QOTD: Quote of the Day

Shares of Krispy Kreme Inc. were downgraded last month on concerns weight-loss drugs would reduce demand for their doughnuts. – Bloomberg

QOTD: Quote of the Day

Shares of Krispy Kreme Inc. were downgraded last month on concerns weight-loss drugs would reduce demand for their doughnuts. – Bloomberg

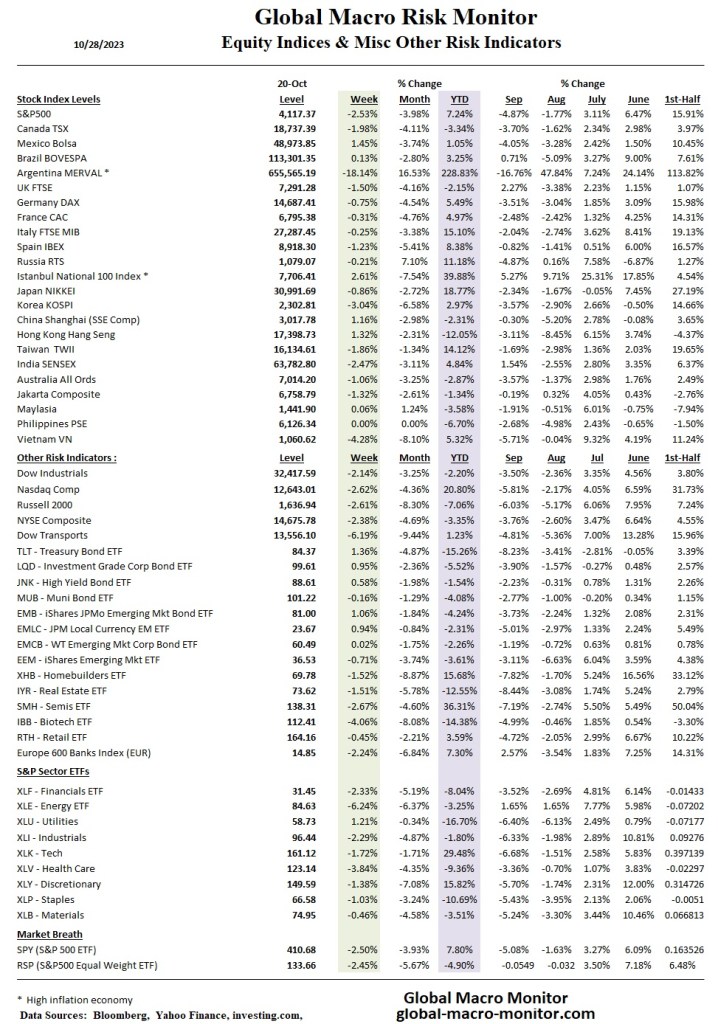

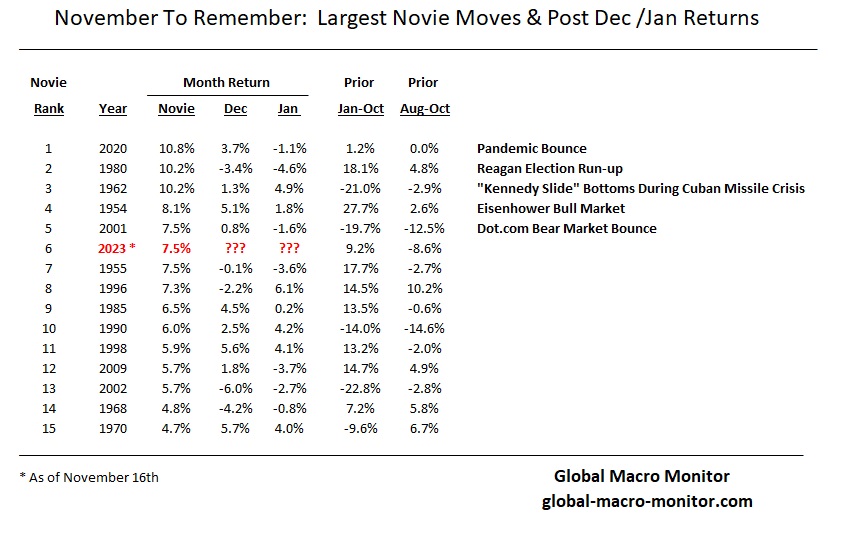

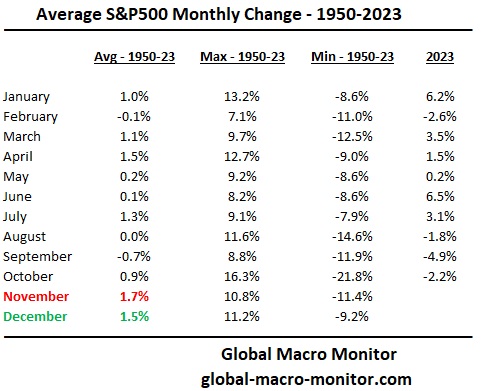

As of today’s close, the S&P move in just the first half of the month already ranks as the 6th most significant November monthly move in over seventy years.

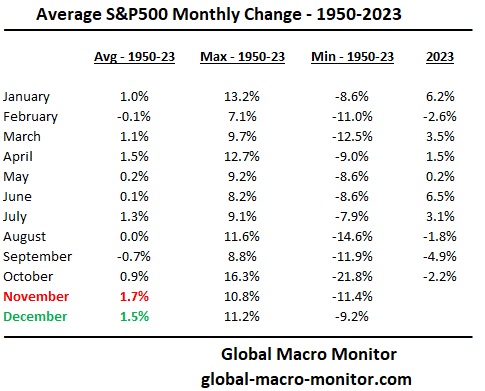

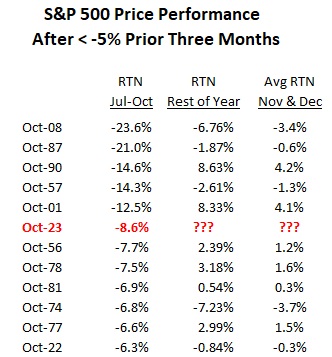

It’s challenging to find a similar set-up going into the end of the year as the index was up 20 percent at the end of July and then took an 8.6 percent swan dive during the next three months, setting up this humungous bounce in the first few weeks of November. Recall that, on average, November is the best month of the year for stocks by a wide margin, followed by December.

Of course, the set-up for December will change if we get a decent pullback in the next few weeks. It’s stunning to hear some talking heads predict another 7-10 percent for the rest of the year. It is possible, and we will take it, but the empirical probabilities suggest otherwise, as illustrated in the above table.

It’s a mug’s game trying to predict short-term stock moves, but we can’t help ourselves. Given the seasonals, the empirical probabilities point higher, likely after the stock market digests this big move, churning and burning in a narrow range before the Santa Claus ramp.

