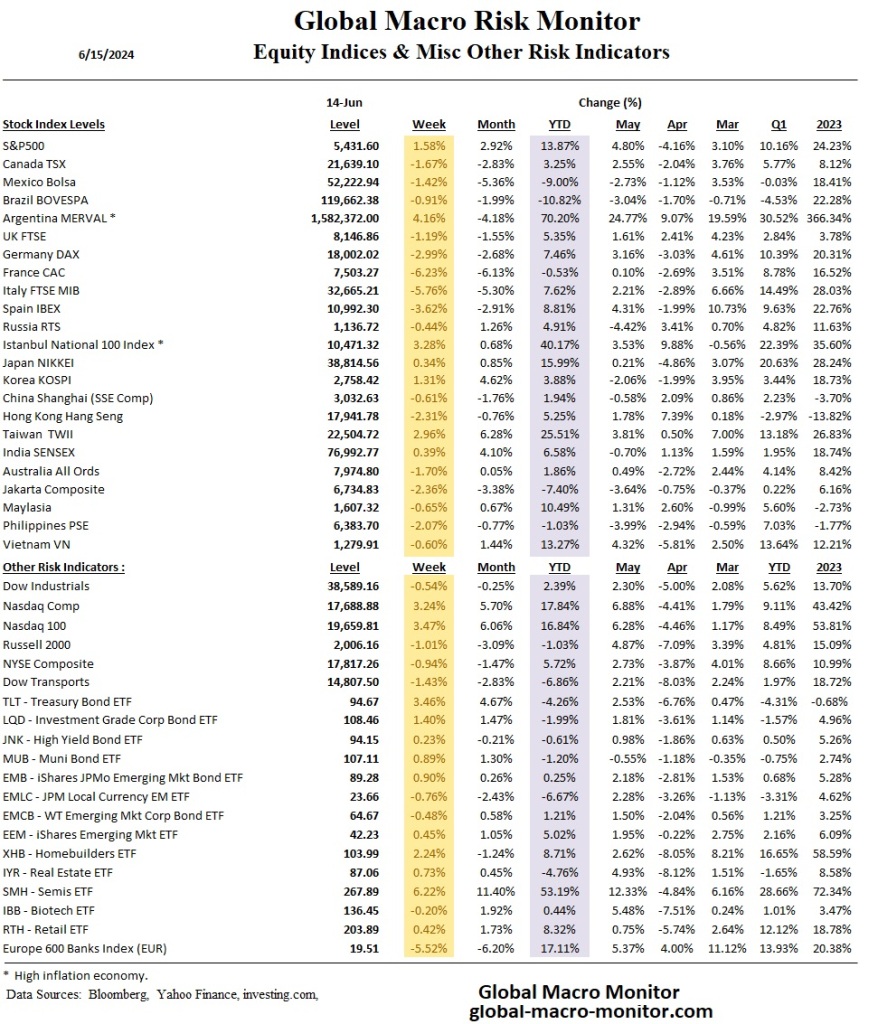

This week’s Global Macro Risk Monitor shows significant declines in European markets following a hard-right swing in the Euro parliamentary election. The Euro weakened by 0.92 percent against the USD, and the German DAX and French CAC fell 2.99 percent and 6.23 percent on the week. Euro sovereign bond spreads reflected increased risk, most widening significantly for the week. These movements underscore market concerns over potential political instability and economic policy shifts. In contrast, the S&P 500 and tech sectors in the US continued to show robust performance, highlighting sector disparities and the narrow breadth of the market. The equal-weighted S&P 500 was down ½ percent for the week.

