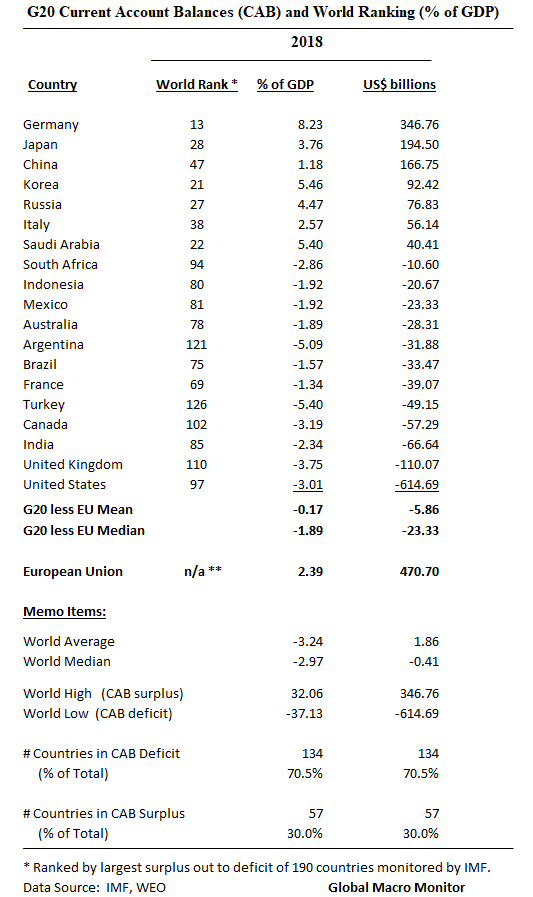

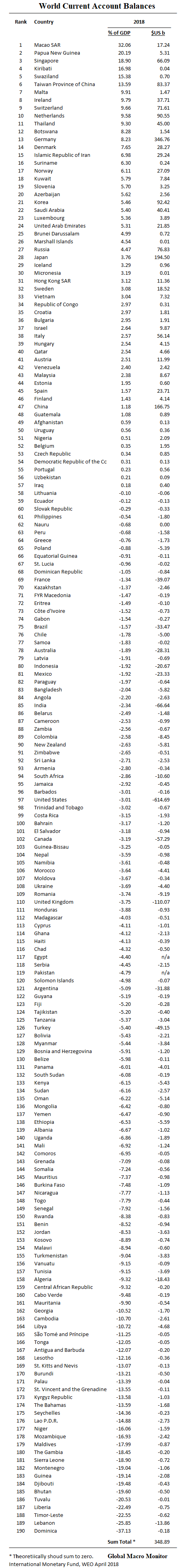

We have updated our ranking of the world’s 2018 Current Account Balances (CAB) by country from largest surplus o largest deficit in the ginormous table below. The data are from the recent April 2018 IMF’s World Economic Outlook database.

Before checking out the G20 and world ranks, let’s review a little theory and understand what drives the current account, or that nasty word “trade deficits.”

Current Account Balance

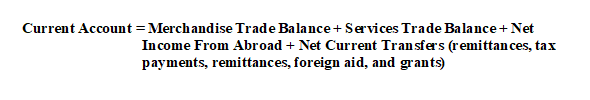

The following equation defines the current account balance.

What Drives The Current Account

Contrary to popular belief and political bias, a country’s overall current account or trade balance is not so much the result of “fair” or “reciprocal” trade but defined primarily by the net savings in the home country’s private and public sector.

It is explained clearly by the following national income identity, which we have posted several times over the years.

(S-I) + (T-G) = Current Account Balance (Foreign Savings)

(S-I) is the ‘private savings balance’ or the difference between private sector savings (S) and investment (I); (T-G) is the ‘government balance’ or the difference between tax receipts (T) and all government expenditure (G); (X-M) is the difference between exports (X) and imports (M) and is usually called the simple ‘current account balance’. – George Irvin

If a country runs an overall savings deficit in the public and private sector, by definition, it has to run a current account deficit, which is simply importing foreign savings to fill the gap of domestic savings over investment.

And a large current account deficit is not always a bad thing, especially depending on it’s financed. For example, Mozambique runs large current account deficits due to huge investments in its gas sector, and financed by foreign direct investment flows from big oil multinationals.

Trump’s Twin Deficits

We posted this last January 2017, almost a week before President Trump was inaugurated,

If President Trump succeeds in implementing his proposed tax cuts and $1 trillion infrastructure spending plans, the U.S. current account deficit, by definition, will, once again, balloon as net public savings will decline and, we believe, will be complemented by a decline in net private savings as business investment and private consumption increases.

The tax cuts have been implemented, the budget deficit has ballooned, and public savings have declined.

