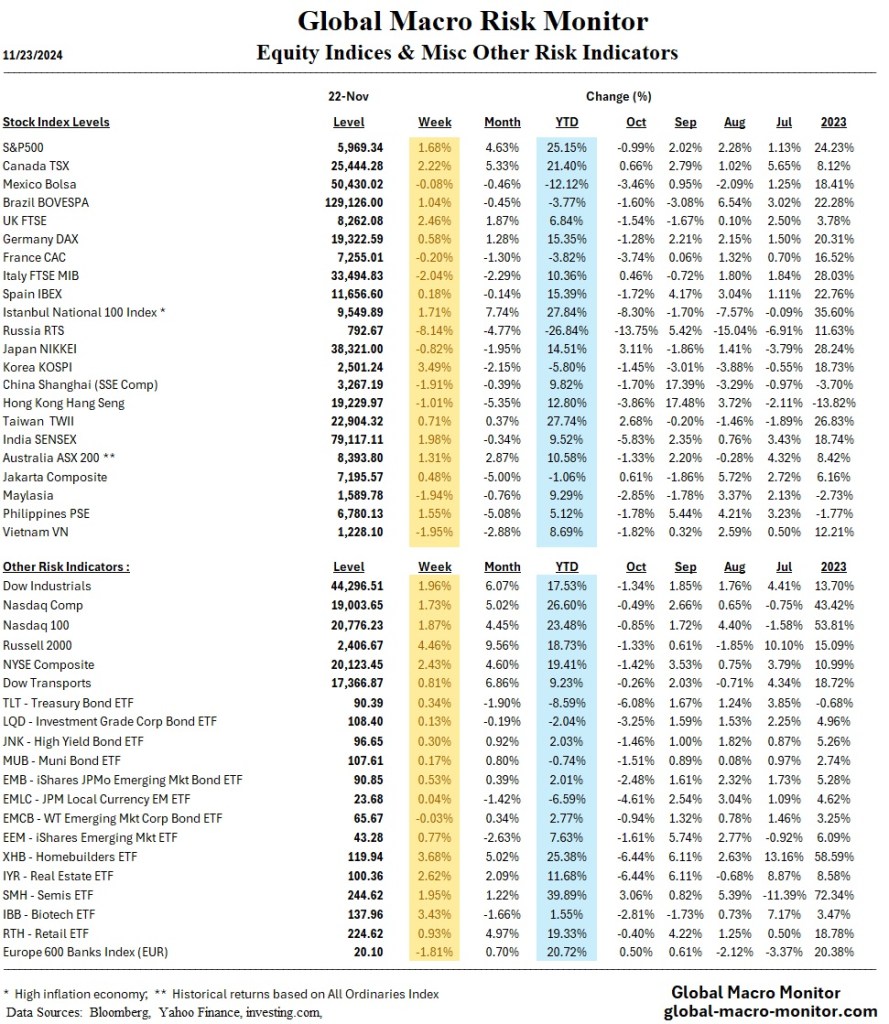

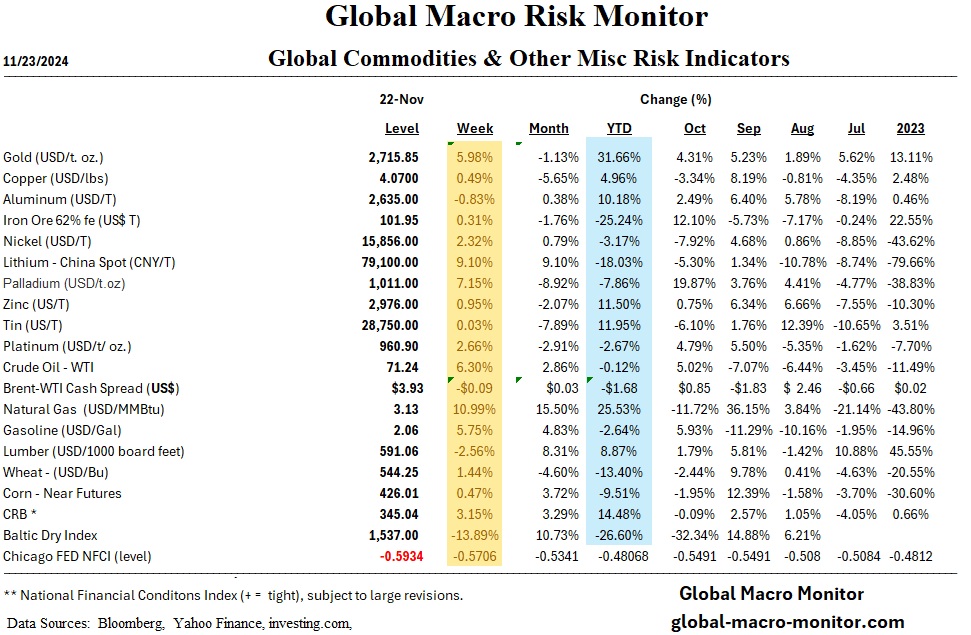

Financial conditions in the United States, as measured by the Chicago Fed’s National Financial Conditions Index (NFCI), have reached their most accommodative levels since November 2021—a period when the Federal Reserve’s policy rate stood at zero and quantitative easing was at its peak (refer to the commodities table). This shift coincides with notable market movements: gold and Bitcoin surged this week, and expectations for future rate cuts are gradually being priced out.

Of particular interest, Tesla posted a 10% rally (see Equity ETF & Magnificent 7 table), fueling what some might characterize as a “Crony Capitalism” trade. These developments underscore the dynamic interplay between easing financial conditions and market sentiment. Further shifts are anticipated—stay tuned for additional analysis.