We have added the Mag 7 to our equity table. Some have not performed so magnificently year-to-date. Watch this space. And what’s up with gold breaking out to new highs? Watch that space.

We have added the Mag 7 to our equity table. Some have not performed so magnificently year-to-date. Watch this space. And what’s up with gold breaking out to new highs? Watch that space.

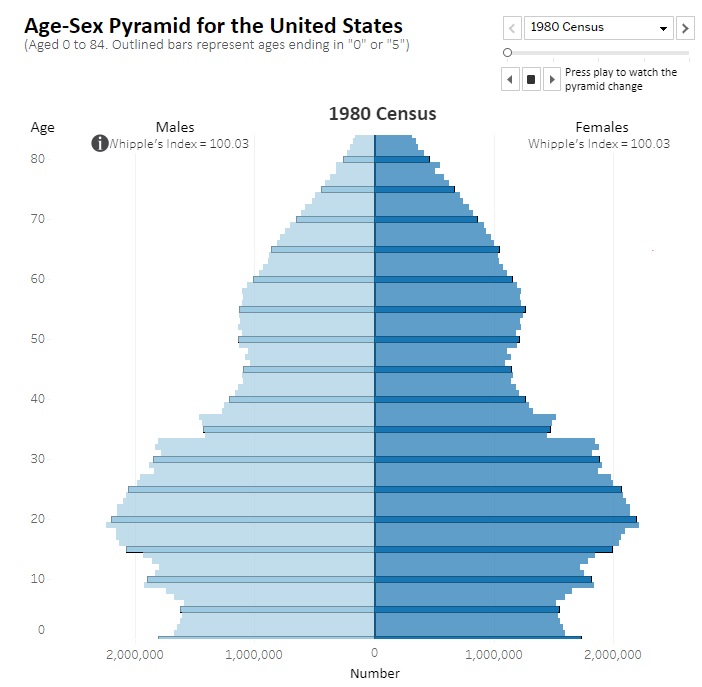

Demographers describe the baby-boom generation as ”the pig in the python,” which refers to a visual and descriptive metaphor for how a large age cohort (the “pig”) moves through the demographic structure (the “python”) over time. It illustrates the bulge or significant impact this group has on various aspects of society, including the economy, housing market, and social services, as it ages. Graying boomers now make up the bulk of the python’s tail, however, enter the new pig: “peak millennials” (PMs).

“It’s Me, Hi, I’m the Problem. I’m 33”

The New York Times ran a good article today reflecting on PMs — individuals born between 1990 and 1991 who are part of American history’s most significant demographic cohort. The piece narrates the life decisions of PMs, noting how these often coincided with broader trends among their peers, such as attending college during a time of record matriculation rates, moving to urban centers, struggling with student debt, buying homes during a housing market surge, and marrying in a year with a high number of weddings.

The narrative underscores this demographic’s economic and societal impact, illustrating how their collective actions have shaped market trends, real estate dynamics, and cultural shifts. The article delves into the challenges and pressures of being part of this densely populated group, highlighting the effects on housing, education, employment, and family planning while also touching on broader implications for future economic conditions and social structures.

Key Points:

Comparative Demographic Pyramids: 1980 vs. 2020

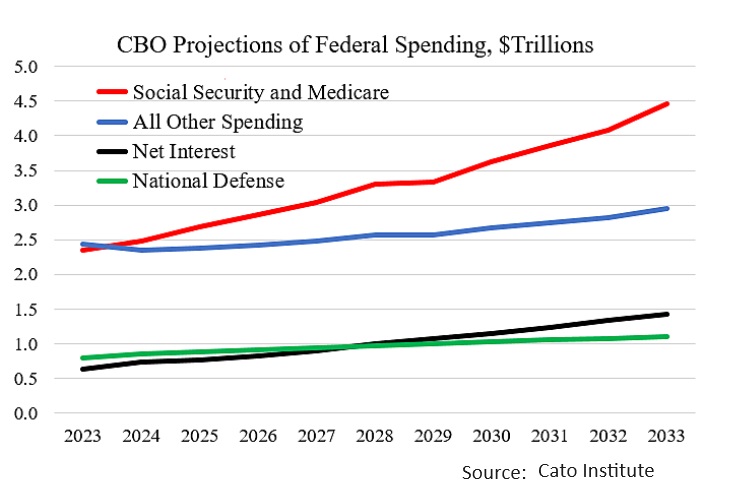

Social Security and Medicare are the primary factors contributing to escalating federal budget deficits and debt, as indicated by the charts below using data from the Congressional Budget Office (CBO). The total expenditure for these two senior programs is expected to surge from $2.35 trillion in 2023 to $4.46 trillion by 2033. At that point, Social Security and Medicare expenditures will quadruple the national defense spending.

