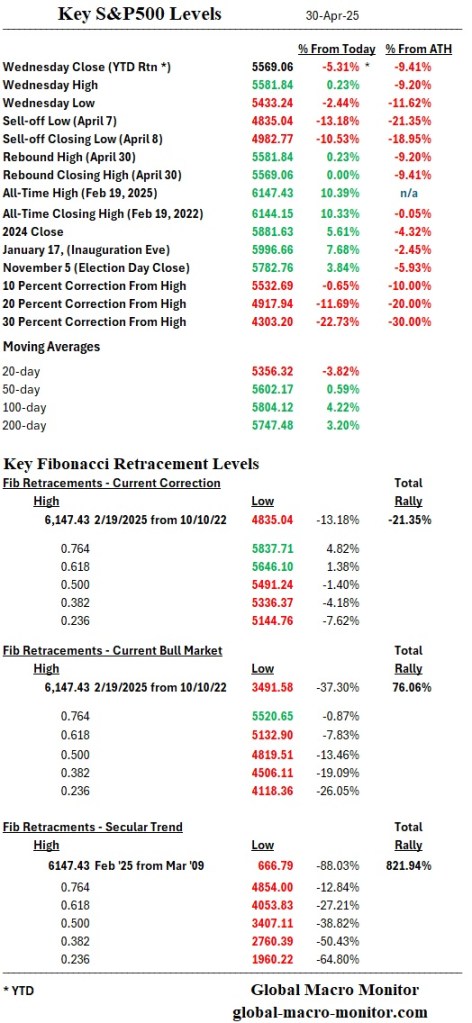

Equity markets extended their rebound today, bouncing smartly from a sharp early morning sell-off. The S&P 500 closed at its highest level since the recent correction, marking a notable shift in sentiment. Based on where futures are trading this evening, the index appears poised to open above its 50-day moving average (currently at 5602.17), a level closely watched by systematic and momentum-driven strategies. A decisive move above this threshold could trigger mechanical buying and attract further technical inflows.

The next resistance lies at the 0.618 Fibonacci retracement level (5646.19), a technically significant marker often associated with sentiment inflection points. Given the still-uncertain macroeconomic backdrop, reclaiming that level would be notable—if not perplexing.

The market continues to play chicken with the economic data, refusing to turn bearish until it sees the whites of recessionary eyes. Despite mixed macro signals, investors are holding their ground, unwilling to price in a downturn without clear, negative confirmation. So far, the data hasn’t delivered a decisive blow. Meanwhile, tonight’s strong prints from Meta and Microsoft underscore that the AI-driven growth narrative remains intact, providing just enough fuel to keep risk appetite alive, particularly in the mega-cap tech space.

I hear tell when the market movers take over, look out.