-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,215 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

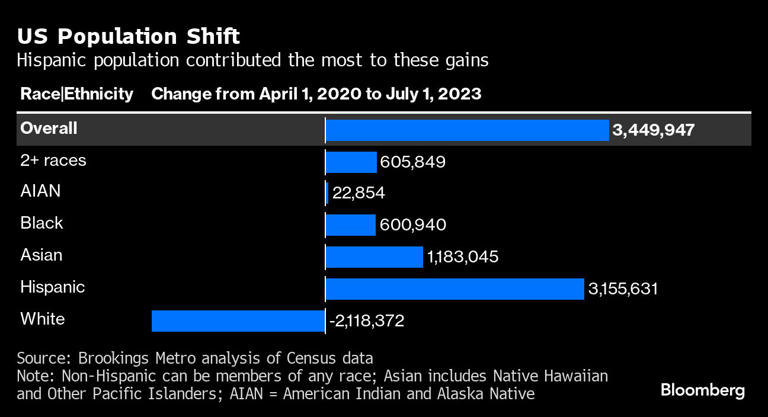

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

PPI Softer: Services Offset Energy Price Increase

The Producer Price Index (PPI) for final demand was softer than expected in July, increasing by 0.1%, following a 0.2% rise in June. Over the past 12 months, the index advanced by 2.2%. The July increase was driven by a 0.6% rise in final demand goods, particularly energy prices, which grew by 1.9%. Final demand services fell 0.2%, primarily due to a drop in trade services margins. Excluding volatile categories like food, energy, and trade services, prices increased by 0.3% in July, resulting in a 3.3% year-over-year rise.

Key Points

- July 2024 PPI Increase: 0.1% increase in the PPI for final demand.

- 12-Month PPI Change: PPI for final demand up 2.2% year-over-year.

- Final Demand Goods: Prices rose by 0.6%, driven by a 1.9% increase in energy.

- Final Demand Services: Prices decreased by 0.2%, with trade services margins falling 1.3%.

- Energy Impact: 60% of the increase in goods prices was attributed to higher energy costs.

- Notable Price Increases: Gasoline up 2.8%, with rises in diesel fuel, meats, and jet fuel.

- Exclusions Effect: Excluding food, energy, and trade services, prices rose by 0.3%, up 3.3% year-over-year.

Source: BLS

Posted in Uncategorized

Leave a comment

Google’s Search Monopoly

“Google’s distribution agreements are exclusive and have anticompetitive effects,” Judge Amit Mehta of U.S. District Court for the District of Columbia wrote in his nearly 300-page court ruling.

Mehta cited Google’s exclusive distribution agreements with browser developers, smartphone makers, and wireless carriers.

The biggest partner in those deals is Apple , which receives an undisclosed percentage of Google’s ad revenue from the searches that happen on iPhones and in Apple’s Safari browser. The arrangement led to a $20 billion payment from Google to Apple in 2022, according to court filings. The number is likely larger today. – Barron’s

Posted in Uncategorized

1 Comment

QOTD: Externalities of Writing

QOTD: Quote of the Day

…writing is not just the output that readers consume but a process of reflection and intellectual discovery by the writer, hopefully to originate novel ideas, not just express existing ones. – Economist

Posted in Uncategorized

2 Comments

It’s Not The Economy, Stupid!

“The economy, stupid” is a phrase that was coined by Jim Carville in 1992. It is often quoted from a televised quip by Carville as “It’s the economy, stupid.” Carville was a strategist in Bill Clinton‘s successful 1992 U.S. presidential election against incumbent George H. W. Bush. – Wikipedia

The current assertion that the economy is in or heading toward recession and the Federal Reserve must execute an emergency rate cut, amplified by the former president’s alarming “GREAT DEPRESSION OF 2024” warning, warrants a closer examination. By the way, the former president is in rare company as stocks experienced two bear markets (a 20% decline) during his single term, and he persistently pressured the Fed to reduce rates to stabilize stocks during the Christmas bear market of 2018.

