The 10-year Treasury rate fell almost 10 bps to close at 2.52 percent, just 4 bps off its August 24 recent low. A close below 2.50 percent will clear the way for a move to challenge the December ’08 low of 2.03 percent. Surprisingly, the S&P 500 is almost 100 points above its August 24 close. The bond, equities, and commodities have been moving together in a powerful rally since early September. If sustained, it would be an early sign loose monetary conditions are beginning to bite.

We wrote in August that the 1o-year Treasury bond was fundamentally overvalued at 2.5 percent yet could rally to 2.0 percent with a new round of European sovereign debt worries or the announcement of QE2. We expected a back up and thought 2.80 percent would provide a good entry for traders. The closing high during the correction was 2.795 percent.

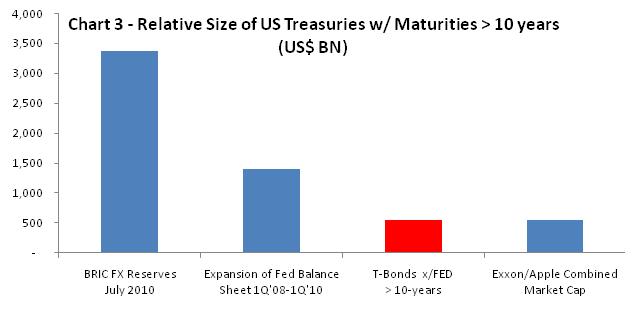

We recognize the bond, given its small size relative to other asset classes and pools of liquidity, lives, simultaneously, in two realities. The fundamental reality, based on economic, credit, monetary and foreign exchange risks, is that the bond is overvalued at 2.50 percent, in our opinion. The technical reality is different story, however, where the Fed could theoretically could buy up the entire curve from 10-30 years with just half what it spent in QE1 (see chart). We have learned not to fight the Fed.

Finally, even just observing the 2.50 percent interest rate through fundamental reality increases the risks of self fulfilling deflation through a positive feedback loop. We wrote,

“One danger of the lack of price discovery [in the bond market] is the potential formation of a positive feed-back loop, where other markets fail to discount these distortions and act accordingly. One prominent economic strategist recently stated, ‘We’re in a depression. That is what the bond market is telling us.’“

So there you have it. Two realities, two cats. One cat named Dave, who says the bond is fundamentally cheap based on the economic outlook and move to 2 percent is a done deal. The other cat named Doug, who says the bond is the “short of the decade,” but getting the timing right is difficult.

We side with Doug and will look for strong technical confirmation before entry or a reversal in the fundamental reality, such as change in monetary policy and/or economic conditions. Stay tuned!

Agree with your thesis. The US should probably bring back the Long Bond as a way of mitigating this problem. Not to mention that it would be a great

Agree with your thesis. The US should probably bring back the Long Bond as a way of mitigating this problem. Not to mention that it would be a great yield curve play for the US.

Pingback: MS Poll: 53% Believe US Debt Crisis By 2012 | Global Macro Monitor

Pingback: US Budget Deficit 9th Largest Economy in the World | Global Macro Monitor

Pingback: 10-year Treasury Bond Rate At Key Resistence | Global Macro Monitor

Pingback: The Broken Bond Market - All Noise, No Signal - Investing Matters

Pingback: The Broken Bond Market – All Noise, No Signal | Earths Final Countdown

Pingback: The Broken Bond Market - All Noise, No Signal -

Pingback: The Broken Bond Market – All Noise, No Signal | High Priority News

Pingback: The Broken Bond Market – All Noise, No Signal | US-China News

Pingback: The Broken Bond Market – All Noise, No Signal | Daily News Inc.

Pingback: The Broken Bond Market - All Noise, No Signal - Stockmarket news - Forex - News - Realtime market Data- World News - Trading Ideas- Tradebuddy.online

Pingback: The Broken Bond Market – All Noise, No Signal | It's Not The Tea Party

Pingback: The Broken Bond Market – All Noise, No Signal | Centinel2012

Pingback: The Broken Bond Market - All Noise, No Signal | Zero Hedge

Pingback: The Broken Bond Market - The Falling Darkness

Pingback: Reflexivity And Why The Fed Must Sell The Long End | CapitalistHQ

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Juan Darden's Blog

Pingback: Reflexivity And Why The Fed Must Sell The Long End | StockTalk Journal

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Melinda Owens's Blog

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Linda Frazier's Blog

Pingback: Bonds and the Yield Curve | ducati998

Regardless of what the temperature is outside, in the

hive it has to remain a relentless 95 deg. There is but

one main type of Honey Bee, with two subspecies that may be affecting the United Kingdom.

Manuka honey Elixirs can also be an all natural soothing

formulation for dry throats.

Geralmente, a restabelecimento é rápida e também indolor. http://walkofflame.vyncke.com/index.php/component/k2/item/392-the-making-of-the-movies/392-the-making-of-the-movies?limitstart=0

Pingback: What Is The Message Of The Bond Market? Nuttin’! | Global Macro Monitor

Superb blog! Do you have any helpful hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you suggest starting with a free platform

like WordPress or go for a paid option? There are so many choices

out there that I’m completely confused .. Any recommendations?

Cheers!

Excellent article! We are linking to this particularly great content on our site.

Keep up the good writing.