Macro Overview

Global markets closed the week on a cautiously optimistic note as softer U.S. inflation data revived hopes of synchronized easing among major central banks. Yet outside the U.S., the picture remains mixed: Europe is showing tentative momentum, Japan is poised for reflation, and China continues to wrestle with domestic softness. The common thread is that policy traction, not growth momentum, is doing the heavy lifting.

The disinflation narrative remains intact, but beneath the surface, trade fragmentation, sanctions, and political volatility are redefining relative winners. Investors should be wary of extrapolating the U.S. resilience story to other economies—many are still in the early innings of normalization.

Regional Highlights

United States

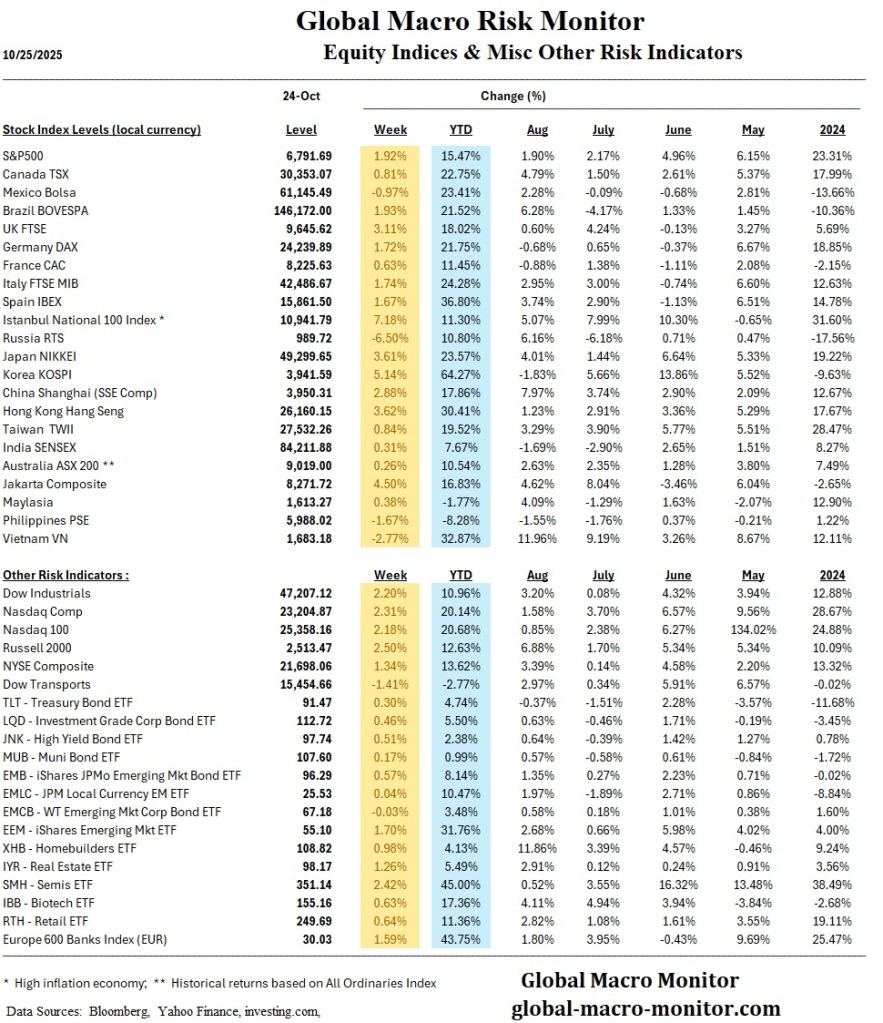

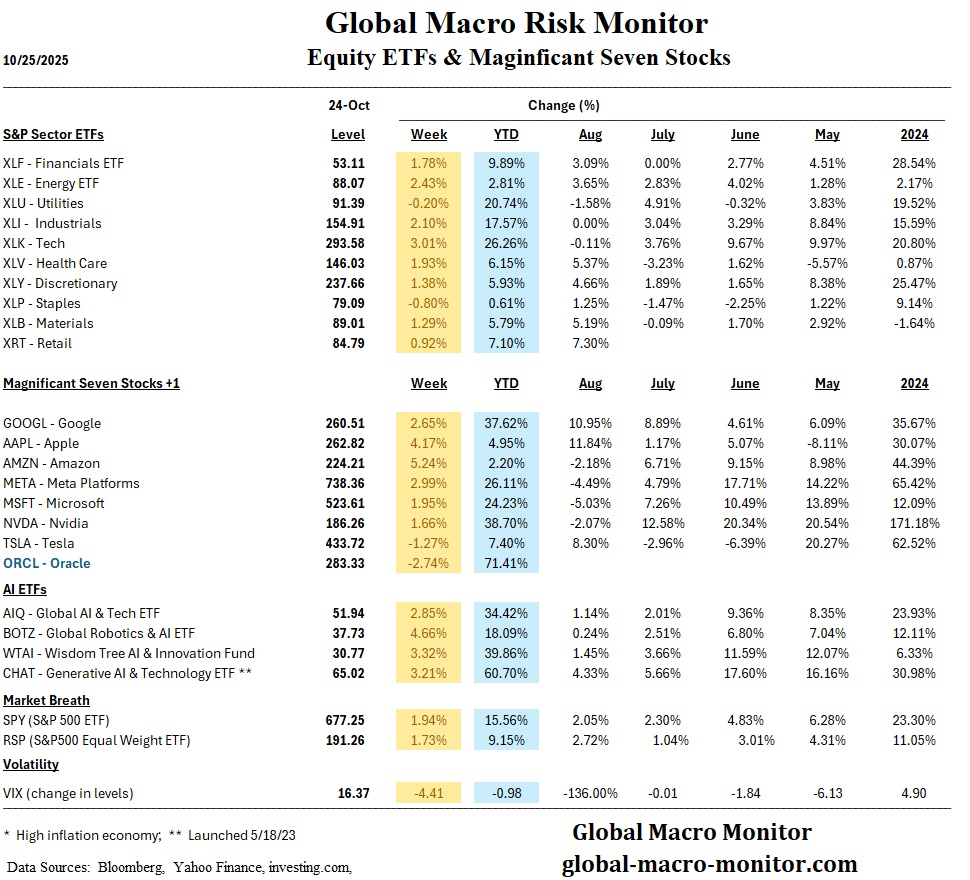

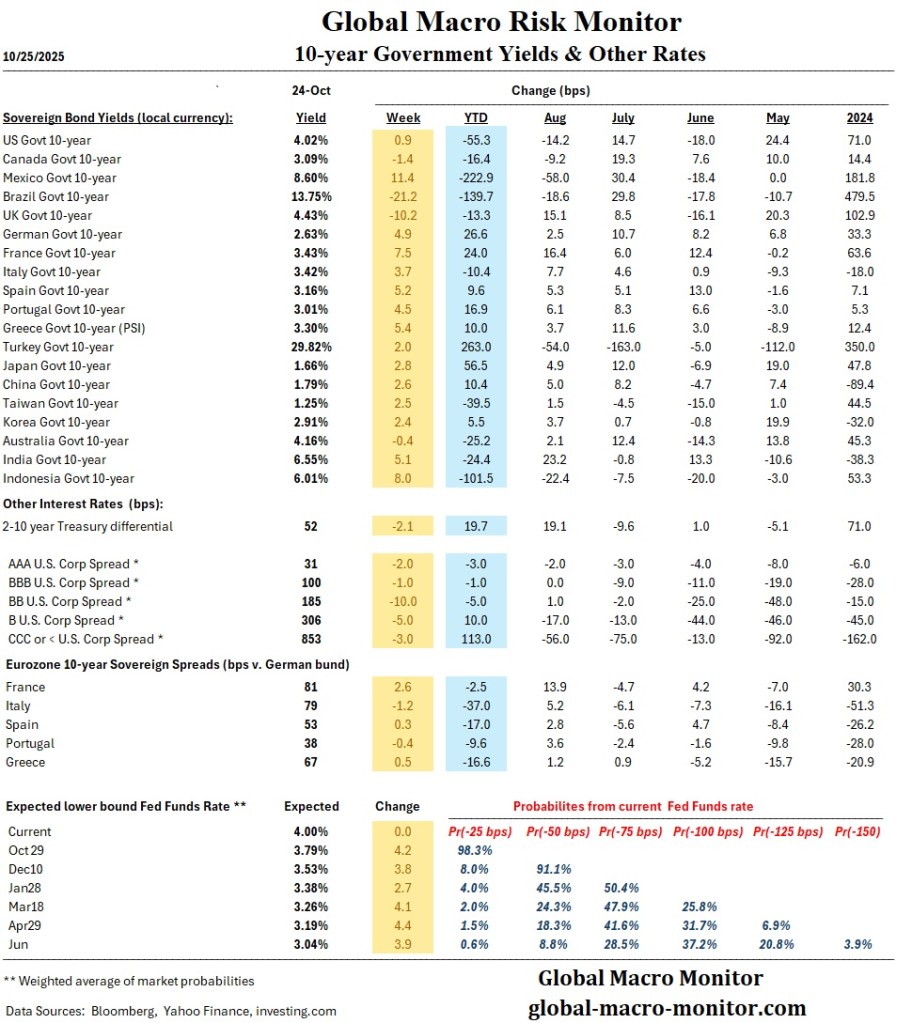

The U.S. economy continues to be the gravitational center of global finance, blending vast geographic diversity with technological dynamism and deep consumer markets. The latest CPI data showed inflation cooling to 3.0%, bolstering expectations for another Fed rate cut this week. The S&P 500 and Nasdaq reached new record highs, powered by technology and energy sectors.

