We are not discussing any proposal to exit the euro. The government is determined to avoid the materialisation of market conditions that push us towards an exit in any way. – Giovanni Tria, Italian finance minister, June 11

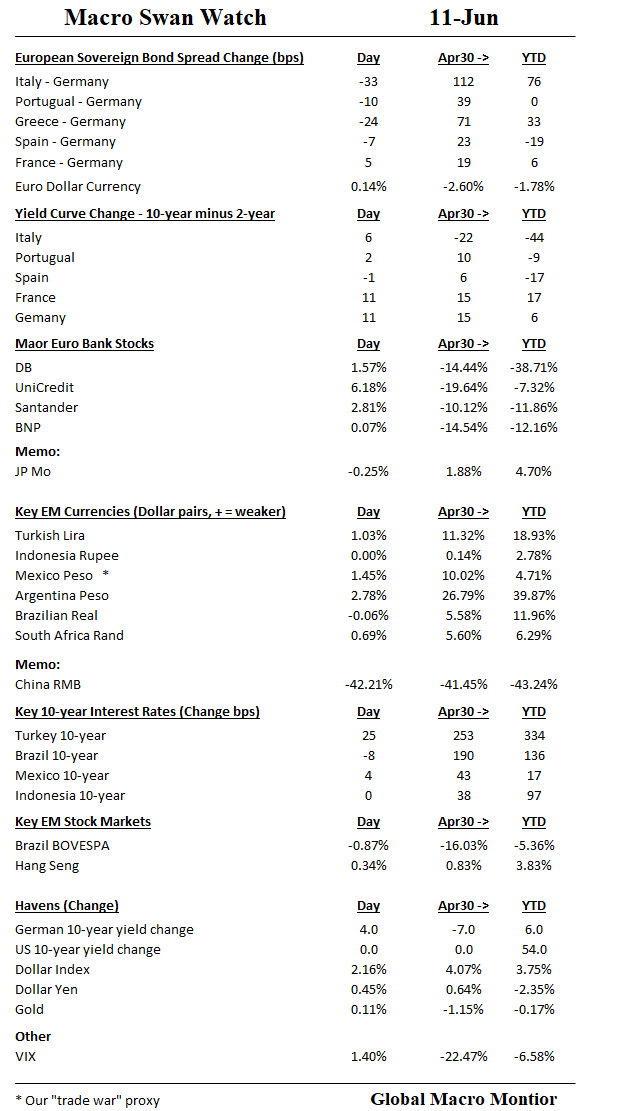

Italian and Euro periphery assets recovered today on the back of euro positive comments by the new Italian finance minister (see above). Italy’s 10-year sovereign spread in big by 33 bps against the the Bund with the curve steepening by 6 bps. Unicredit up over 6 percent.

BNP and other French bank lagged as the the government signaled the country’s banks need to raise additional capital. European banks still woefully undercapitalized.

EM

EM currencies remain under pressure as the focus now turns to Mexico’s presidential election on July 1. BMI research is now giving the lefty candidate, Andres Manuel Lopez Obrador (AMLO), a 90 percent of becoming the next president of the United Mexican States. Watch how this picture unfolds.