“The economy, stupid” is a phrase that was coined by Jim Carville in 1992. It is often quoted from a televised quip by Carville as “It’s the economy, stupid.” Carville was a strategist in Bill Clinton‘s successful 1992 U.S. presidential election against incumbent George H. W. Bush. – Wikipedia

The current assertion that the economy is in or heading toward recession and the Federal Reserve must execute an emergency rate cut, amplified by the former president’s alarming “GREAT DEPRESSION OF 2024” warning, warrants a closer examination. By the way, the former president is in rare company as stocks experienced two bear markets (a 20% decline) during his single term, and he persistently pressured the Fed to reduce rates to stabilize stocks during the Christmas bear market of 2018.

Technical Not Fundamental

From our perspective, the current market downturn is predominantly technical and does not indicate an imminent recession, although it is inevitable that a recession will occur – someday. Once again, financial pundits are retrofitting fundamentals to explain the stock market’s price movements.

The employment report released last Friday, which contained some positive aspects, served as a pretext for selling in an overheated market that had surged 38% since the end of last October and over 62% in less than two years. The unwinding of leverage and crowded trades, including the yen carry trade (often exaggerated), is contributing to this correction.

We posted last Thursday night that the S&P 500 was vulnerable, positioned right at support, and that a breach of 5,400 would likely lead to a move down to 5,100. Today’s low on the S&P 500 was 5,119.26.

Employment Report Insights

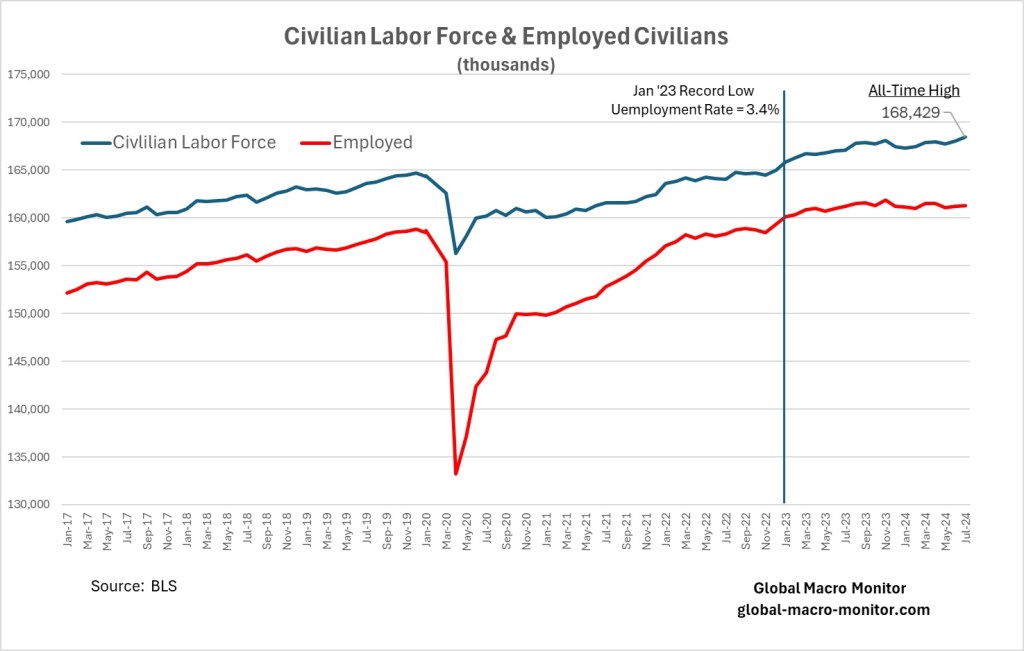

The employment report from last Friday was not as dire as many perceive. The Bureau of Labor Statistics (BLS) reported the economy created 114,000 payroll jobs according to the establishment survey and 67,000 jobs based on the household survey. For those interested in the methodological differences between these surveys, further details are available here.

Both measures indicated net job gains, albeit modest compared to recent years, and the rise in the unemployment rate can be attributed solely to an increase in the labor force. An expanding labor force, coupled with productivity gains, not only drives economic expansion but also helps mitigate inflationary pressures that have challenged policymakers in recent years. Moreover, the employment report showed the size of the U.S. labor force hit an all-time high in July. That’s unambiguously positive.

The market has been smacked with a dose of reality over the past few weeks and may need more time to shed its excessive froth. It is crucial for investors and policymakers to maintain a level-headed perspective during these periods of volatility.