Summary Bullets

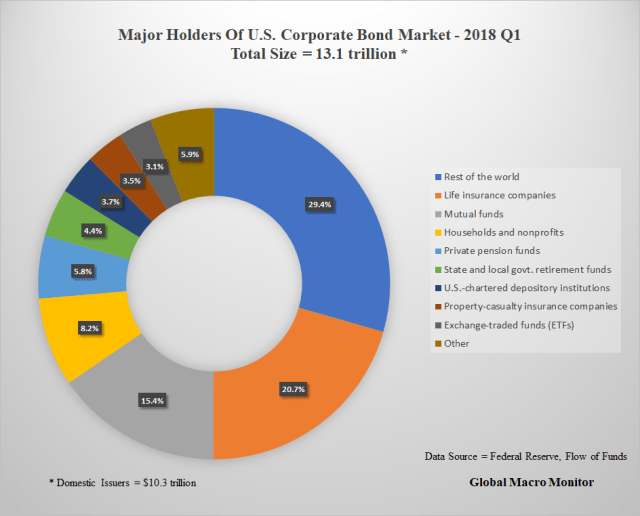

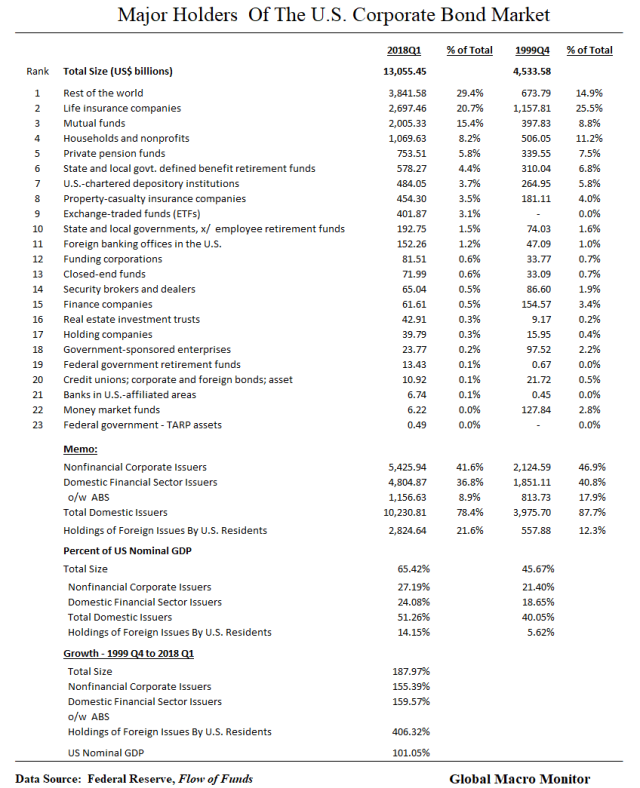

- The size of the U.S. corporate bond market, as measured by the Fed’s Flow of Funds, totals $13.1 trillion at the end of Q1 2018

- It includes $10.2 trillion of domestic issues and $2.8 trillion of foreign issues held by U.S. residents

- The market has increased from 45.7 percent of GDP at the end of 1999 to 65.4 percent of GDP

- The total size of the market has grown by 188 percent since the turn of the century as compared to nominal GDP growth of 102 percent

- Foreigners hold 30 percent of the market, almost double from the end of 1999

- Life insurance companies are the largest domestic holder of corporate bonds

- Mutual funds are the second largest domestic investors at 15.4 percent followed by households (including hedge funds), private pension funds, and state & local govt retirement funds

- The corporate bond market is now 65.4 of U.S. GDP, of which, domestic issuers total 51 percent of GDP

Always interesting insights on this blog. Keep up the good work.

Thank you!

Is there a updated version of this? Would love to see the changes

I will try, brother.

How do I know if I’m a holder or not I can not find anything under my name but I know I am a holder but can not prove it everyone thinks I’m retarded and just dismiss’s me I also have files on my phone but do not understand them