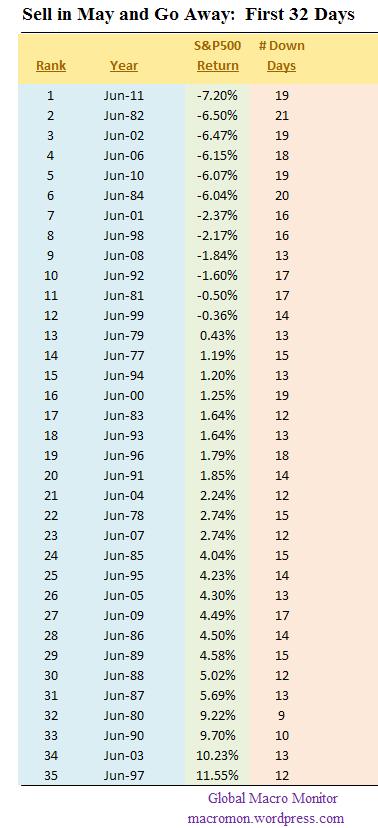

The table below illustrates that the 2011 “Sell in May and Go Away” trade has generated the highest return of the past 35 years. That is, if you sold or shorted the S&P500 at the close of the last trading day of April, you’d be sitting on a 7.2 percent return as of today’s close (June 15). Note also the S&P500 has traded lower 19 of the 32 trading days during this period.

Lots of records, near records, and streaks this year. Makes you kind of think we’re in the midst of some sort of market climate change, no?

(click here if table is not observable)

Pingback: Sell in May and Go Away Trade: First 32 Days | Wordwide News Exposed