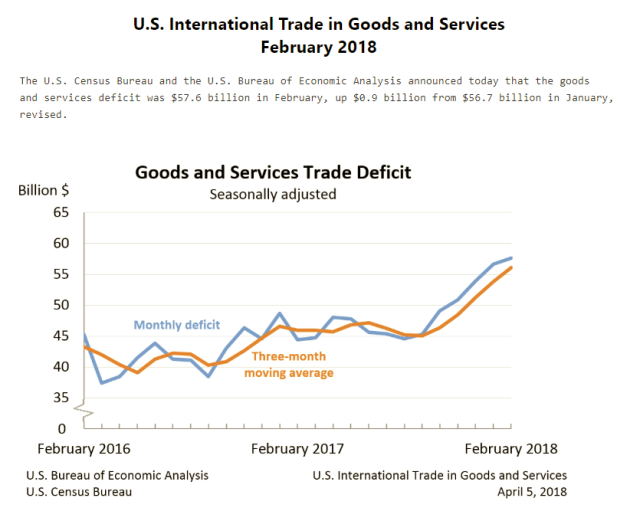

Voilà! Tke a look at what is happening with he U.S. trade deficit.

We hear about a pickup in capital expenditures by the business sector, and if not offset by personal savings, the trade and current account deficits will further continue to balloon.

If the U.S. had “reciprocal trade” – i.e., higher tariffs — without an offsetting increase in private or public savings, the overall trade or current account deficit would remain roughly the same, but economic growth would be slower, and inflation would be higher. That is stagflation.

The administration will be chasing its tail, as the external deficits continue deteriorate trying to impose external balance by higher tariffs, rather than restoring internal balance through adjusting savings.

In others, FUBARing the economy, and resulting in stagflation.

The trade or current account deficit is simple a safety valve or pressure release for too much domestic demand relative to savings, which keeps inflation and interest rates lower than they would otherwise be.

Better Trade Deals Through Opening Markets

We agree it is optimal to negotiate better trade deals, especially with China as they are big boys now, but we should not delude ourselves into thinking it is going to improve the over trade and current account balance. There are much better ways for the country to protect those who have been hurt by free trade than imposing tariffs..

We don’t think the president and the administration are free traders but are more motivated to protect certain industries and labor groups in the President’s political base.

G20 Current Accounts

Now check out the G20 current accounts.

As we write the largest surplus and largest deficit countries in the world are holding a joint news conference in Washington..

Not hearing much about the underlying cause of the imbalances (note the U.S. has cut its current deficit in half over the last ten years).

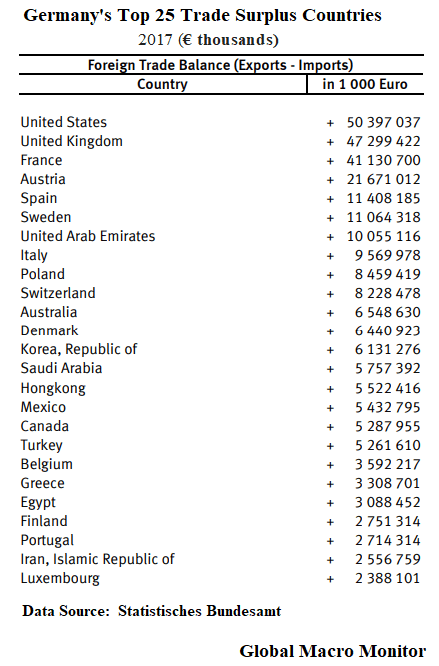

Also, don’t understand where President Trump is coming up with his $151 trade deficit number with Germany he is putting out there. The Census Bureau calculates a deficit in goods and services with Germany in 2017 at -$67.7 billion.

He may be referring to just imports of goods. He also seems to be conflating NATO contributions.

Does it even matter anymore in our post-Truth world? Don’t bother me with the facts, ma’am.

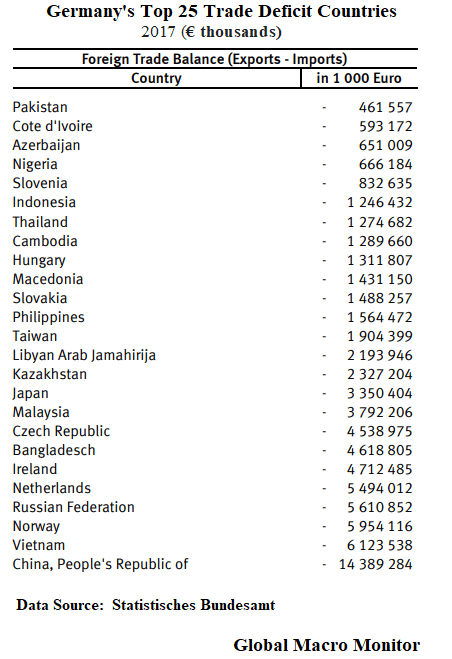

German Trade Surplus By Top Countries

Before the G20, first Germany”s 2017 top trade surpluses and deficits by country.

Note Germany’s current account surplus of over 8 percent of GDP. The country has had a free ride with its exchange rate and participation in the Euro. The old Deutsche Mark would probably be 20-30 percent higher in value than the Euro. The common currency makes German exports super competitive.

Pressure Coming

Nevertheless, the country is going to come under intense pressure to stimulate domestic demand to reduce the surplus, which would be very positive for the Eurozone economies.

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates - aroundworld24.com

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates | State of Globe

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates – open mind news

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates | Real Patriot News

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates | Investing Daily News

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates - megaprojectfx-forex.com

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates – customchakra.com

Pingback: T-Minus… Prepare For Much Higher Long-Term Rates – forexoperate.com