- Equity Performance:

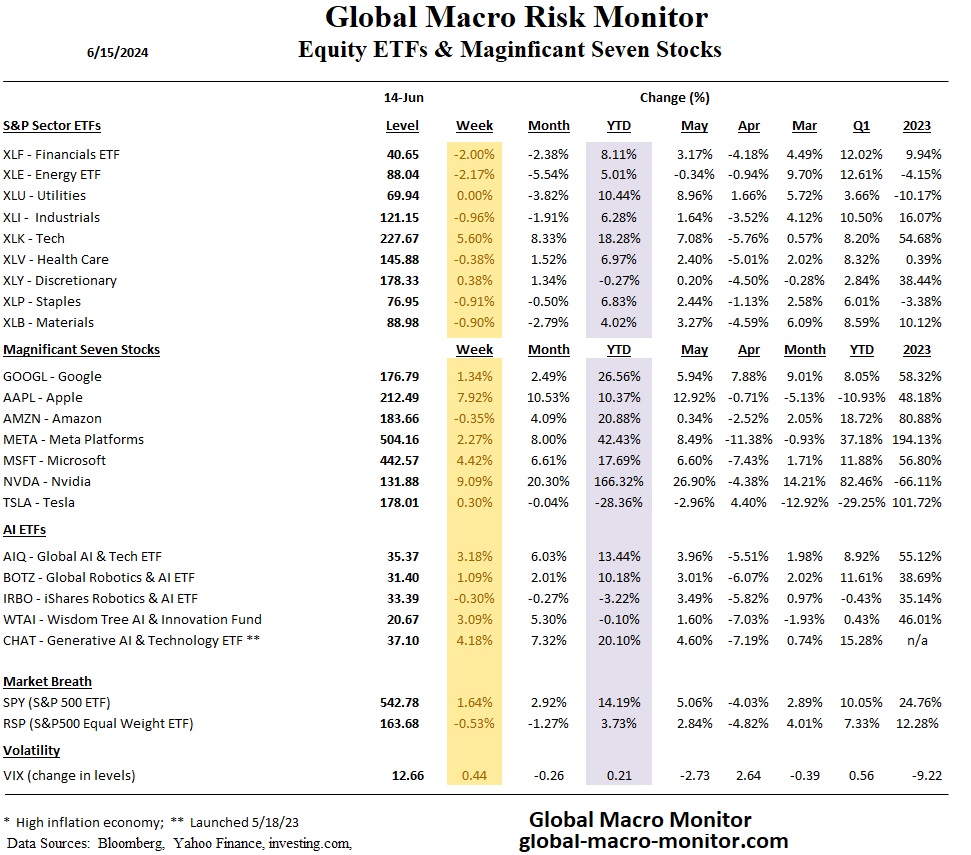

- The S&P 500 gained 1.58 percent weekly, driven by tech sector strength.

- Apple (AAPL) and Nvidia (NVDA) saw weekly gains of 7.92 percent and 9.09 percent respectively.

- The equal-weighted S&P500 was down 0.53 percent for the week, reflecting the very narrow breadth of this market

- European markets were slammed by the results of the European Parliamentary elections’ big lurch to the hard right. The French CAC led the declines, falling 6.23 percent for the week.

- Sector and ETF Trends:

- Financials (XLF) and Energy (XLE) ETFs fell over 2 percent.

- AI and tech ETFs showed robust weekly performances, highlighting investor interest.

- Sovereign Bonds:

- The US 10-year yield dropped 20.6 bps for the week.

- European sovereign spreads blew out.

- France’s spread over the German bund is now 75, but surprisingly, only 3 bps tighter than Portugal.

- Currencies:

- The Dollar Index rose 0.55 percent last week and is now up 4.09 percent YTD.

- The South African rand was close to 3 percent stronger after the ANC formed a coalition government.

- Commodities:

- Gold increased 1.71 percent for the week, now up 13.06 percent YTD.

- Copper rose 0.39% on the week, adding to its YTD gain of 16.07 percent

- Energy Commodities:

- Crude Oil rose 4.13 percent.

- Natural Gas fell 1.75 percent.

- Market Volatility and Conditions:

- VIX increased slightly by 0.44 points for the week.

- Chicago Fed NFCI indicates easing financial conditions with a reading of -0.5639