President Biden’s top aide wakes up almost every morning at around 3:30 a.m. in his suburban Maryland home, rolls over in bed and pulls out his iPhone to check a number critical to the fate of the presidency.

The information sought by Biden’s chief of staff is not covert intelligence from a foreign government nor a top-secret national security assessment, but a publicly available tracker on AAA.com — the average national gas price, which updates in the early morning. – Washington Post, November 2022

The direction of oil prices over the next eight weeks will heavily influence the upcoming U.S. presidential election as its main derivative, gasoline prices, have an outsized influence on consumer and voter confidence. Gasoline, which represents half of U.S. oil consumption, is a visible and highly sensitive commodity, shaping inflation expectations and directly impacting household finances.

Gasoline futures fell sharply last week, closing at a three-year low on Friday. Gas prices in the futures market are down over 20 percent since the beginning of July. Generally, it takes a few weeks for price changes in RBOB gas futures to show up at the retail pump as distributors and sellers run down their more expensive inventory.

Recent declines in gasoline prices have provided relief to consumers, especially in key battleground states like Arizona and Nevada, where lower prices could benefit the Harris campaign.

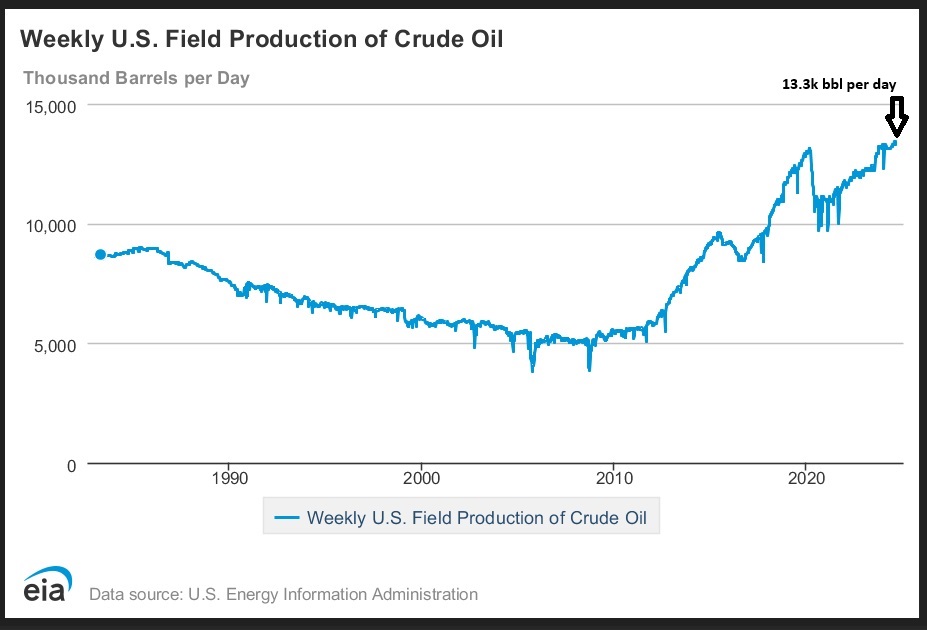

The oil market is so weak that it shrugged off a rescue from OPEC+, who announced on Thursday a delay in future production increases. Oil markets are being affected by slowing Chinese growth, increasing U.S. crude production, and OPEC+’s evolving production strategy.

Stay tuned and strap in for the coming conspiracy theories.

Key Facts:

- Gasoline makes up half of U.S. oil consumption

- A 6.9 million barrel inventory drop briefly pushed prices up but didn’t reverse long-term declines

- China’s slowing growth is reducing global oil demand, especially for industrial inputs

- U.S. crude oil production hit a record 13.4 million barrels per day

- OPEC+ delayed its planned production increase until after the election

- Gasoline prices are falling nationwide, reaching $3.31/gallon on average

- Prices in battleground states have dropped significantly, favoring the current administration

- Rising U.S. oil output is putting downward pressure on global prices

- Global oil inventories fell by 26.2 million barrels in June

- Geopolitical risks, including tensions in the Middle East, remain potential market disruptors