Technical Not Fundamental

From our perspective, the current market downturn is predominantly technical and does not indicate an imminent recession, although it is inevitable that a recession will occur – someday. Once again, financial pundits are retrofitting fundamentals to explain the stock market’s price movements.

The employment report released last Friday, which contained some positive aspects, served as a pretext for selling in an overheated market that had surged 38% since the end of last October and over 62% in less than two years. The unwinding of leverage and crowded trades, including the yen carry trade (often exaggerated), is contributing to this correction.

We posted last Thursday night that the S&P 500 was vulnerable, positioned right at support, and that a breach of 5,400 would likely lead to a move down to 5,100. Today’s low on the S&P 500 was 5,119.26.

Employment Report Insights

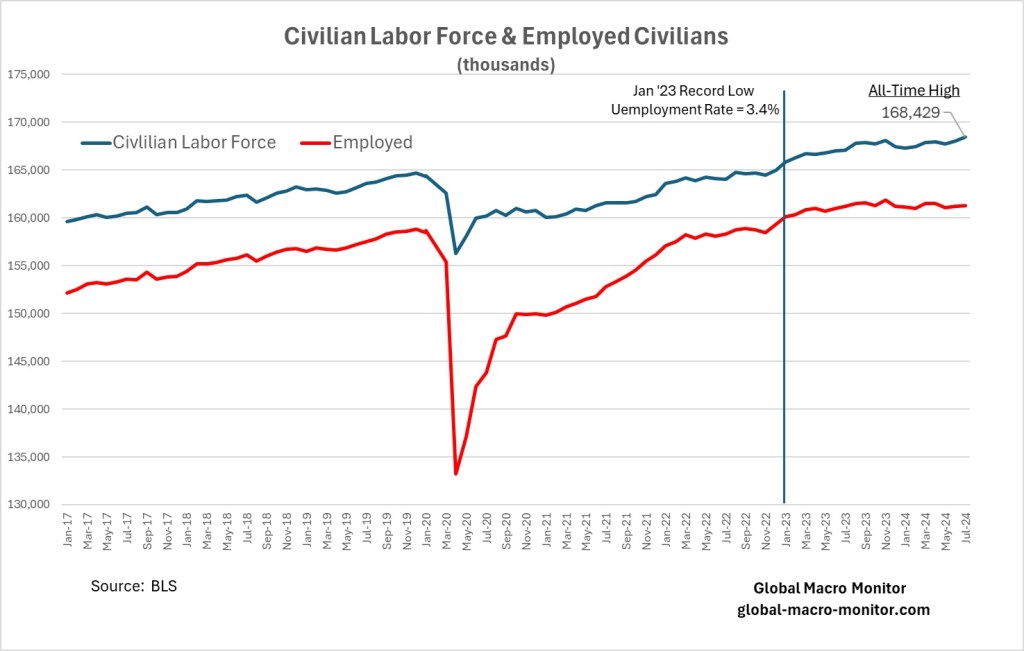

The employment report from last Friday was not as dire as many perceive. The Bureau of Labor Statistics (BLS) reported the economy created 114,000 payroll jobs according to the establishment survey and 67,000 jobs based on the household survey. For those interested in the methodological differences between these surveys, further details are available here.

Both measures indicated net job gains, albeit modest compared to recent years, and the rise in the unemployment rate can be attributed solely to an increase in the labor force. An expanding labor force, coupled with productivity gains, not only drives economic expansion but also helps mitigate inflationary pressures that have challenged policymakers in recent years. Moreover, the employment report showed the size of the U.S. labor force hit an all-time high in July. That’s unambiguously positive.

The market has been smacked with a dose of reality over the past few weeks and may need more time to shed its excessive froth. It is crucial for investors and policymakers to maintain a level-headed perspective during these periods of volatility.

Posted in Uncategorized

Leave a comment