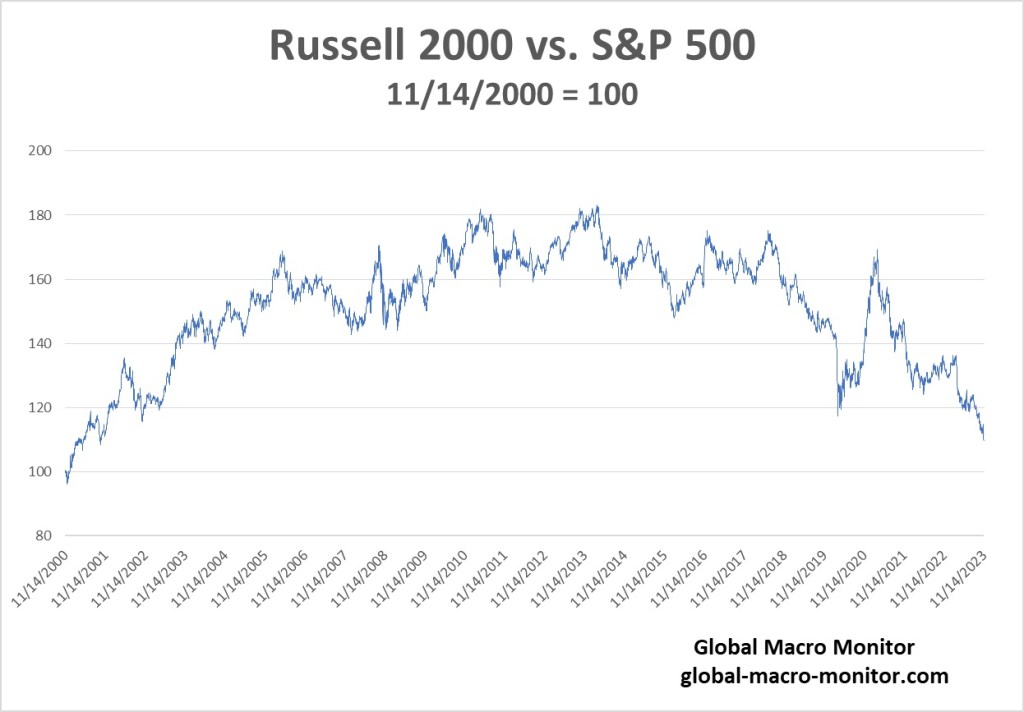

Today’s relative performance in the Russell 2000 was disappointing, but we do suspect that small caps will lead when the market begins its next holiday leg up. If not, we will take it as a signal a recession looms.

Who said this business was easy?

Wow! Humungo move on the decent inflation report. A much higher probability of a soft landing is now being priced during the most wonderful time of the year for stocks.

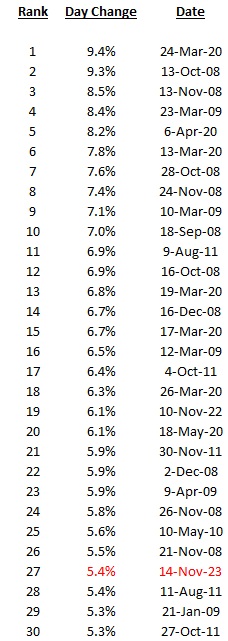

The Russell 2000 was up a stunning 5.4 percent on the day, though only the 27th most significant one-day move since 2000, and look at that multi-year underperformance. We suspect any new discretionary money being put to work into year-end will have the name Russell. Small sector swamped by a burst of buying pushes the Russell north, in our opinion. And it is just that, folks: an opinion.

Originally Posted: November 11, 2018

To honor Veterans’s Day, we are reposting our June 2017 butterfly piece, which illustrates how sleepwalking can lead the world into a war that nobody wants.

French President, Emmanuel Macron, warned today about sleepwalking into another great conflict.

“I know there are old demons which are coming back to the surface. They are ready to wreak chaos and death. History sometimes threatens to take its sinister course once again. – President Macron

The butterfly effect is the concept that small causes can have large effects. Initially, it was used with weather prediction but later the term became a metaphor used in and out of science.

In chaos theory, the butterfly effect is the sensitive dependence on initial conditions in which a small change in one state of a deterministic nonlinear system can result in large differences in a later state. The name, coined by Edward Lorenz for the effect which had been known long before, is derived from the metaphorical example of the details of a tornado (exact time of formation, exact path taken) being influenced by minor perturbations such as the flapping of the wings of a distant butterfly several weeks earlier. Lorenz discovered the effect when he observed that runs of his weather model with initial condition data that was rounded in a seemingly inconsequential manner would fail to reproduce the results of runs with the unrounded initial condition data. A very small change in initial conditions had created a significantly different outcome. — Wikipedia

On this day in history, June 28, 1914, the driver for Archduke Franz Ferdinand, nephew of Emperor Franz Josef and heir to the Austro-Hungarian Empire, made a wrong turn onto Franzjosefstrasse in Sarajevo.

Just hours earlier, Franz Ferdinand narrowly escaped assassination as a bomb bounced off his car as he and his wife, Sophie, traveled from the local train station to the city’s civic city. Rather than making the wrong turn onto Franz Josef Street, the car was supposed to travel on the river expressway allowing for a higher speed ensuring the Archduke’s safety.

Yet, somehow, the driver made a fatal mistake and tuned onto Franz Josef Street.