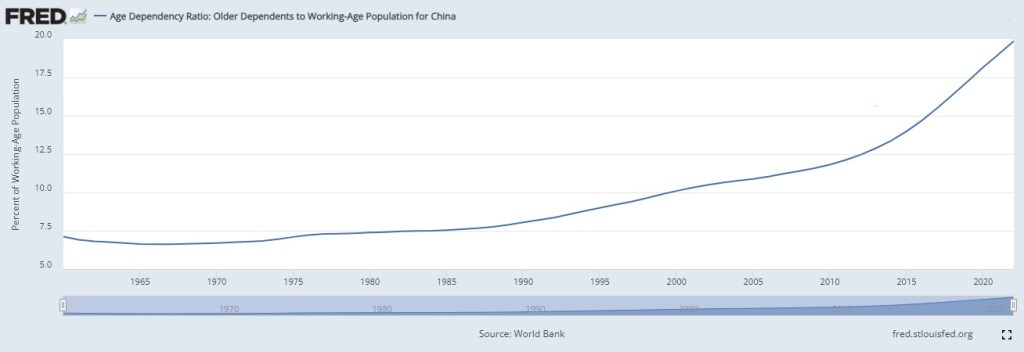

Dependency Ratio

The dependency ratio is a measure of the number of dependents aged zero to 14 and over the age of 65, compared with the total population aged 15 to 64. This demographic indicator gives insight into the number of people of non-working age, compared with the number of those of working age.

It is also used to understand the relative economic burden of the workforce and has ramifications for taxation. The dependency ratio is also referred to as the total or youth dependency ratio.

KEY TAKEAWAYS

- The dependency ratio is a demographic measure of the ratio of the number of dependents to the total working-age population in a country or region.

- This indicator paints a picture of the make-up of a population compared to its workforce and can shed light on the tax implications of dependency.

- As the overall age of the population rises, the ratio can be shifted to reflect the increased needs associated with an aging population.

Formula for the Dependency Ratio

Dependency Ratio = # Dependents/Population Aged 15 to 64

What Does the Dependency Ratio Tell You?

A high dependency ratio means those of working age, and the overall economy, face a greater burden in supporting the aging population. The youth dependency ratio includes those only under 15, and the elderly dependency ratio focuses on those over 64.

The dependency ratio focuses on separating those of working age, deemed between the ages of 15 and 64 years of age, from those of non-working age. This also provides an accounting of those who have the potential to earn their own income and who are most likely to not earn their own income.

Various employment regulations make it unlikely that individuals less than 15 years old would get employed for any personal income. A person who turns 64 years old is generally considered to be of normal retirement age and is not necessarily expected to be part of the workforce. It is the lack of income potential that generally qualifies those under 15 and over 64 as dependents as it is often necessary for them to receive outside support to meet their needs.

An Analysis of Dependency Ratios

Dependency ratios are generally reviewed to compare the percentage of the total population, classified as working age, that will support the rest of the non-working age population. This provides an overview for economists to track shifts in the population.

As the percentage of non-working citizens rises, those who are working are likely subject to increased taxes to compensate for the larger dependent population. – Investopedia

