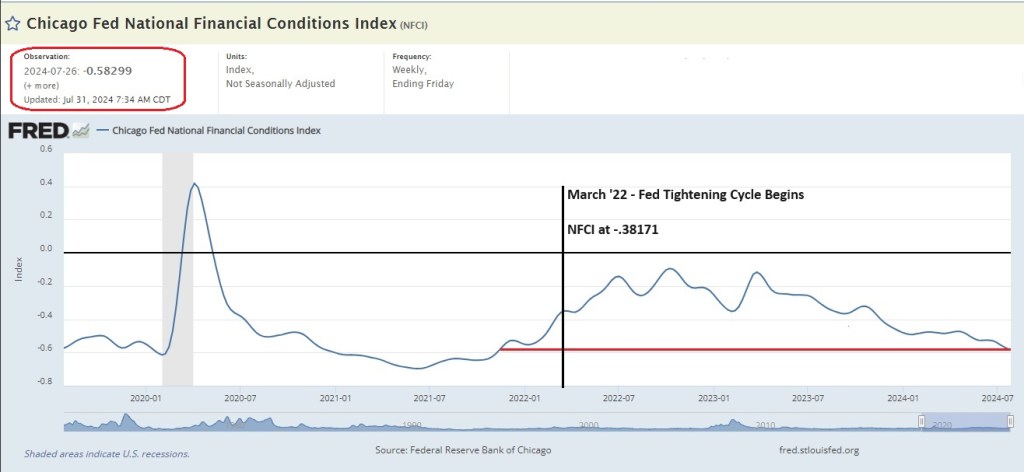

The Chicago Fed’s National Financial Conditions Index (NFCI) is significantly easier than when the Fed started the tightening cycle in March 2022 (see the chart below). As the market ramps up based on the expectation of a September rate, financial conditions are set to ease even further. In our opinion, there is far from a zero probability that the Fed will be forced to backpedal. Markets also create “liquidity,” which can stimulate demand.

Here’s a synopsis of today’s FOMC meeting:

Federal Reserve Chair Jerome Powell signaled that an interest rate cut may be coming at the September FOMC meeting, following the Fed’s decision to maintain its benchmark rate at 5.25%-5.5%, the highest in over two decades. Powell emphasized the Fed’s dependence on data and economic outlook when making this decision. Adjustments in the Fed’s language now reflect the FOMC’s attention to risks on both sides of its dual mandate: inflation and employment. The Fed acknowledged progress towards its 2% inflation goal, a moderated labor market, and easing inflation, yet stressed the need for “greater confidence” in inflation trends before reducing rates. Treasury yields dropped, and the S&P 500 gained, reflecting investor anticipation of a rate cut. Powell noted varying potential scenarios for rate cuts based on economic developments, underscoring a balanced approach to managing employment and inflation risks. The Fed’s shift in focus highlights the need to foster maximum employment alongside price stability.

The NFCI is constructed to have an average value of zero and a standard deviation of one over a sample period extending back to 1971. Positive values of the NFCI have been historically associated with tighter-than-average financial conditions, while negative values have been historically associated with looser-than-average financial conditions. – Chicago Fed