The 19-year-old anarchist and Serbian nationalist, Gavrilo Princip, who was part of a small group who had traveled to Sarajevo to kill the Archduke, and a cohort of the earlier bomb thrower, was on his way home thinking the plot had failed. He stopped for a sandwich on Franz Josef Street.

Seeing the driver of the Archduke’s car trying to back up onto the river expressway, Princi seized the opportunity and fired into the car, shooting Franz Ferdinand and Sophie at point-blank range, killing both.

That small wrong turn, a minor perturbation to the initial conditions, or deviation from the original plan, set off the chain events that led to World War I.

Stumbling Into The Great War

Fearing Russian support of Serbia, Franz Josef would not retaliate by invading Serbia unless he was assured he had the backing of Germany. It is uncertain as to whether the Kaiser gave Franz Josef Germany’s unequivocal support. Russia, fearing Germany would intervene, mobilized its troops forcing Germany’s hand.

The great European powers thus stumbled into a war they didn’t want through complicated entanglements and alliances, and miscalculation. Russia backing Serbia; France aligned with Russia, Germany backing the Austro-Hungarian Empire; and Britian, who really didn’t have a dog in the fight except her economic interests, aligned with France and Russia.

Later the U.S. would enter the war due to Germany’s unrestricted submarine warfare threatening American merchant ships and the Kaiser floating the idea of an alliance with Mexico in the famous Zimmerman Telegram, which was intercepted by the British.

Of course, some will argue that Great War in Europe was inevitable

The great Prussian statesman Otto von Bismarck, the man most responsible for the unification of Germany in 1871, was quoted as saying at the end of his life that “One day the great European War will come out of some damned foolish thing in the Balkans.” It went as he predicted. – History.com

Nevertheless, maybe the course of history would have been different if not for that wrong turn on June 28, 1914, which created the humongous butterfly effect, which we still experience the consequences this very day.

The botched Treaty of Versailles sowed the seeds the for World II. The War contributed to the Russian revolution and Cold War. The redrawing of borders in the Middle East after the War created the conditions for the instability and breakdown to tribalism the region experiences today.

A map marked with crude chinagraph-pencil in the second decade of the 20th Century shows the ambition – and folly – of the 100-year old British-French plan that helped create the modern-day Middle East.

Straight lines make uncomplicated borders. Most probably that was the reason why most of the lines that Mark Sykes, representing the British government, and Francois Georges-Picot, from the French government, agreed upon in 1916 were straight ones. — BBC News

If Franz Ferdinand had not been murdered on this day in history, that conflict between the Serbs and the Austro-Hungarian Empire may have been contained to just the Balkans. Maybe.

The butterfly effect. Think how many small events, decisions, mistakes, one small turn, or “minor perturbations” in plans have had enormous consequences in your own personal life.

Stocks began “the most wonderful time of the year” by putting in a nice performance on the first day of the best-performing month of the year. The S&P500 was up 1.05 percent to start the month of November, which on average has generated a 1.7 percent price return since 1950, followed by December with an average performance of 1.5 percent.