U.S. Age Dependency Ratio: Older Dependents to Working-Age Population

China Age Dependency Ratio: Older Dependents to Working-Age Population

COTD = Chart of the Day

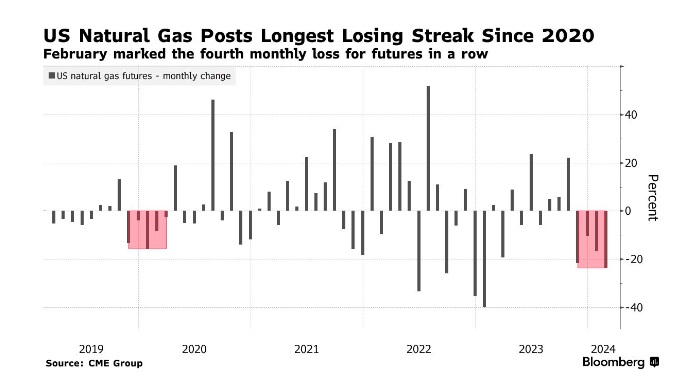

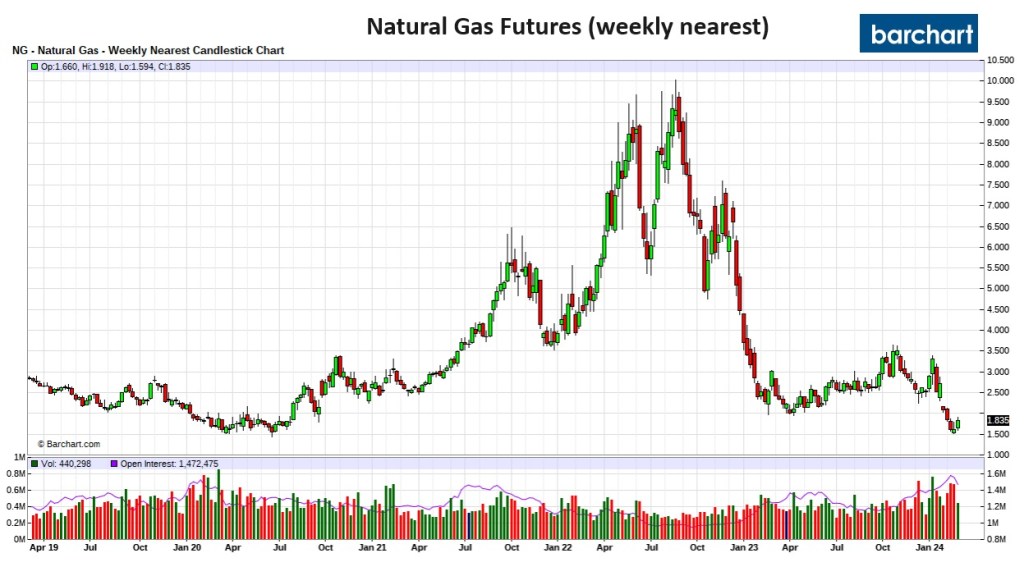

Oh, Nattie, you beast! You are the “widow maker.“. You have hurt us so many times.

