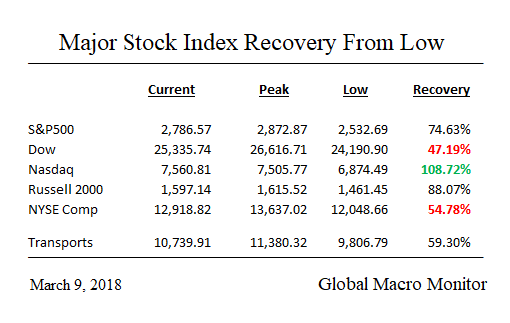

Today’s big rally on the back of the Goldilocks employment report, i.e, strong jobs growth and moderate wage pressures, took the Nasdaq, with its 45 percent tech weighting, to an all-time high. Not the overall market, however, as the NYSE Composite has only recovered a little over 50 percent of its loss. Moreover, the Dow has not even recovered 50 percent of its loss.

The recovery has therefore been narrow but it feels the path of least of resistance is higher as we just don’t see sustained selling by real money accounts.

Thus, after today’s economic data and how the market behaved after the Gary Cohn resignation here is our view: short-term – impossible to predict but not going to stand in the way of the freight train, which wants to move higher; medium-term – we are bearish based on extreme valuations, higher interest rates, and declining global liquidity; long-term – always bullish as stocks follow the economy and the natural state is for the economy to grow. Buyer after the bear market takes valuations back to reasonable levels, which we expect sometime this year. Always a seller at extreme valuation peaks.

Remember, the 11th commandment of trading,

Those who remain flexible shall not be broken – Moses of the S&P