China’s collapse in foreign lending has contributed to a world of hurt and burdensome debt.

China also lent more than $1 trillion abroad, largely for infrastructure projects to be built by Chinese companies under its Belt and Road Initiative. Over the past two decades, one in three infrastructure projects in Africa was built by Chinese entities. The long-term debt risks for fragile developing economies were often ignored.

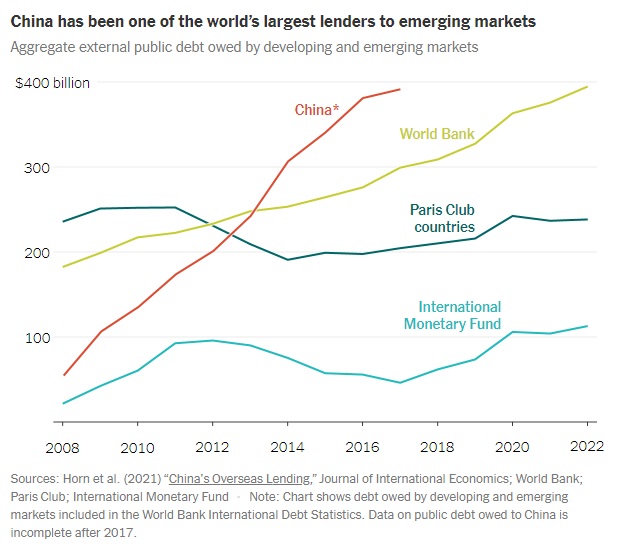

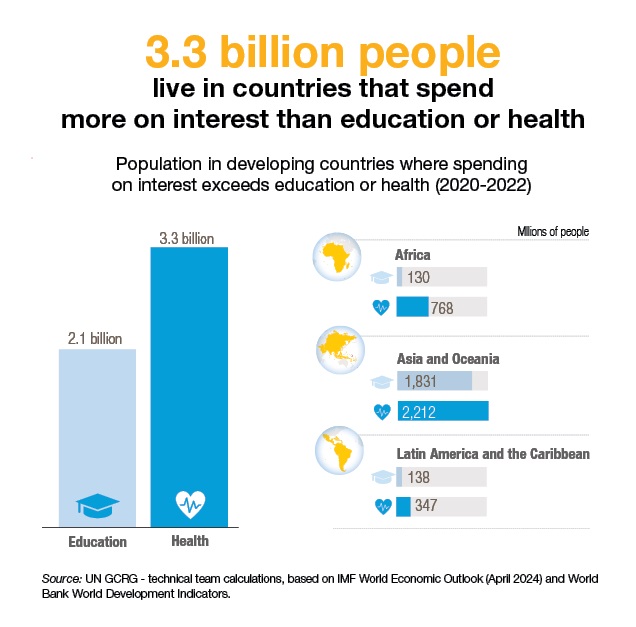

…China, now by far the world’s largest sovereign lender, has played a leading role in saddling many countries with levels of debt, often through nontransparent arrangements, that are comparable with those seen in the 1980s. The situation is becoming perilous. Over the past decade, during which China doled out more lending than the Paris Club — a grouping of 22 of the world’s largest creditor nations — the total value of interest payments of the 75 poorest countries in the world have quadrupled and will outstrip their total annual spending on health, education and infrastructure combined, according to the World Bank. An estimated 3.3 billion people live in countries where interest payments exceed investments in either education or health, the United Nations said. – NY Times