Culturally, U.S. consumer behavior remains a global bellwether: strong service-sector PMIs and steady employment have kept discretionary spending robust despite policy uncertainty. Regionally, the Sunbelt states continue to lead population and industrial growth, benefiting from reshoring and logistics expansion, while coastal metros navigate slower real estate cycles.

The nation’s fiscal trajectory remains a long-term concern, but near-term resilience underscores the adaptability of a continental economy that thrives on innovation, diversified resources, and high labor mobility.

Europe

The eurozone surprised with its strongest PMI print since mid-2024, signaling that the region’s manufacturing drag may finally be easing. Germany’s rebound is supporting the bloc, while France remains an outlier, weighed down by political friction and sluggish domestic demand. The ECB is likely to stay on hold this quarter, but forward markets already price the first cut by March 2026.

United Kingdom

Inflation held steady at 3.8% for a third month, while retail sales unexpectedly rose 0.5%, reflecting consumer resilience amid declining real wages. Markets now expect the Bank of England to pivot dovishly by December, helping sterling-denominated assets recover after months of underperformance.

Japan

Japanese equities surged on optimism surrounding newly elected Prime Minister Sanae Takaichi’s pro-growth agenda. The yen’s slide to ¥153 per USD aided exporters, while inflation staying near 3% keeps the Bank of Japan under pressure to hike—likely early 2026. Political stability and fiscal stimulus underpin Japan’s role as Asia’s equity bright spot.

China

China’s 4.8% Q3 GDP growth masks underlying weakness: retail sales slowed to 3.0% YoY and fixed-asset investment contracted. Industrial production, however, rose 6.5% on export strength. The latest Party Plenum emphasized tech self-reliance and manufacturing resilience, but the housing downturn and deflation risk still cloud the outlook.

Emerging Markets

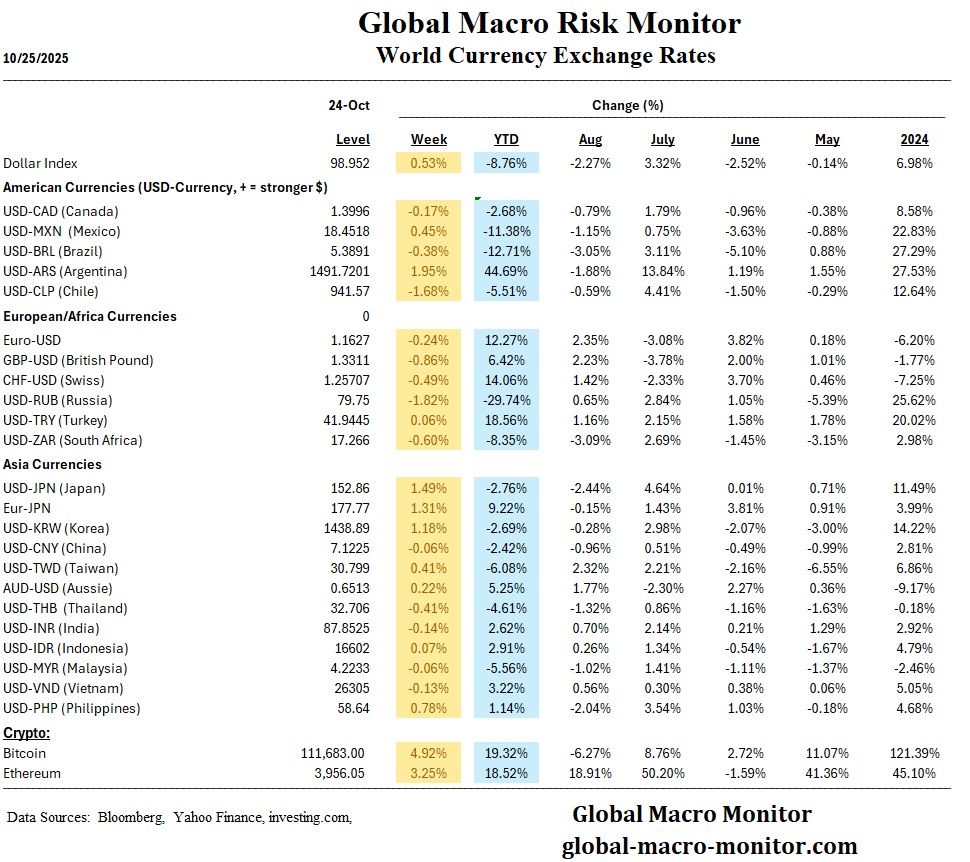

Hungary and Türkiye illustrate divergent EM trajectories—Budapest holding rates firm to anchor inflation, Ankara easing despite resurgent prices. Latin America remains relatively stable, supported by strong terms of trade and disciplined fiscal stances. EM Asia’s central banks, meanwhile, prioritize FX stability over growth stimulus.

