COTD – Chart of the Day

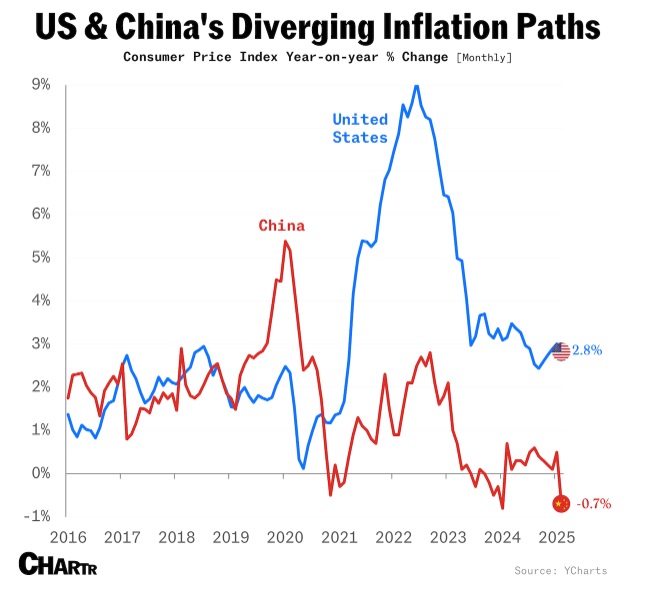

China and the U.S. are experiencing contrasting inflation trends, shaping distinct economic policy responses. In February 2025, China’s consumer price index (CPI) turned negative for the first time in 13 months, signaling deflation due to weak domestic demand, a real estate crisis, and manufacturing overcapacity. The U.S., however, grapples with post-COVID inflation at 2.8%, prompting the Federal Reserve to maintain relatively high interest rates. China is deploying stimulus measures to revive demand, while the U.S. remains cautious with monetary policy. These divergent paths, trade tensions, and currency fluctuations create complex investment risks and opportunities for global markets.