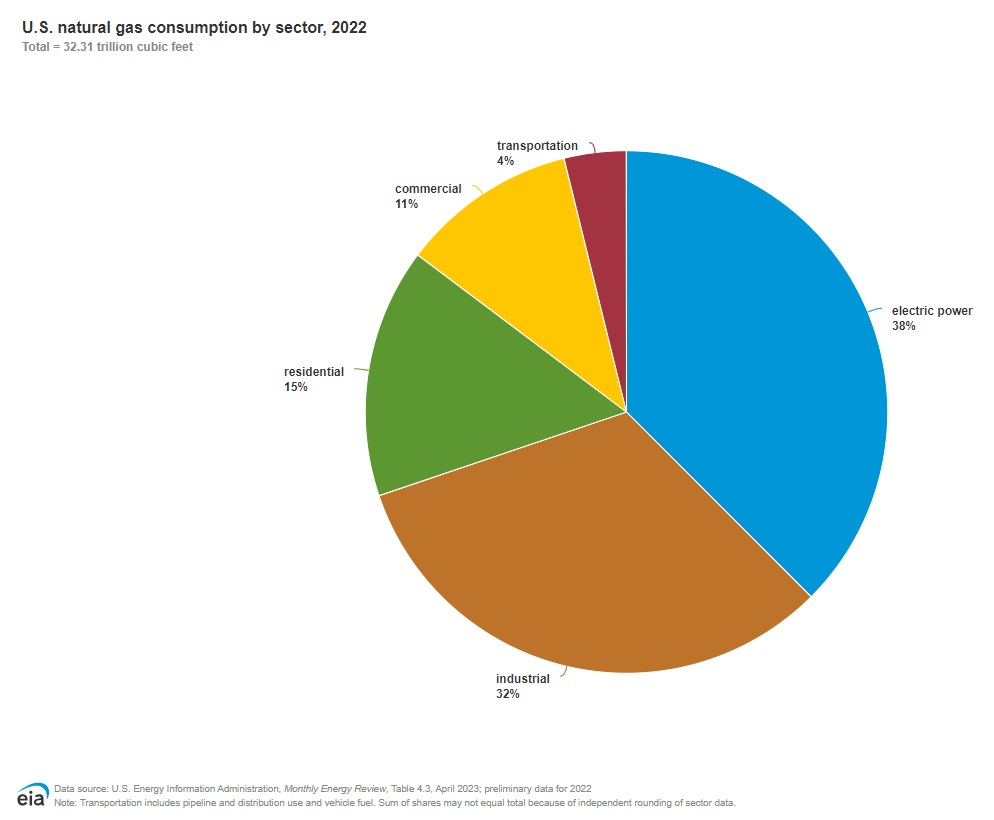

Natural Gas

US natural gas futures capped a fourth monthly loss in February after prices plummeted to lows not seen since June 2020. An unusually mild North American winter has dampened demand for the home-heating fuel as production soared, prompting the longest streak of monthly declines for gas contracts since the beginning of the pandemic. Analysts expect prices to remain depressed for awhile, given that forecasts show unseasonably warm weather for much of the next month. Meanwhile, US inventories continue to hover well above typical seasonal levels, with stockpiles in the latest week sitting about 27% above the five-year average — adding further pressure to prices. – Bloomberg

If the stock market is defined as the S&P500, the answer is: “On average, no.”

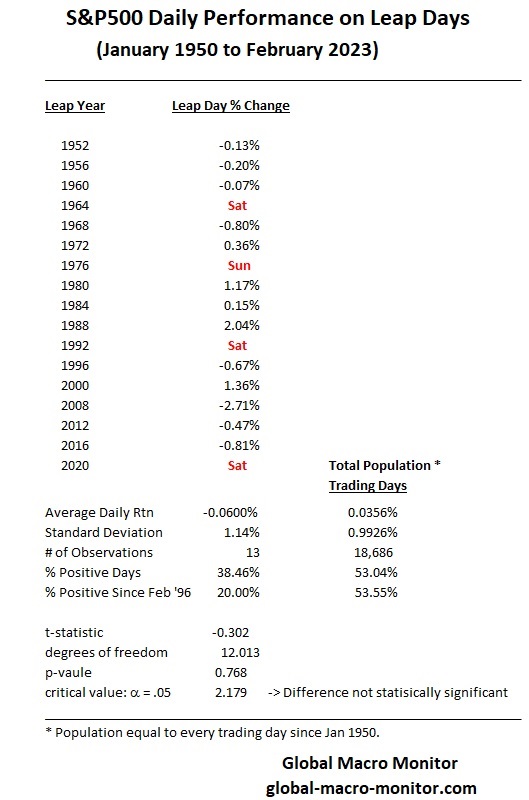

The following table illustrates that of the 13 leap trading days (February 29) since 1950, when the markets were open, the average leap day return is -0.06 percent versus 0.0356 percent for the total population of 18,686 trading days.

Only 5 of the 13 leap days (38 percent) have generated positive returns versus 53 percent for all trading days since 1950. Four of the past five leap days (2020 fell on a Saturday) have seen negative returns, with the last three consecutive leap days in the red.

Statistically Meaningful?

Is the return differential meaningful? Statisticians would say no.

Based on the results of our two-tailed t-test, there is insufficient evidence to conclude that a significant difference exists in the mean value between leap year returns.

The t-statistic of -0.302 indicates the direction and magnitude of the difference between the average returns, relative to the variation observed within the groups. However, the p-value of 0.768 falls short of the critical value at the 0.05 alpha level (95% confidence level) of 2.179, suggesting the hypothesis that the two means are not statistically different cannot be rejected. This implies that the observed difference in means between leap returns and all trading day returns is not statistically significant.

The significant disparity in sample sizes statistically swamps any of the signals one might gain from the differences in the data.

Traders Are Not Academics

Nevertheless, traders and algorithms are not academic statisticians. They look for patterns and run with them. In fact, it’s about time we get used to the fact that the new AI models, especially the LLMs, derive their logic from empirical observations, i.e., more data and patterns in the data, and less on traditional logic.

Place your leap day bets.