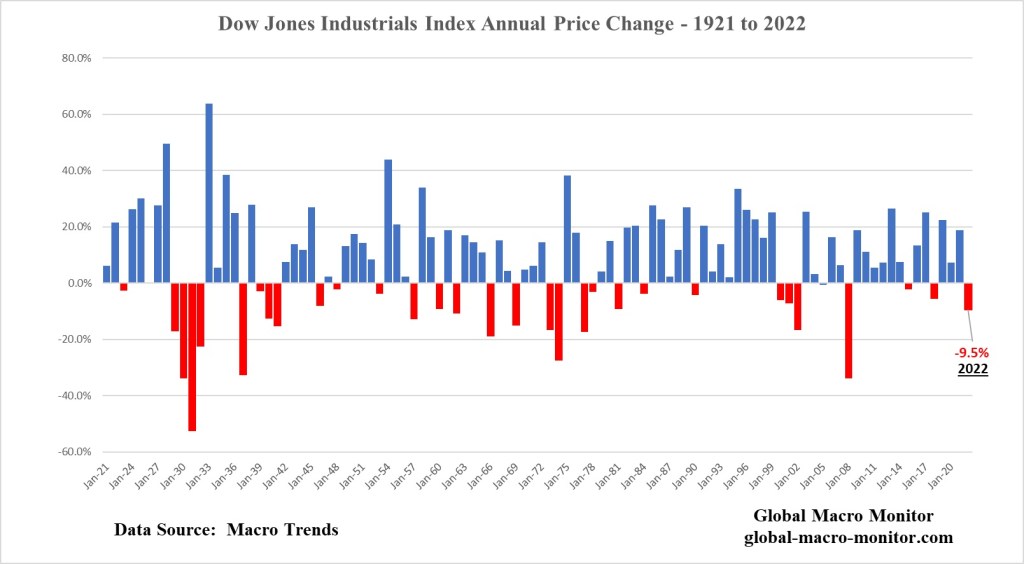

The index entered November after generating three consecutive months of negative returns, falling 8.61 percent since the end of July. Only five times in the last seventy-three years has the S&P500 entered November after such a poor performance in the prior three months. The following table shows that in three of those times, the performance for the rest of the year was negative, while in the other two instances, the S&P was up north of 8 percent.

It’s going to be an interesting rest of the year. Place your bets, folks.

Must view, folks. It should sound familiar if you’ve been reading GMM over the past year.

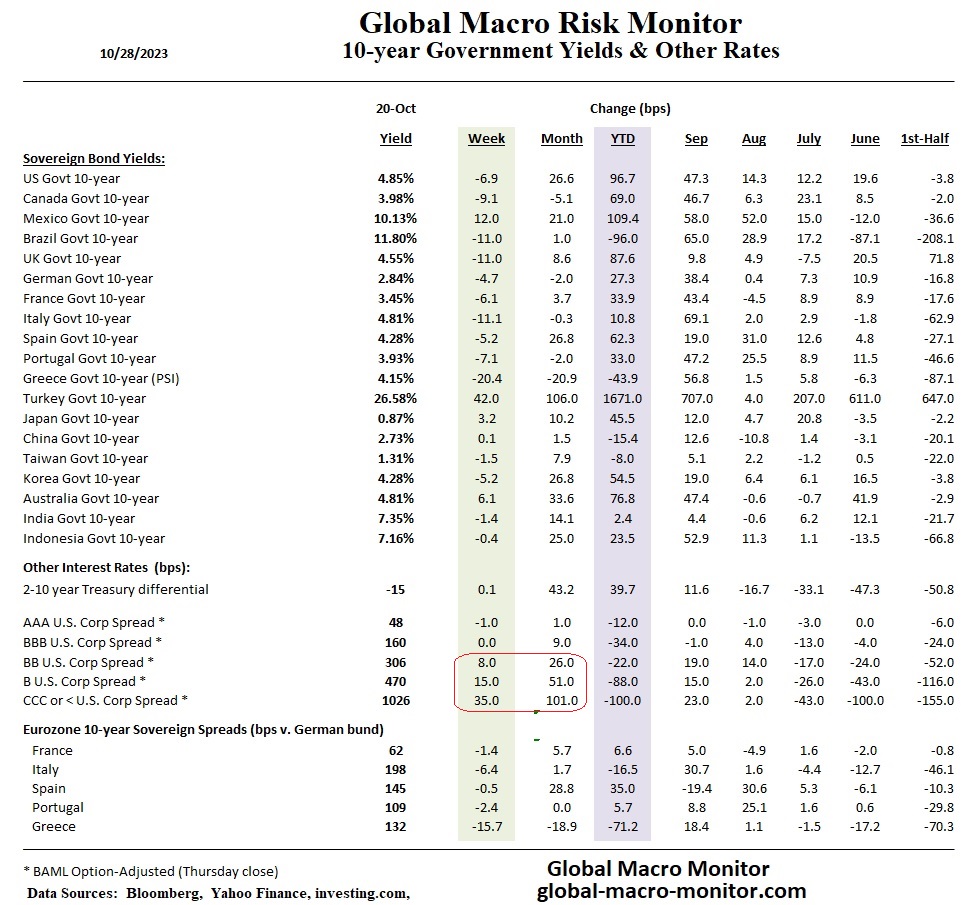

Lower-quality credit spreads starting to blow out.