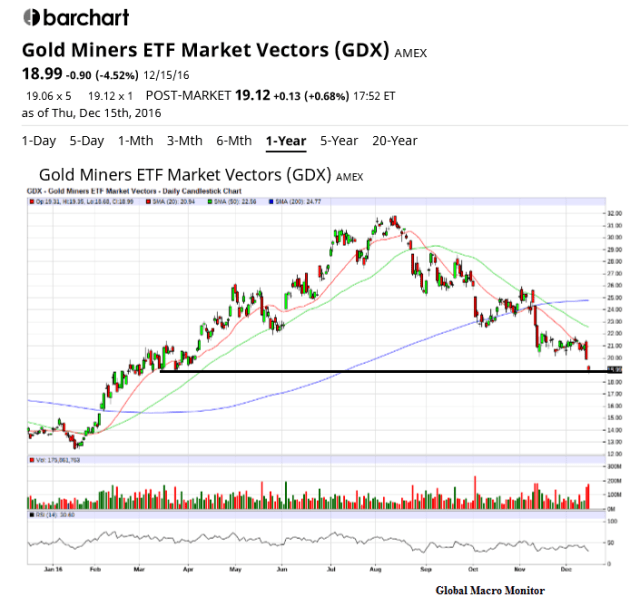

The gold miners index (GDX) gapped down another 4 1/2 percent today even after yesterday’s 5 percent down day. Gold, the Feb futures contract, closed down about another $15 lower from the 5 pm electronic futures market close in New York last night.

The GDX also broke the key Fibonacci .618 retracement level — from the swing January low to the swing August high — at $19.67 and is now barely hanging on to the March support at just under $19. If it doesn’t hold here, the next stop looks to be the year and all-time low at $12.47. Not going to get there tomorrow, but we think – are guessing – we close the year at around $16, down another 15 percent from today’s close.

This would still give the GDX a respectable 17.7 percent return on the year. The index is currently up 40 percent year-to-date even as gold, the commodity, now just up 6.4 percent year-to-date, is going down faster than a case of a beer at a college frat party.

Note, the GDX RSI is starting to signal oversold at 30.6. Maybe that is why we saw big buyers step in right at the close to send the price back up to $19 level.

Stay tuned.