Surprisingly few ripples on Swan Lake today.

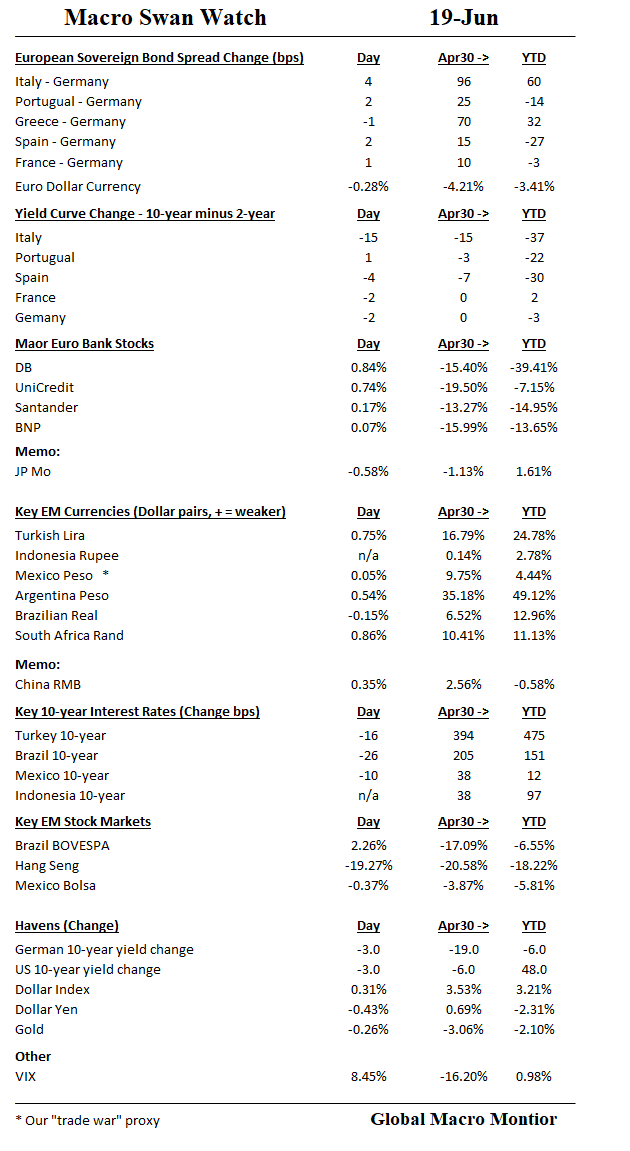

The Turkish lira, Argentine peso, and SA rand a bit weaker.

We are stunned at the complacency in the markets given the hawkish Fed and now coupled with trade war jitters. These are tectonic events.

Many believe the admin’s hardline on trade is just the “Art of the Deal.” Haven’t we learned anything in the last 15 months? There is no method to the administration’s madness. It’s all impulse, one transaction at a time.

Furthermore, many think the Chinese will run out of tit for Trump’s tat. Total nonsense! President Xi orders the domestic market closed to Apple products. with the world’s largest market cap, and its lights out for the U.S. equity market. See here.

FED

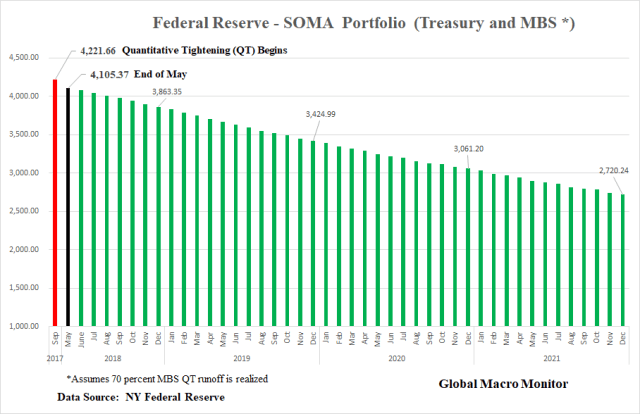

Finally, the Fed has already reduced its SOMA portfolio by $116.3 billion since October, and we estimate another $250 billion into year-end. The cumulative $360 billion reduction by the end of December is not insignificant and equivalent to almost 10 percent of the U.S. adjusted monetary base.

We expect a market epiphany sometime soon.