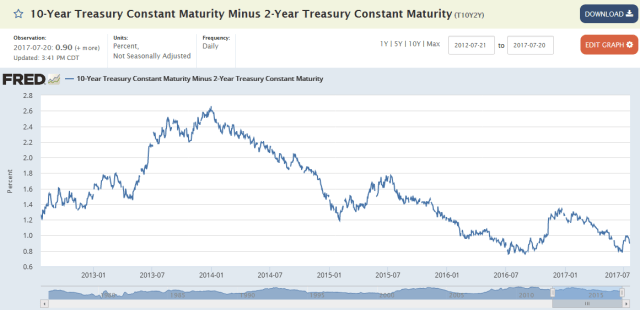

In our piece, Reflexivity And Why The Fed Must Sell The Long End, posted on June 13th, we warned of the dangers of a flattening yield curve based on distorted interest rates due to QE.

..some still look to the badly distorted bond market as a signal of the health of the economy and act accordingly. Such as delaying capital spending; becoming more risk averse; and cutting back on consumption, for example.

A flatter yeld curve also makes bank lending less profitable.

This could thus lead to what George Soros calls “reflexivity“, a feedback loop where the negative, but false, signal from the bond market actually causes an economic slowdown or leads to a recession. So much for efficient markets.

Recall the famous line of one prominent market strategist during the dark days of the great recession,

“ We’re in a depression. That is what the bond market is telling us.”

Or the ubiquitous, “what is the bond market telling us?” Come on, man! – GMM

FED Will Mind The Yield Curve

In her Congressional testimoney last week, Janet Yellen stated the FOMC will “mind the yield curve” as they begin their quantitative tightening (QT).

Federal Reserve Chairwoman Janet Yellen on Thursday said the central bank would consider the bond market yield curve as it slowly reduces its $4.5 trillion balance sheet, which it had used to help stimulate the economy.

…“Now, we think that our purchases of assets did have some positive effect in depressing longer-term interest rates relative to short-term interest rates. But of course we will take that into effect, namely a steepening of the yield curve, in how we set the federal funds rate, which I hope will remain our primary tool for adjusting the stance of monetary policy.” – MarketWatch

No, we really don’t think we influenced her testimony.