The 10-year Treasury yield broke out and closed above a new 5-year high today.

If you didn’t catch our analysis from a few weeks back why long-term interest rates were set to move higher, run don’t walk to, Prepare For Much Higher Long-Term Rates.

It is nice to see others on the Street coming around to our view. Goldman was out with a piece yesterday.

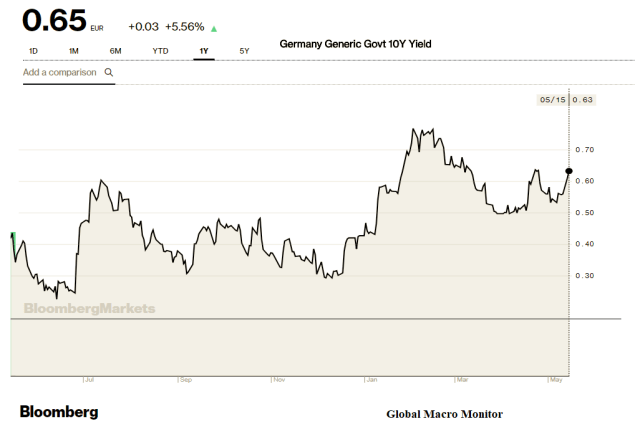

German Bunds

German bund yields are also moving higher.

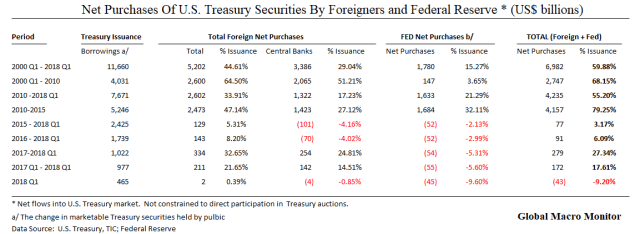

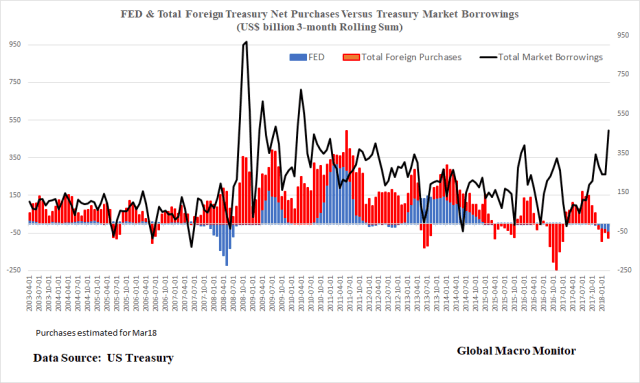

Easy Money Deficit Financing Is Over

The following table and chart are key to understanding the what is bothering the bond market.

Legacy Of QE

Nevertheless, the legacy of the Fed’s quantitative easing (QE) still lingers in the Treasury market. We will be out with a post later in the week on this very subject.

Upshot

The question is will the move in bond yields smack equities even more than they did today, and relink the JFK-Trump S&P500 analog? We give at least a 60 percent probability.

If debt worries begin to dominate the thinking of traders, it may stick until action is taken on the budget deficit, either by rolling back some of the tax cuts or spending cuts, which the market will not like. We heard on CNBC today that May tax receipts are down 18 percent y/y as result of the tax cuts.

Debt worries, and the stock of debt, in particular, are “more than a feeling” and real, and can’t be wished away.