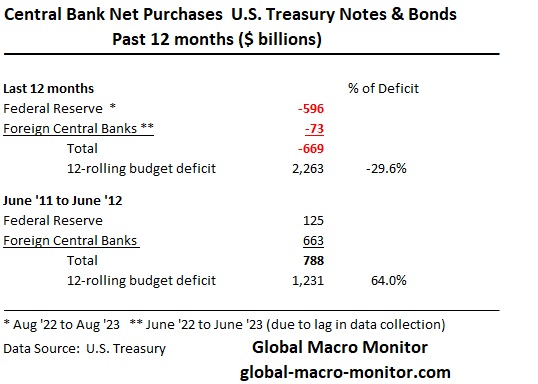

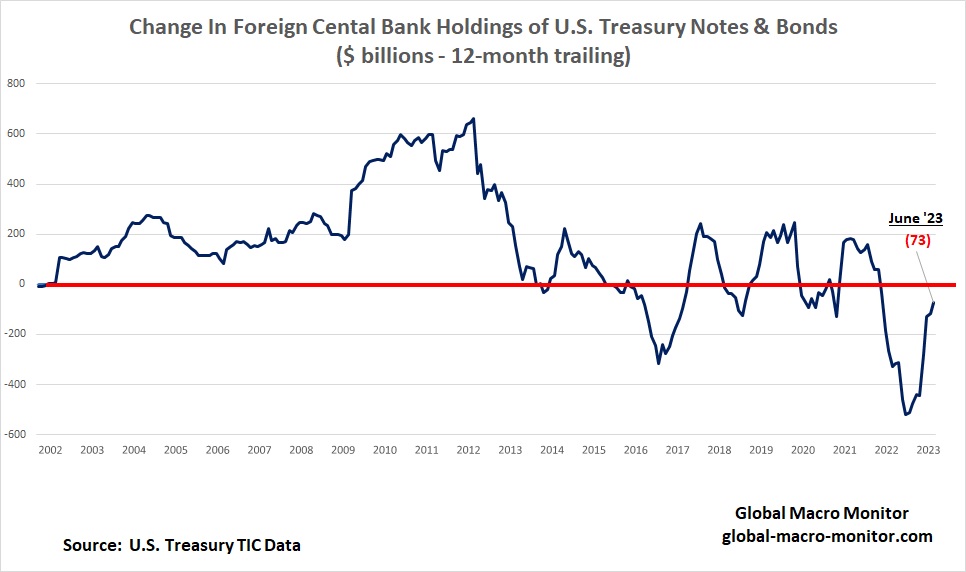

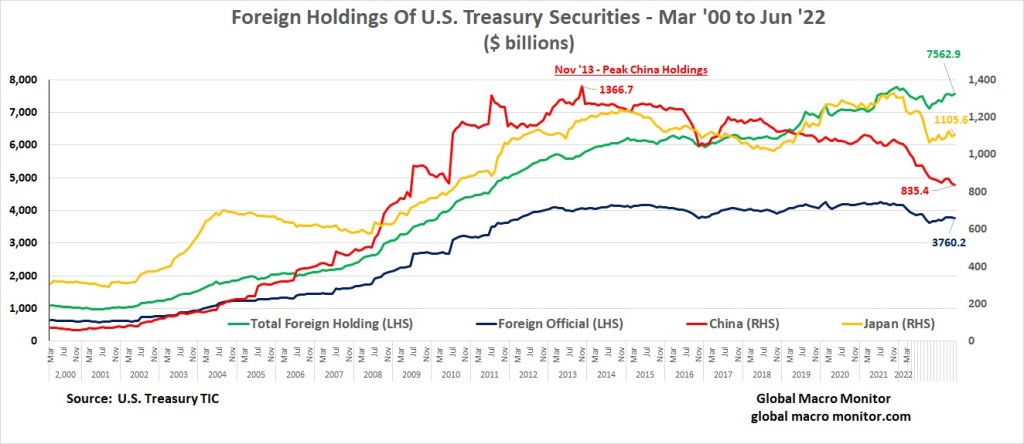

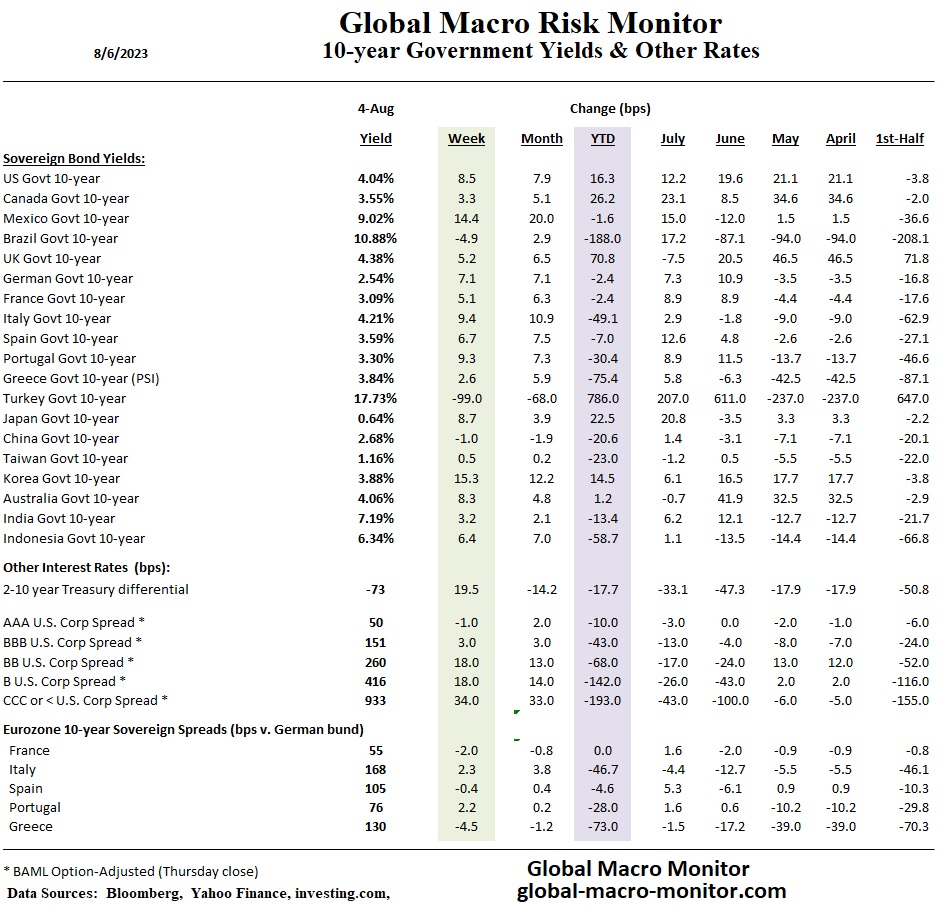

Today’s release of the U.S. Treasury International Capital (TIC) flows data highlights a continued trend of foreign central banks reducing their holdings of U.S. notes and bonds, albeit at a notably decelerated pace. Between June ’22 and June ’23, foreign central banks divested $73 billion in Treasury notes and bonds. This divestment rate is notably more gradual compared to the preceding six months, mainly due to the big dumps observed in 2022 rolling out of the 12-month cumulative total.

Concurrently, the Federal Reserve (Fed) has rolled off $596 billion from its holdings of notes and bonds over the past year.

