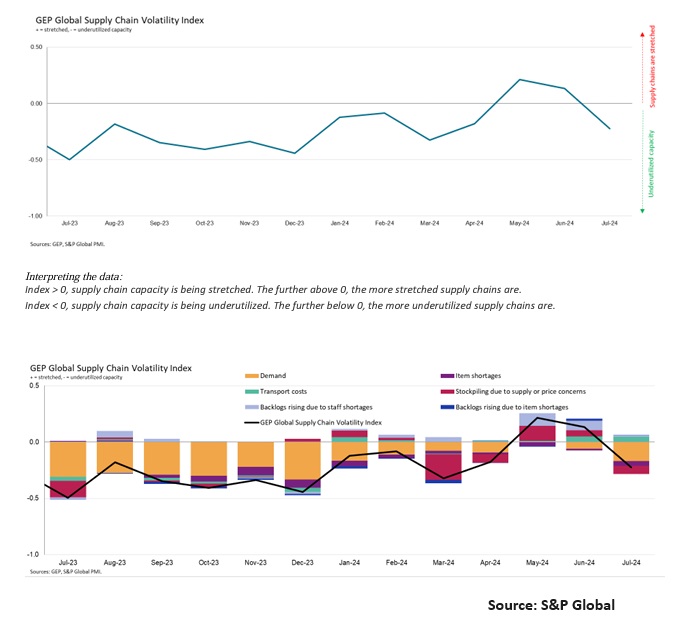

The latest release from S&P Global regarding the GEP Global Supply Chain Volatility Index for July underscores a marked decrease in supplier capacity utilization, falling to a four-month low not observed since April. This downturn indicates an alleviation of strains across international supply chains concurrently with a general softening in demand across multiple regions.

Europe stands out with pronounced underutilization, driven predominantly by a manufacturing sector grappling with recessionary forces. Germany, in particular, has seen a significant contraction in factory purchasing activity, exemplifying the region’s economic challenges.

Similarly, growth in Asia has slowed, with factory demand plummeting to the lowest levels since December 2023. Chinese manufacturing sectors have notably reduced purchasing activity for the first time in nine months, marking significant economic softening. Japan’s manufacturing malaise has further exacerbated the region’s declining performance.

Conversely, North America’s supply chain utilization has seen only marginal changes from June. Nevertheless, the region is not without difficulties, evidenced by a slowdown in purchasing across the United States, Mexico, and Canada. Canada, in particular, has experienced the most severe contraction within the region, whereas earlier growth observed in Mexican factories has abated somewhat, marking the first downturn in demand since October 2023.

Despite these challenges, global supply chains have maintained a degree of operational efficiency, with negligible disturbances in stock levels, shortages, or undue price fluctuations. However, global transportation costs have escalated to a 21-month peak, largely propelled by increased expenses in Asia.

The diminished purchasing activities reflect broader economic slowdowns, prompting intensified discussions about the necessity for the Federal Reserve to reduce interest rates to bolster demand and mitigate further economic deceleration in the latter half of the year.

Overall, the July 2024 S&P Global report signals growing concerns over deteriorating economic conditions globally, with particular emphasis on critical areas such as Europe and Asia and the subsequent impact on the efficiency of international supply chains.