The bounce lacked sufficient momentum to reach the 200-day moving average but managed to hit 5700 before pulling back. We suspect the index will chop between 5500 and 5700 for the next few days or possibly a couple of weeks before testing and breaking the recent low.

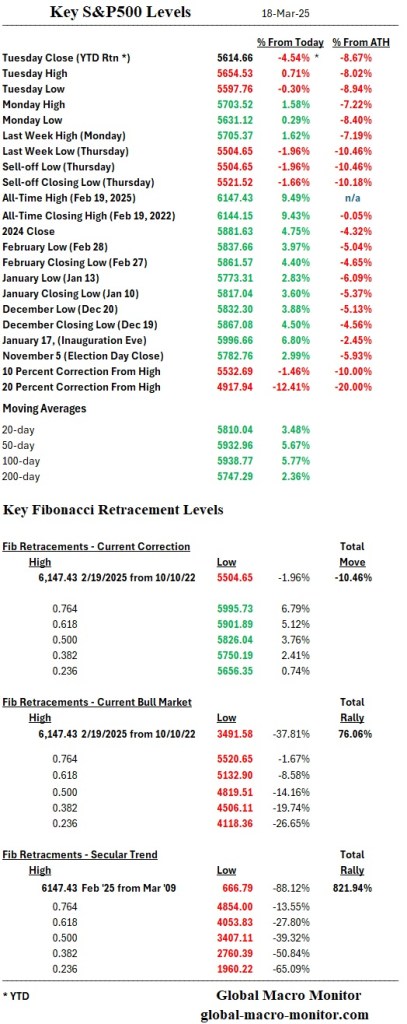

Key levels to watch:

- 5504.65 – Recent low and key support

- 5647.29 – First Fibonacci retracement of the correction

- 5703.52 – Yesterday’s high and near-term resistance

For now, our priors are the index will remain in a consolidation phase, with sellers capping upside moves and buyers stepping in near support. A break below 5504.65 could accelerate downside momentum, while a move above 5703.52 would indicate renewed buying strength.

Stay frosty, folks.