By contrast, looking back to June 2012, foreign central banks acquired $663 billion in notes and bonds on a rolling 12-month basis, whereas the Fed’s acquisitions amounted to $125 billion. The former purchases were rooted in a strategic policy to prevent excessive appreciation of exchange rates, while the latter transactions constituted part of the Fed’s quantitative easing strategy, both characterized by a complete lack of price sensitivity.

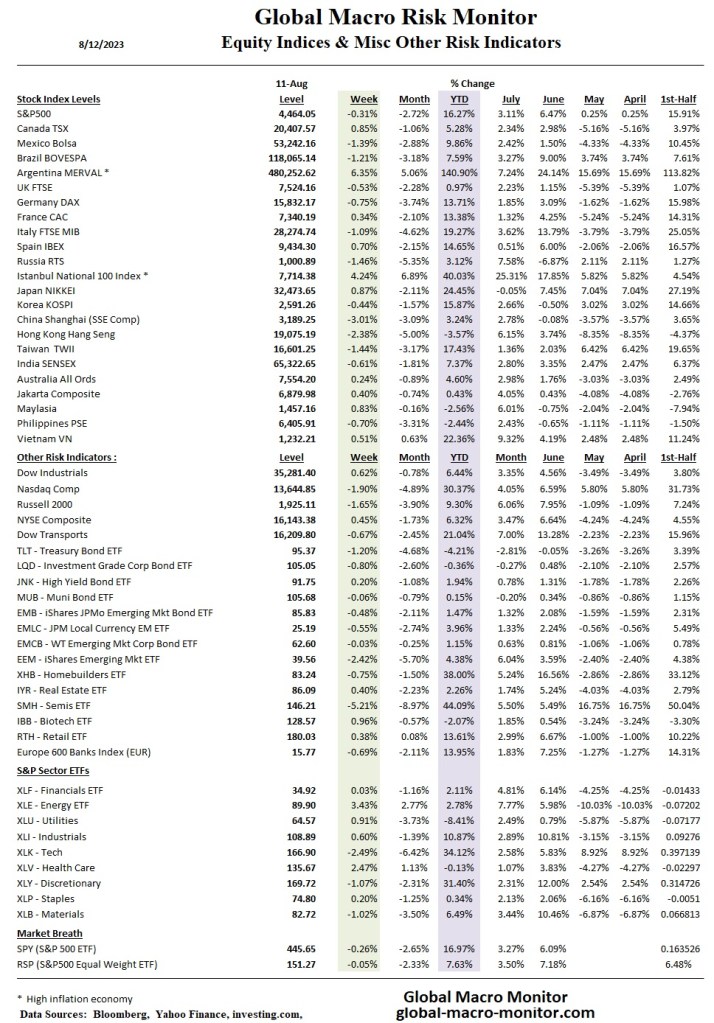

This shift in the roles of central banks, transforming from primary buyers to notable sellers, stands as a significant factor contributing to the recent surge in real interest rates, particularly in the more market-driven segment of the yield curve. We suggest that this trend could persist, influencing rates in the long-term sector of the curve.

That is unless safe haven flows come out of risk assets and reverse the yield spikes.

Stay frosty, folks.