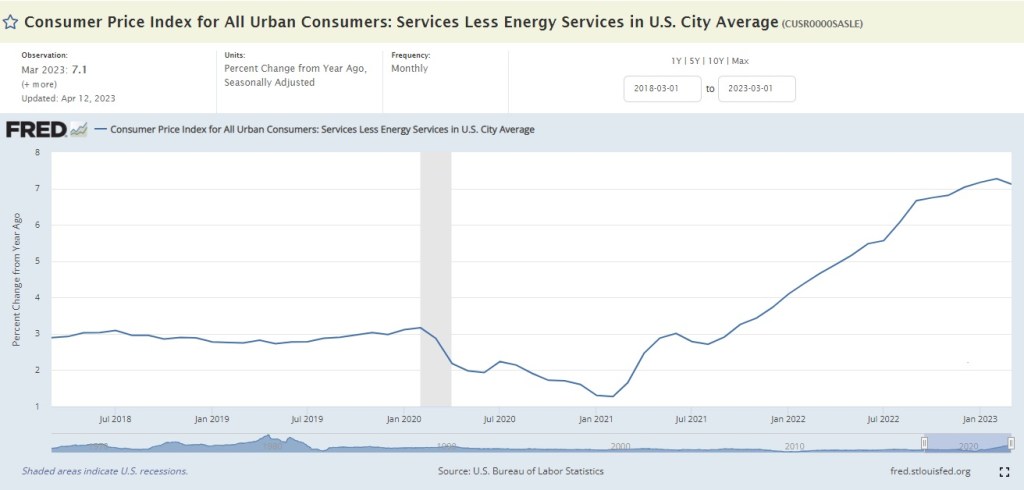

Service inflation x/ energy services remain close to the February peak of 7.3 percent. The Fed is watching.

Plurilateralism refers to trade and investment negotiations between three or more countries, but fewer than all World Trade Organization (WTO) members. Plurilaterals can occur inside the WTO, where non-signatories still receive the benefits through the most-favoured-nation requirement. – EastAsiaForum

As every major country in Latin America shifts to the left in reaction to widening inequality, capital is flying out of the region. Wealthy and, increasingly, middle-class investors are looking for a Plan B in case of more economic and political upheaval. People and corporations in the region’s five largest economies pulled roughly $137 billion out of their countries in 2022. That number—preliminary data from the Institute of International Finance, a group of banking institutions—is 41% higher than the 2021 figure and the most since 2010. – Bloomberg

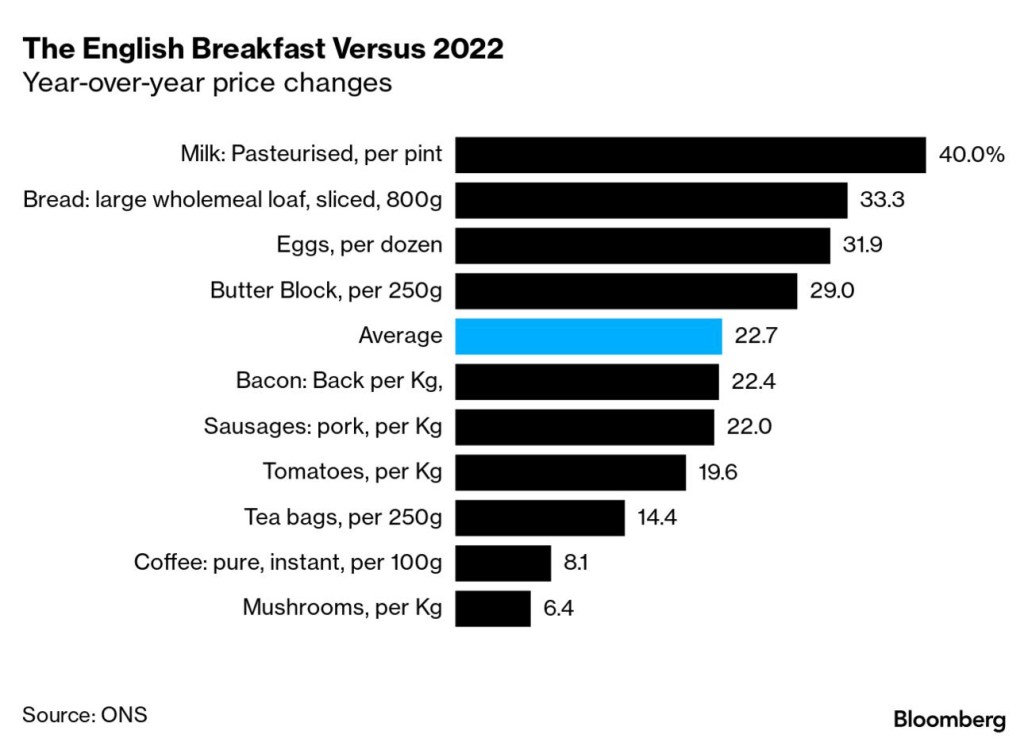

The price of a full English breakfast jumped to a new high as stubborn food price inflation makes life harder for British consumers.

The average cost of ingredients to make a traditional fry-up soared almost 23% from a year earlier in March. – Bloomberg

It is a turning point the world has not seen in centuries, and is unlikely to see again for centuries more.

India is on the cusp of passing China in population, according to the latest U.N. estimates. At 1.428 billion people, India has already edged past mainland China, the data show, and it will soon surpass the mainland and Hong Kong combined.

With China’s population declining, the margin between the two countries will only grow as India becomes the most populous country in history. What had long been the world’s largest democracy is now, simply, the world’s largest everything. – NY Times

Good piece on Bloomberg today about the auto repo industry. It looks like many car owners bought too much auto:

With more Americans struggling to pay their bills, the $1.7 billion industry for repossessing such assets as cars, trucks and boats is gearing up for a boom. The effects are expected to reverberate through countless ordinary lives and onto Wall Street, where car loans are packaged into bonds and sold to investors…

In March, the percentage of subprime auto borrowers who were at least 60 days late on their bills was 5.3%, up from a seven-year low of 2.58% in May 2021 and higher than in 2009, the peak of the financial crisis, data from Fitch Ratings show. While not all of those borrowers will face repossessions, the risk is high…

It’s difficult to determine exactly how many repossessions occur each year, but Cox Automotive estimates that there were 1.2 million in 2022, up about 5.3% from 2021 but still down from 1.68 million in 2019. The Repossessors Summit made its debut in 2009, when there were a record 1.77 million repossessions. – Bloomberg