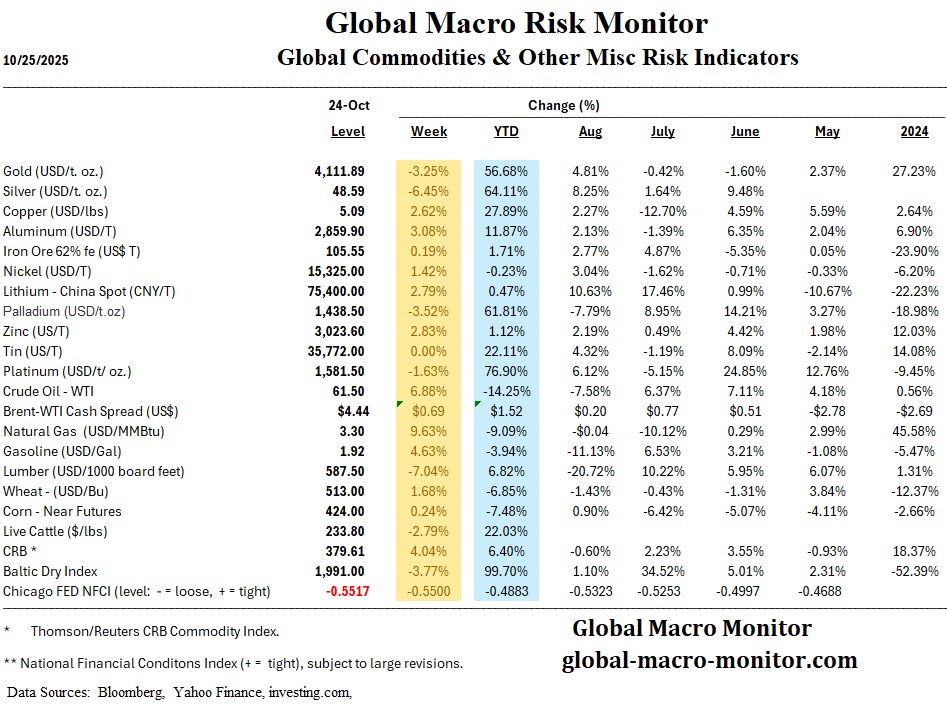

Commodities & FX

Oil spiked on renewed geopolitical risk, while gold paused after a nine-week rally. The yen and euro softened against the dollar, reflecting policy divergence. EM FX was broadly stable, aided by capital inflows into local-currency debt.

Week Ahead

U.S. Events

- FOMC Meeting (Wed, Oct 29):

Markets are pricing a near 100% probability of a 25bp cut (see Yield table below). Attention will center on Chair Powell’s tone, confirmation of a “data-dependent” bias could sustain equity momentum, while any hawkish dissent may trigger volatility across Treasurys and risk assets. - Mega-Cap Tech Earnings:

Microsoft, Alphabet, Meta, Amazon, and Apple report this week. Their forward guidance will heavily influence the AI-led equity rally and broader risk sentiment. - Q3 GDP (Thu, Oct 30):

The first estimate is expected near 3.9%. A downside surprise could reinforce the case for additional easing; an upside beat risks delaying rate cuts. - Consumer Confidence & Durable Goods (Mon–Tue):

Key indicators for household and business resilience amid fiscal uncertainty.

Global Events

- Euro Area GDP Flash (Wed, Oct 30):

Early indicators suggest flat growth, but any positive surprise would strengthen euro assets and ease fears of a winter slowdown. - Bank of Japan Policy Meeting (Fri, Oct 31):

Markets expect no change, but commentary around wage growth and yen weakness will signal timing for normalization. - China PMI Data (Thu, Oct 30):

A key barometer of industrial recovery; weak data could prompt further fiscal acceleration. - UK Autumn Budget (Thu, Oct 30):

Possible tax adjustments and energy support may influence gilt yields and BoE expectations. - EM Inflation Prints (Brazil, Indonesia, South Africa):

Data will determine whether rate-cut cycles can continue amid higher commodity costs.