China has been at the center of the rise of FinTech firms since the Great Financial Crisis (GFC). Some of these firms have become huge.

Watch this space.

In the United States, the majority of lenders rely on FICO scores to determine a borrower’s creditworthiness. An individual’s FICO score is based on his or her credit history, which includes factors like credit utilization, on-time payments, and average age of accounts. By contrast, Sesame Credit and Tencent Credit draw on the two tech giants’ massive pool of user data to assign credit scores, incorporating criteria like a borrower’s social network, online shopping history, educational background, income level, and profession. – Brookings

Source: Brookings

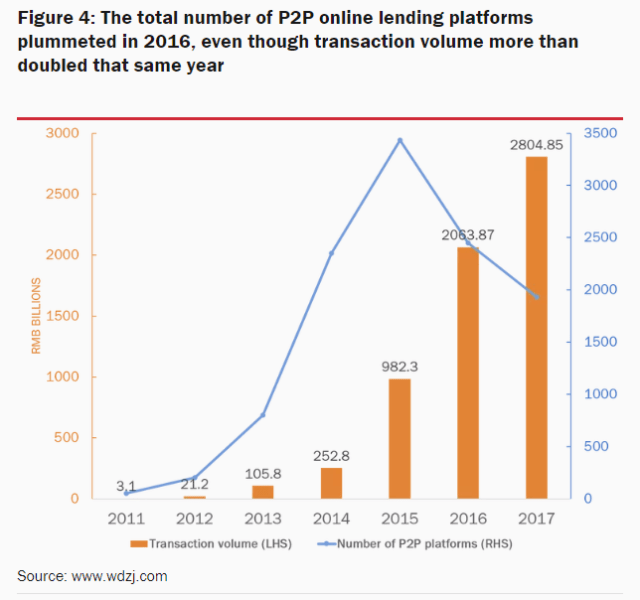

Chinese police shut down a planned protest by groups of investors angry at government inaction over their losses from the peer to peer lending crisis ► Subscribe to FT.com here: http://bit.ly/2GakujT