Key Facts:

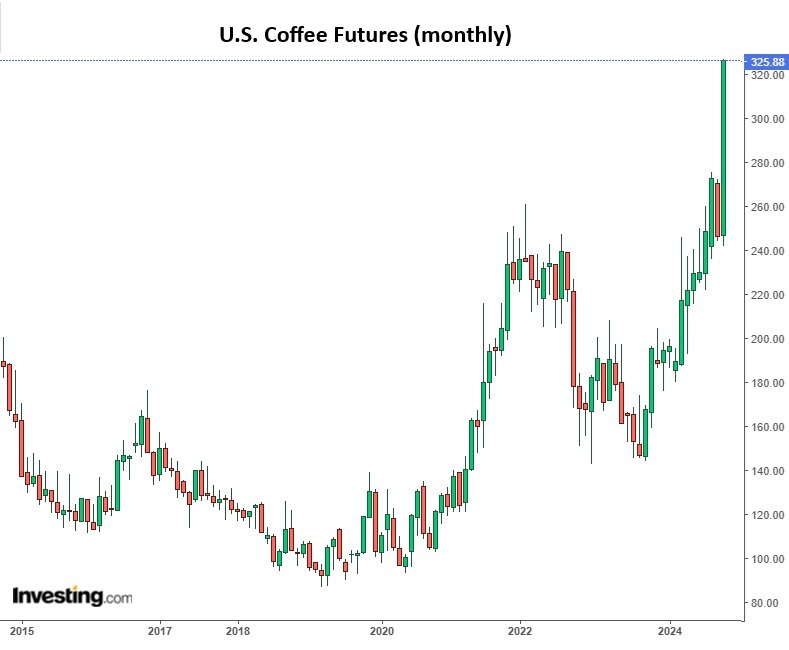

- Record Prices: Arabica and robusta futures reached their highest levels in nearly five decades.

- Supply Crisis: Brazil’s drought and Vietnam’s robusta deficits have driven a prolonged global shortage.

- EU Regulations: Import restrictions tied to deforestation concerns are pressuring European buyers.

- Market Behavior: U.S. roasters increased purchases amid tariff concerns and rising prices.

- Consumer Impact: Prices are expected to rise further, signaling a prolonged strain on coffee markets.

“I have never seen anything like this before,” said Tomas Araujo, trading associate at brokerage StoneX. “This is not going to be resolved this year and that’s why the roaster has started going into panic mode.”

Coffee futures soared to a 47-year high due to global supply shortages and concerns over impending EU anti-deforestation laws. Arabica prices surged 4.7%, reaching $3.23 per pound, while robusta climbed 7.7%, doubling its price since the year’s start. Prolonged droughts in Brazil, the largest arabica producer, and poor weather in Vietnam, the leading robusta producer, have exacerbated the supply crunch.

Commercial buyers, anticipating tighter markets and regulatory uncertainty, have aggressively stockpiled (self-fulfilling!). The EU legislation requiring proof of deforestation-free coffee imports has added urgency to these purchases. Furthermore, potential U.S. import tariffs have prompted early buying by American roasters. This mix of factors points to sustained price volatility, pressuring profit margins across the coffee value chain.

Source: FT