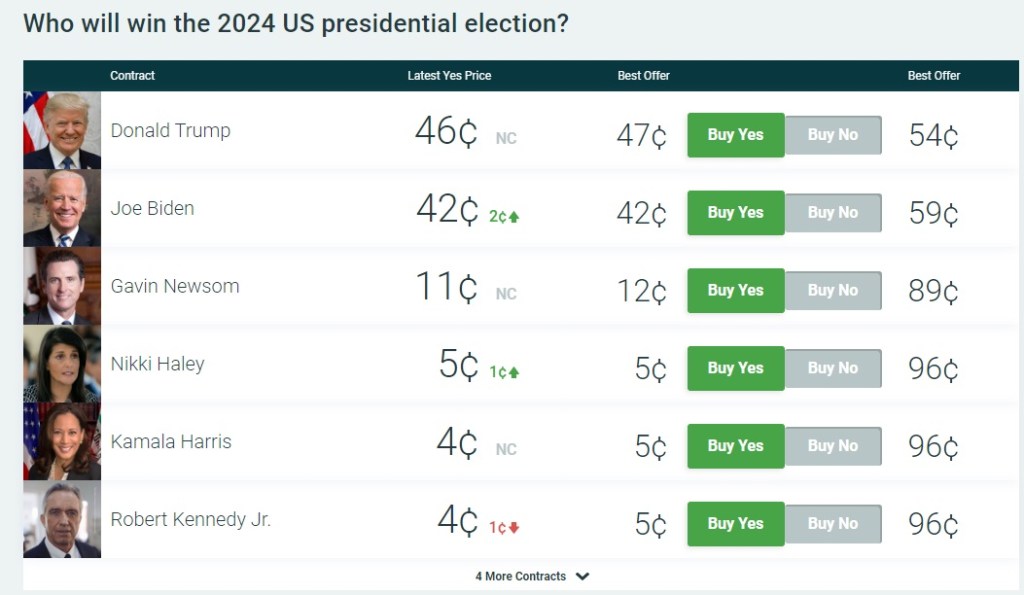

We have noticed an interesting anomaly with respect to the U.S. Presidential election in the political betting markets over at PredictIt.org. We’ve been trading on this site since the 2004 election.

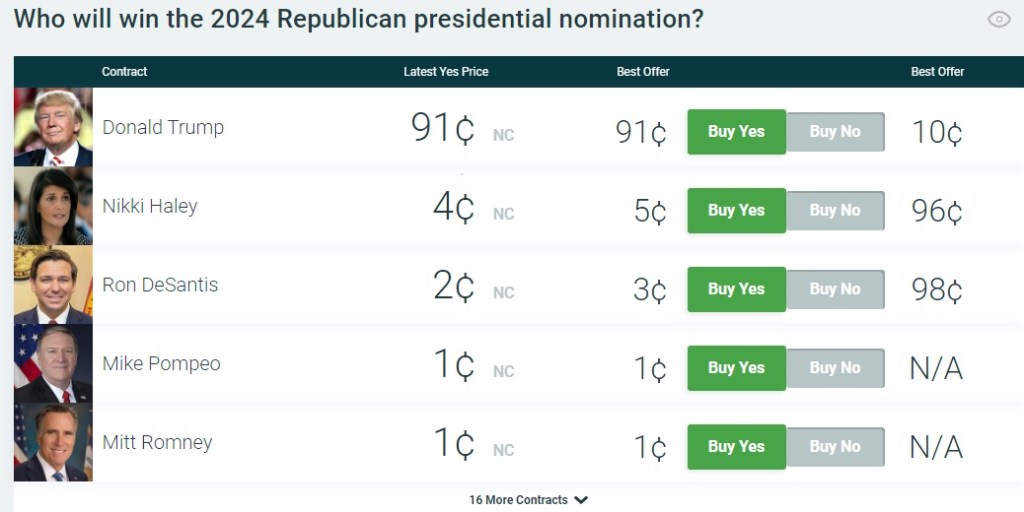

The site is pricing the Democratic Party to win the presidential election at $.54 (think of it as a probability), with the Republican Party priced at $.48. However, PreditIt has Donald Trump priced at $.46 to win the election with President Biden priced at $.42.

Not So “Risk-Free”

Doesn’t that present an arbitrage opportunity? Sell the Democratic Party at $.53 and buy Biden at $.43, banking $.10 no matter the final outcome? But risk-free? Not so fast.

It seems the market is pricing a significant chance of Biden dropping out of the race and being replaced by a stronger candidate with a better chance of beating Trump. That is so far off the conventional wisdom’s radar it will shock many.

Nevertheless, the market is pricing Biden with only a 74 probability of being his party’s nominee versus Trump’s 91 percent.

If you have strong conviction it will be Biden and Trump on the ballot on election day, do the arbitrage. Even better, sell all the other candidates, which could bank you more but at a larger potential loss.

We heard from a friend this weekend, ‘There is no way in hell it won’t be Biden and Trump on November 5th.” We asked if he would like to bet on it. The response was a resounding no. That would have been an easy $.30 plus if he bet us straight up, hedging with a buy of both Biden and Trump to win their party nominations.

Risk-free arbitrage opportunities are rare and include counter-party risk, which many overlook or don’t consider.