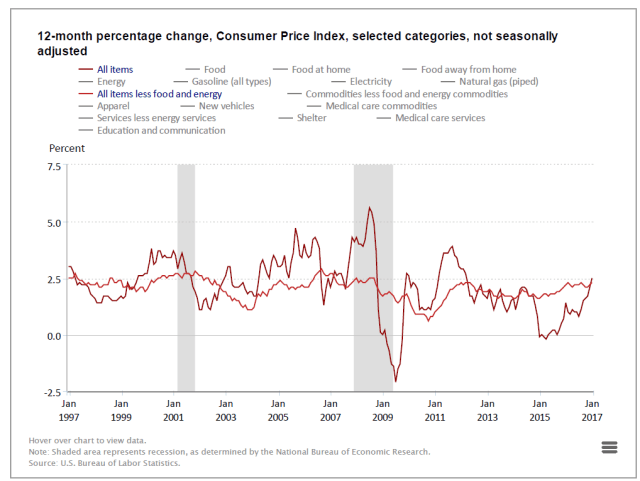

CPI out this morning, up 0.6 percent for January, more than double the 0.3 percent that was expected. The hottest number since February 2013. The main culprit was the rise in the cost of gasoline, which accounted for half the increase. The year-on-year increase for all items in the CPI basket is 2.5 percent. CPI inflation ex/ food and energy up 0.3 percent, up 2.3 percent year-on-year.

Note our post from a few weeks ago, Inflation Cometh. The stimulus of the coming tax cuts and infrastructure spend will most likely start to kick in mid-2018. So, we repeat, inflation cometh!. As they used to say on the north side of Chicago, “wait until next year.”

What’s so good about inflation?

Never could understand why inflation was thought as a good thing. Check out the release on real wages today.

We like falling prices and paying less for goods and services. Increases our real income.

The markets, and maybe even the Fed, seem not to be able to distinguish between goods and services inflation/deflation with asset inflation/deflation. Could be because the Fed has become increasingly reliant on asset inflation as a transmission mechanism of effecting monetary policy. That is, stimulating domestic demand through the wealth effect.

The border-adjustment tax will be a disaster for lower income groups. Reverse Robin Hood tax reform, in our opinion. Bad for Trump voters.